Market Summary

BCO Stock Price

BCO RSI Chart

BCO Valuation

BCO Price/Sales (Trailing)

BCO Profitability

BCO Fundamentals

BCO Revenue

BCO Earnings

Breaking Down BCO Revenue

Last 7 days

6.7%

Last 30 days

4.6%

Last 90 days

14.1%

Trailing 12 Months

47.4%

How does BCO drawdown profile look like?

BCO Financial Health

BCO Investor Care

Historical Charts for Stock Metrics

| Year | Q1 | Q2 | Q3 | Q4 |

|---|---|---|---|---|

| 2024 | 4.9B | 0 | 0 | 0 |

| 2023 | 4.6B | 4.7B | 4.8B | 4.9B |

| 2022 | 4.3B | 4.4B | 4.4B | 4.5B |

| 2021 | 3.8B | 4.0B | 4.1B | 4.2B |

| 2020 | 3.7B | 3.6B | 3.6B | 3.7B |

| 2019 | 3.5B | 3.6B | 3.7B | 3.7B |

| 2018 | 3.4B | 3.5B | 3.5B | 3.5B |

| 2017 | 3.1B | 3.2B | 3.2B | 3.3B |

| 2016 | 3.0B | 3.0B | 3.0B | 3.0B |

| 2015 | 3.4B | 3.3B | 3.2B | 3.1B |

| 2014 | 3.8B | 3.7B | 3.7B | 3.6B |

| 2013 | 3.7B | 3.7B | 3.8B | 3.8B |

| 2012 | 3.8B | 3.8B | 3.7B | 3.7B |

| 2011 | 3.3B | 3.5B | 3.7B | 3.8B |

| 2010 | 3.1B | 3.1B | 3.1B | 3.1B |

| 2009 | 0 | 3.2B | 3.1B | 3.1B |

| 2008 | 0 | 0 | 0 | 3.2B |

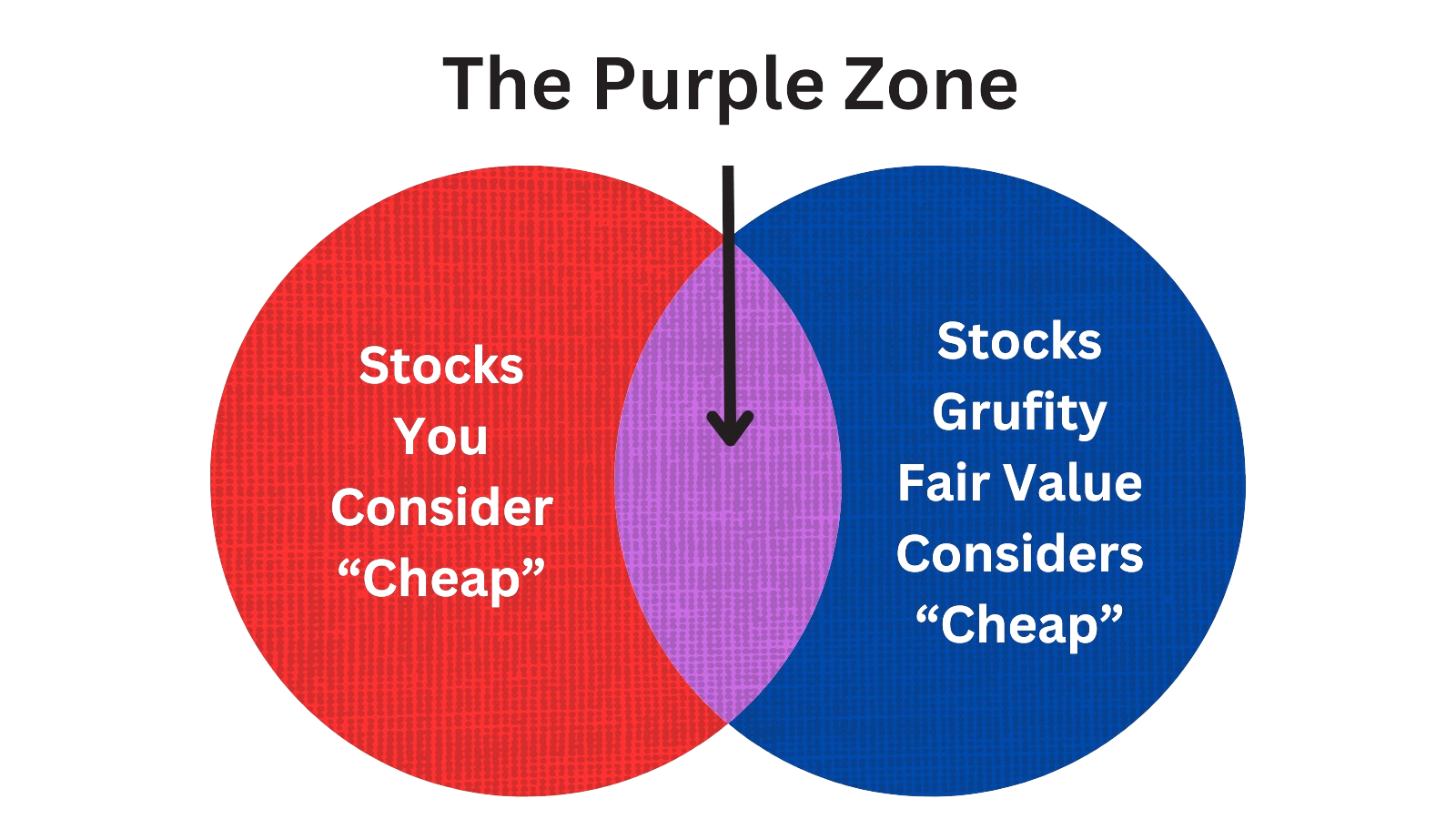

Stocks Marked 'Very Cheap' by Grufity's Fair Value Model Have Outperformed Russell 2000 Index

Small Caps and Mid Caps are mostly overlooked by investors as all the focus goes to Magnificent 7. These stocks that are not part of the beauty contest require a deeper look. However, all large cap stocks were once small caps. Grufity's Fair Value model opens up this unverse as it separates high-performing, rewarding stocks from low-performing risky stocks. <b>Russell 2000 stocks that were marked 'Very Cheap' by the model doubled in three years while the index was flat.</b>

Returns of $10,000 invested in:

Very Cheap Stocks: $21,859

Russell 2000 Index: $10,334

Very Expensive Stocks: $8,224

Russell 2000 stocks considered 'Very Cheap' by the model greatly outperformed Russell 2000 index and the 'Very Expensive' bucket over past three years.

Tracking the Latest Insider Buys and Sells of Brink's Co-The

Filter Transactions| Datesorted ascending | Name | Buy/Sell | $ Value | Avg. Price | # Shares | Title |

|---|---|---|---|---|---|---|

| May 02, 2024 | docherty susan e | acquired | - | - | 2,402 | - |

| May 02, 2024 | andrade kathie j. | acquired | - | - | 2,402 | - |

| May 02, 2024 | wyche keith r | acquired | - | - | 2,402 | - |

| May 02, 2024 | herling michael j | acquired | - | - | 2,402 | - |

| May 02, 2024 | parker arthelbert louis | acquired | - | - | 2,402 | - |

| May 02, 2024 | clough ian d | acquired | - | - | 2,402 | - |

| Apr 01, 2024 | herling michael j | acquired | - | - | 169 | - |

| Apr 01, 2024 | clough ian d | acquired | - | - | 158 | - |

| Mar 17, 2024 | eubanks richard m. | sold (taxes) | -62,192 | 84.5 | -736 | president and ceo |

| Mar 13, 2024 | bossart dominik | sold | -849,600 | 84.96 | -10,000 | evp |

Which funds bought or sold BCO recently?

View All Details| Datesorted ascending | Fund Name | Type | % Chg | $ Change | $ Held | % Portfolio |

|---|---|---|---|---|---|---|

| May 07, 2024 | NEW YORK STATE COMMON RETIREMENT FUND | reduced | -4.83 | -7,000 | 20,810,000 | 0.03% |

| May 07, 2024 | OPPENHEIMER ASSET MANAGEMENT INC. | reduced | -4.23 | 7,564 | 1,287,500 | 0.02% |

| May 07, 2024 | M&T Bank Corp | added | 30.57 | 469,038 | 1,732,420 | 0.01% |

| May 07, 2024 | CIM INVESTMENT MANAGEMENT INC | unchanged | - | 23,164 | 483,055 | 0.14% |

| May 07, 2024 | AMJ Financial Wealth Management | reduced | -25.93 | -119,039 | 417,280 | 0.14% |

| May 07, 2024 | ASSETMARK, INC | unchanged | - | 1,364 | 28,453 | -% |

| May 07, 2024 | SEI INVESTMENTS CO | reduced | -0.33 | 885,910 | 19,793,800 | 0.03% |

| May 07, 2024 | Horizon Investment Services, LLC | added | 11.8 | 133,197 | 897,043 | 0.44% |

| May 07, 2024 | Arizona State Retirement System | reduced | -4.61 | 2,254 | 1,143,760 | 0.01% |

| May 07, 2024 | Headlands Technologies LLC | sold off | -100 | -9,499 | - | -% |

Are Funds Buying or Selling BCO?

Unveiling Brink's Co-The's Major ShareHolders

| Date Filed | Name of Filer | Percent of Class | No. of Shares | Form Type | |

|---|---|---|---|---|---|

| Feb 13, 2024 | vanguard group inc | 10.21% | 4,598,937 | SC 13G/A | |

| Feb 12, 2024 | american century investment management inc | 3.78% | 1,703,422 | SC 13G/A | |

| Feb 12, 2024 | william blair investment management, llc | 7.0% | 3,155,930 | SC 13G/A | |

| Feb 12, 2024 | fuller & thaler asset management, inc. | 6.96% | 3,134,520 | SC 13G/A | |

| Feb 09, 2024 | fmr llc | - | 0 | SC 13G/A | |

| Jan 23, 2024 | blackrock inc. | 12.5% | 5,619,581 | SC 13G/A | |

| Dec 11, 2023 | fmr llc | - | 0 | SC 13G/A | |

| May 10, 2023 | vanguard group inc | 10.06% | 4,691,057 | SC 13G/A | |

| Feb 14, 2023 | fuller & thaler asset management, inc. | 7.92% | 3,676,858 | SC 13G/A | |

| Feb 09, 2023 | fmr llc | - | 0 | SC 13G/A |

Recent SEC filings of Brink's Co-The

View All Filings| Date Filed | Form Type | Document | |

|---|---|---|---|

| May 08, 2024 | 10-Q | Quarterly Report | |

| May 08, 2024 | 8-K | Current Report | |

| May 06, 2024 | 4 | Insider Trading | |

| May 06, 2024 | 4 | Insider Trading | |

| May 06, 2024 | 4 | Insider Trading | |

| May 06, 2024 | 4 | Insider Trading | |

| May 06, 2024 | 4 | Insider Trading | |

| May 06, 2024 | 4 | Insider Trading | |

| May 06, 2024 | 4 | Insider Trading | |

| May 06, 2024 | 4 | Insider Trading |

- …

Peers (Alternatives to Brink's Co-The)

| Name | Mkt Capsorted ascending | Revenue | Price %, 1M | Returns, 1Y | P/E | P/S | Rev 1-Yr | Inc 1-Yr |

|---|---|---|---|---|---|---|---|---|

| LARGE-CAP | ||||||||

ADP | 99.4B | 18.9B | -1.50% | 13.70% | 26.88 | 5.26 | 7.08% | 13.46% |

CTAS | 70.1B | 9.4B | 1.93% | 49.61% | 46.6 | 7.45 | 9.34% | 15.98% |

CPRT | 53.0B | 4.1B | -2.01% | 38.74% | 39.09 | 13.06 | 10.52% | 25.37% |

EFX | 29.0B | 5.4B | -9.55% | 17.56% | 51.91 | 5.41 | 5.76% | -4.95% |

BAH | 19.6B | 10.3B | 2.56% | 63.55% | 47.89 | 1.9 | 13.90% | -5.05% |

ALLE | 10.8B | 3.6B | -6.61% | 15.05% | 20.07 | 3 | 4.33% | 10.69% |

| MID-CAP | ||||||||

RHI | 7.4B | 6.2B | -7.22% | 4.88% | 20.86 | 1.2 | -13.83% | -42.32% |

AL | 5.5B | 2.7B | -2.78% | 28.51% | 9.35 | 2.01 | 15.08% | 16.51% |

SRCL | 4.4B | 2.6B | -8.93% | 8.80% | -224.06 | 1.66 | -3.11% | -123.81% |

ABM | 2.8B | 8.2B | 1.61% | 5.47% | 11.04 | 0.35 | 3.98% | 33.49% |

| SMALL-CAP | ||||||||

AZZ | 1.9B | 2.7B | -8.07% | 111.87% | 18.61 | 0.7 | 104.63% | 188.16% |

ALTG | 384.8M | 1.9B | -10.69% | -15.56% | 43.24 | 0.2 | 15.20% | -4.30% |

ARC | 118.3M | 283.1M | 3.01% | -2.49% | 13.52 | 0.42 | -0.83% | -20.92% |

AQMS | 51.5M | 1.1M | -25.81% | -58.18% | -2.15 | 49.78 | 336.95% | -55.13% |

AWX | 8.3M | 81.0M | -9.36% | -18.66% | -7.54 | 0.1 | -4.98% | -14.33% |

Brink's Co-The News

Brink's Co-The Earnings Report: Key Takeaways & Analysis

| Income Statement (Quarterly) | (In Millions) | |||||||||||||||||||||

| Description | (%) Q/Q | 2024Q1 | 2023Q4 | 2023Q3 | 2023Q2 | 2023Q1 | 2022Q4 | 2022Q3 | 2022Q2 | 2022Q1 | 2021Q4 | 2021Q3 | 2021Q2 | 2021Q1 | 2020Q4 | 2020Q3 | 2020Q2 | 2020Q1 | 2019Q4 | 2019Q3 | 2019Q2 | 2019Q1 |

| Revenue | -0.8% | 1,236 | 1,246 | 1,227 | 1,216 | 1,185 | 1,191 | 1,137 | 1,134 | 1,074 | 1,098 | 1,076 | 1,049 | 978 | 1,022 | 971 | 826 | 873 | 936 | 928 | 914 | 905 |

| Cost Of Revenue | 0.6% | 927 | 922 | 921 | 944 | 920 | 874 | 881 | 868 | 840 | 820 | 838 | 819 | 759 | 757 | 743 | 684 | 693 | 707 | 714 | 709 | 703 |

| Costs and Expenses | 3.2% | 1,128 | 1,093 | 1,091 | 1,114 | 1,097 | 1,041 | 1,062 | 1,035 | 1,011 | 978 | 1,000 | 975 | 913 | 913 | 884 | 824 | 842 | 860 | 869 | 863 | 844 |

| EBITDA Margin | 6.5% | 0.16* | 0.15* | 0.15* | 0.14* | 0.14* | 0.13* | 0.14* | 0.14* | 0.14* | 0.14* | 0.13* | 0.13* | - | - | - | - | - | - | - | - | - |

| Interest Expenses | 6.7% | 56.00 | 52.00 | 54.00 | 51.00 | 47.00 | 44.00 | 35.00 | 32.00 | 28.00 | 29.00 | 28.00 | 28.00 | 27.00 | 26.00 | 27.00 | 23.00 | 20.00 | 22.00 | 23.00 | 23.00 | 23.00 |

| Income Taxes | -55.0% | 26.00 | 58.00 | 37.00 | 23.00 | 20.00 | 45.00 | 9.00 | 29.00 | -41.10 | 61.00 | 23.00 | 23.00 | 14.00 | 53.00 | 59.00 | -43.20 | -12.20 | 24.00 | 15.00 | 13.00 | 10.00 |

| Earnings Before Taxes | 49.3% | 78.00 | 53.00 | 87.00 | 59.00 | 38.00 | 94.00 | 31.00 | 68.00 | 33.00 | 111 | 46.00 | 50.00 | 29.00 | 79.00 | 37.00 | -27.20 | -9.40 | 21.00 | 22.00 | 27.00 | 24.00 |

| EBT Margin | 16.0% | 0.06* | 0.05* | 0.06* | 0.05* | 0.05* | 0.05* | 0.05* | 0.06* | 0.06* | 0.06* | 0.05* | 0.05* | - | - | - | - | - | - | - | - | - |

| Net Income | 704.9% | 49.00 | -8.15 | 46.00 | 35.00 | 18.00 | 42.00 | 19.00 | 38.00 | 74.00 | 47.00 | 19.00 | 27.00 | 15.00 | 25.00 | -23.90 | 15.00 | 3.00 | -2.60 | 5.00 | 13.00 | 14.00 |

| Net Income Margin | 32.7% | 0.02* | 0.02* | 0.03* | 0.02* | 0.03* | 0.04* | 0.04* | 0.04* | 0.04* | 0.03* | 0.02* | 0.01* | - | - | - | - | - | - | - | - | - |

| Free Cashflow | -96.6% | 12.00 | 340 | 144 | 106 | -90.30 | 228 | 111 | 71.00 | -113 | 150 | 152 | 42.00 | - | - | - | - | - | - | - | - | - |

| Balance Sheet | (In Millions) | |||||||||||||||||||||

| Description | (%) Q/Q | 2024Q1 | 2023Q4 | 2023Q3 | 2023Q2 | 2023Q1 | 2022Q4 | 2022Q3 | 2022Q2 | 2022Q1 | 2021Q4 | 2021Q3 | 2021Q2 | 2021Q1 | 2020Q4 | 2020Q3 | 2020Q2 | 2020Q1 | 2019Q4 | 2019Q3 | 2019Q2 | 2019Q1 |

| Assets | 1.2% | 6,679 | 6,602 | 6,265 | 6,411 | 6,253 | 6,366 | 5,933 | 5,823 | 5,750 | 5,567 | 5,553 | 5,578 | 5,191 | 5,136 | 4,903 | 4,771 | 3,801 | 3,764 | 3,703 | 3,732 | 3,602 |

| Current Assets | 4.2% | 2,905 | 2,788 | 2,462 | 2,517 | 2,448 | 2,597 | 2,447 | 2,222 | 2,084 | 2,000 | 1,963 | 1,890 | 1,777 | 1,815 | 1,705 | 1,675 | 1,339 | 1,233 | 1,246 | 1,245 | 1,154 |

| Cash Equivalents | 42.8% | 1,681 | 1,177 | 934 | 890 | 817 | 972 | 1,349 | 1,102 | 1,046 | 1,087 | 1,023 | 941 | 872 | 943 | 795 | 703 | 512 | 469 | 426 | 411 | 380 |

| Net PPE | -1.0% | 1,003 | 1,013 | 966 | 990 | 954 | 935 | 845 | 850 | 870 | 866 | 845 | 865 | 814 | 838 | 812 | 814 | 704 | 763 | 718 | 713 | 698 |

| Goodwill | -1.1% | 1,458 | 1,474 | 1,448 | 1,468 | 1,459 | 1,451 | 64.00 | 1,380 | 1,423 | 1,412 | 1,427 | 1,446 | 126 | 1,219 | 1,184 | 1,114 | 794 | 785 | 776 | 783 | 752 |

| Liabilities | 1.3% | 6,159 | 6,082 | 5,681 | 5,747 | 5,648 | 5,796 | 5,614 | 5,456 | 5,381 | 5,314 | 5,304 | 5,276 | 4,965 | 4,933 | 4,731 | 4,580 | 3,719 | 3,556 | 3,517 | 3,523 | 3,423 |

| Current Liabilities | 2.4% | 1,992 | 1,944 | 1,625 | 1,620 | 1,603 | 1,675 | 1,348 | 1,372 | 1,365 | 1,429 | 1,404 | 1,331 | 1,267 | 1,336 | 1,166 | 1,073 | 981 | 1,002 | 889 | 889 | 845 |

| Short Term Borrowings | 2.2% | 155 | 152 | 125 | 128 | 94.00 | 47.00 | 21.00 | 14.00 | 13.00 | 10.00 | 8.00 | 15.00 | 24.00 | 14.00 | 13.00 | 12.00 | 14.00 | 14.00 | 15.00 | 29.00 | 23.00 |

| Long Term Debt | 1.4% | 3,309 | 3,263 | 3,202 | 3,251 | 3,190 | 3,273 | 3,269 | 3,061 | 2,961 | 2,842 | 2,701 | 2,702 | 2,428 | 2,334 | 2,407 | 2,363 | 1,757 | 1,555 | 1,661 | 1,658 | 1,597 |

| LT Debt, Current | 7.3% | 126 | 117 | 92.00 | 90.00 | 87.00 | 82.00 | 82.00 | 84.00 | 120 | 115 | 136 | 136 | 136 | 137 | 107 | 109 | 74.00 | 75.00 | 74.00 | 73.00 | 70.00 |

| LT Debt, Non Current | -100.0% | - | 3,263 | 3,202 | 3,251 | 3,190 | 3,273 | 3,269 | 3,061 | 2,961 | 2,842 | 2,701 | 2,702 | 2,428 | 2,334 | 2,407 | 2,363 | 1,757 | 1,555 | 1,661 | 1,658 | 1,597 |

| Shareholder's Equity | 30.8% | 520 | 397 | 463 | 664 | 605 | 447 | 319 | 367 | 370 | 253 | 249 | 303 | 225 | 203 | 172 | 191 | 82.00 | 208 | 185 | 210 | 179 |

| Retained Earnings | 6.3% | 354 | 333 | 398 | 431 | 411 | 417 | 399 | 409 | 375 | 313 | 396 | 427 | 413 | 408 | 390 | 455 | 450 | 457 | 468 | 470 | 465 |

| Additional Paid-In Capital | -1.3% | 667 | 676 | 680 | 695 | 686 | 684 | 677 | 676 | 675 | 671 | 691 | 689 | 678 | 672 | 660 | 667 | 662 | 663 | 657 | 648 | 631 |

| Shares Outstanding | 0.2% | 45.00 | 45.00 | 45.00 | 46.00 | 46.00 | 46.00 | 47.00 | 47.00 | 48.00 | 50.00 | 50.00 | 50.00 | - | - | - | - | - | - | - | - | - |

| Minority Interest | 0.6% | 124 | 123 | 122 | 123 | 126 | 123 | 117 | 126 | 130 | 130 | 128 | 129 | 125 | 74.00 | 82.00 | 80.00 | 16.00 | 16.00 | 16.00 | 16.00 | 14.00 |

| Float | - | - | - | - | 3,141 | - | - | - | 2,819 | - | - | - | 3,764 | - | - | - | 2,265 | - | - | - | 4,016 | - |

| Cashflow (Quarterly) | (In Thousands) | |||||||||||||||||||||

| Description | (%) Q/Q | 2024Q1 | 2023Q4 | 2023Q3 | 2023Q2 | 2023Q1 | 2022Q4 | 2022Q3 | 2022Q2 | 2022Q1 | 2021Q4 | 2021Q3 | 2021Q2 | 2021Q1 | 2020Q4 | 2020Q3 | 2020Q2 | 2020Q1 | 2019Q4 | 2019Q3 | 2019Q2 | 2019Q1 |

| Cashflow From Operations | -84.4% | 63,900 | 409,400 | 187,700 | 150,400 | -45,100 | 279,400 | 159,400 | 117,400 | -76,300 | 204,400 | 192,600 | 82,500 | -1,500 | 230,300 | 147,400 | -73,400 | 13,400 | 216,800 | 127,900 | 61,900 | -38,000 |

| Share Based Compensation | 43.1% | 9,300 | 6,500 | 6,400 | 8,300 | 10,900 | 12,300 | 14,300 | 14,900 | 7,100 | 5,200 | 9,200 | 11,100 | 7,600 | 10,400 | 8,300 | 5,400 | 7,200 | 6,800 | 9,800 | 16,700 | 9,400 |

| Cashflow From Investing | -43.6% | -45,800 | -31,900 | -3,300 | -87,000 | -57,600 | -219,100 | -9,600 | -50,500 | -52,000 | -64,400 | -10,400 | -241,400 | -138,500 | -51,900 | -43,700 | -359,400 | -110,400 | -31,500 | -58,800 | -78,500 | -164,200 |

| Cashflow From Financing | -533.3% | -1,300 | 300 | -153,100 | 42,800 | -97,100 | -46,700 | 155,400 | 37,700 | 98,800 | -63,300 | -79,800 | 219,000 | 95,400 | -65,500 | -30,200 | 611,300 | 168,100 | -150,700 | -36,800 | 42,900 | 106,600 |

| Dividend Payments | -1.0% | 9,800 | 9,900 | 10,200 | 10,200 | 9,300 | 9,300 | 9,400 | 9,400 | 9,500 | 9,900 | 9,900 | 10,000 | 7,400 | 7,400 | 7,600 | 7,600 | 7,500 | 7,500 | 7,500 | 7,500 | 7,400 |

| Buy Backs | -66.6% | 21,000 | 62,900 | 90,800 | 1,500 | 16,000 | 23,300 | 30,500 | - | - | 150,000 | 50,000 | - | - | - | 50,000 | - | - | - | - | - | - |

BCO Income Statement

2023-12-31Consolidated Statements of Operations - USD ($) shares in Millions, $ in Millions | 12 Months Ended | ||||

|---|---|---|---|---|---|

Dec. 31, 2023 | Dec. 31, 2022 | Dec. 31, 2021 | |||

| Income Statement [Abstract] | |||||

| Revenues | $ 4,874.6 | $ 4,535.5 | $ 4,200.2 | ||

| Costs and expenses: | |||||

| Cost of revenues | 3,707.1 | 3,461.9 | 3,235.8 | ||

| Selling, general and administrative expenses | 688.1 | 687.0 | 629.7 | ||

| Total costs and expenses | 4,395.2 | 4,148.9 | 3,865.5 | ||

| Other operating income (expense) | (54.2) | (25.3) | 20.0 | ||

| Operating profit | 425.2 | 361.3 | 354.7 | ||

| Interest expense | (203.8) | (138.8) | (112.2) | ||

| Interest and other nonoperating income (expense) | 14.4 | 3.7 | (7.0) | ||

| Income from continuing operations before tax | 235.8 | 226.2 | 235.5 | ||

| Provision for income taxes | 139.2 | 41.4 | 120.3 | ||

| Income from continuing operations | 96.6 | 184.8 | 115.2 | ||

| Income (loss) from discontinued operations, net of tax | 1.7 | (2.9) | 2.1 | ||

| Net income | 98.3 | 181.9 | 117.3 | ||

| Less net income attributable to noncontrolling interests | 10.6 | 11.3 | 12.1 | ||

| Net income attributable to Brink’s | 87.7 | 170.6 | 105.2 | ||

| Amounts attributable to Brink’s: | |||||

| Continuing operations | 86.0 | 173.5 | 103.1 | ||

| Discontinued operations | 1.7 | (2.9) | 2.1 | ||

| Net income attributable to Brink’s | $ 87.7 | $ 170.6 | $ 105.2 | ||

| Basic: | |||||

| Continuing operations (in dollars per share) | [1] | $ 1.86 | $ 3.67 | $ 2.08 | |

| Discontinued operations (in dollars per share) | [1] | 0.04 | (0.06) | 0.04 | |

| Net income (in dollars per share) | [1] | 1.90 | 3.61 | 2.12 | |

| Diluted: | |||||

| Continuing operations (in dollars per share) | [1] | 1.83 | 3.63 | 2.06 | |

| Discontinued operations (in dollars per share) | [1] | 0.04 | (0.06) | 0.04 | |

| Net income (in dollars per share) | [1] | $ 1.87 | $ 3.57 | $ 2.10 | |

| Weighted-average shares | |||||

| Basic (shares) | 46.2 | 47.3 | 49.5 | ||

| Diluted (shares) | 46.9 | 47.8 | 50.1 | ||

| |||||

BCO Balance Sheet

2023-12-31Consolidated Balance Sheets - USD ($) $ in Millions | Dec. 31, 2023 | Dec. 31, 2022 |

|---|---|---|

| Current assets: | ||

| Cash and cash equivalents | $ 1,176.6 | $ 972.0 |

| Restricted cash | 507.0 | 438.5 |

| Accounts receivable (net of allowance: 2023 - $30.4; 2022 - $38.3) | 779.0 | 862.2 |

| Prepaid expenses and other | 325.7 | 324.7 |

| Total current assets | 2,788.3 | 2,597.4 |

| Right-of-use assets, net | 337.7 | 314.5 |

| Property and equipment, net | 1,013.3 | 935.3 |

| Goodwill | 1,473.8 | 1,450.9 |

| Other intangibles | 488.3 | 535.5 |

| Deferred income taxes | 231.8 | 246.2 |

| Other | 268.6 | 286.2 |

| Total assets | 6,601.8 | 6,366.0 |

| Current liabilities: | ||

| Short-term borrowings | 151.7 | 47.2 |

| Current maturities of long-term debt | 117.1 | 82.4 |

| Accounts payable | 249.7 | 296.5 |

| Accrued liabilities | 1,126.9 | 1,019.4 |

| Restricted cash held for customers | 298.7 | 229.3 |

| Total current liabilities | 1,944.1 | 1,674.8 |

| Long-term debt | 3,262.5 | 3,273.2 |

| Accrued pension costs | 148.5 | 131.0 |

| Retirement benefits other than pensions | 159.6 | 174.5 |

| Lease liabilities | 265.8 | 249.9 |

| Deferred income taxes | 56.5 | 67.8 |

| Other | 244.6 | 224.6 |

| Total liabilities | 6,081.6 | 5,795.8 |

| Commitments and contingent liabilities (notes 4, 5, 15, 17, 23 and 24) | ||

| The Brink’s Company (“Brink’s”) shareholders: | ||

| Common stock | 44.5 | 46.3 |

| Capital in excess of par value | 675.9 | 684.1 |

| Retained earnings | 333.0 | 417.2 |

| Benefit plan adjustments | (302.2) | (290.7) |

| Foreign currency translation | (368.2) | (433.8) |

| Unrealized losses on available-for-sale securities | (1.8) | (0.6) |

| Unrealized gains on cash flow hedges | 16.2 | 24.6 |

| Accumulated other comprehensive loss | (656.0) | (700.5) |

| Brink’s shareholders | 397.4 | 447.1 |

| Noncontrolling interests | 122.8 | 123.1 |

| Total equity | 520.2 | 570.2 |

| Total liabilities and equity | $ 6,601.8 | $ 6,366.0 |

| CEO | Mr. Richard Mark Eubanks Jr. |

|---|---|

| WEBSITE | brinks.com |

| INDUSTRY | Information Technology Services |

| EMPLOYEES | 65535 |