Market Summary

BLK Alerts

BLK Stock Price

BLK RSI Chart

BLK Valuation

BLK Price/Sales (Trailing)

BLK Profitability

BLK Fundamentals

BLK Revenue

BLK Earnings

Breaking Down BLK Revenue

Last 7 days

2.0%

Last 30 days

7.8%

Last 90 days

2.3%

Trailing 12 Months

21.3%

How does BLK drawdown profile look like?

BLK Financial Health

BLK Investor Care

Historical Charts for Stock Metrics

| Year | Q1 | Q2 | Q3 | Q4 |

|---|---|---|---|---|

| 2024 | 18.3B | 0 | 0 | 0 |

| 2023 | 17.4B | 17.4B | 17.6B | 17.9B |

| 2022 | 19.7B | 19.4B | 18.6B | 17.9B |

| 2021 | 16.9B | 18.1B | 18.7B | 19.4B |

| 2020 | 14.9B | 15.0B | 15.7B | 16.2B |

| 2019 | 14.0B | 13.9B | 14.0B | 14.5B |

| 2018 | 13.8B | 14.2B | 14.2B | 14.2B |

| 2017 | 11.1B | 11.5B | 12.2B | 12.7B |

| 2016 | 11.3B | 11.2B | 11.1B | 11.2B |

| 2015 | 11.1B | 11.3B | 11.3B | 11.4B |

| 2014 | 10.4B | 10.7B | 11.1B | 11.1B |

| 2013 | 9.5B | 9.8B | 9.9B | 10.2B |

| 2012 | 9.0B | 8.9B | 9.0B | 9.3B |

| 2011 | 8.9B | 9.2B | 9.3B | 9.1B |

| 2010 | 5.7B | 6.7B | 7.7B | 8.6B |

| 2009 | 4.8B | 4.4B | 4.2B | 4.7B |

| 2008 | 0 | 4.9B | 5.0B | 5.1B |

| 2007 | 0 | 0 | 0 | 4.8B |

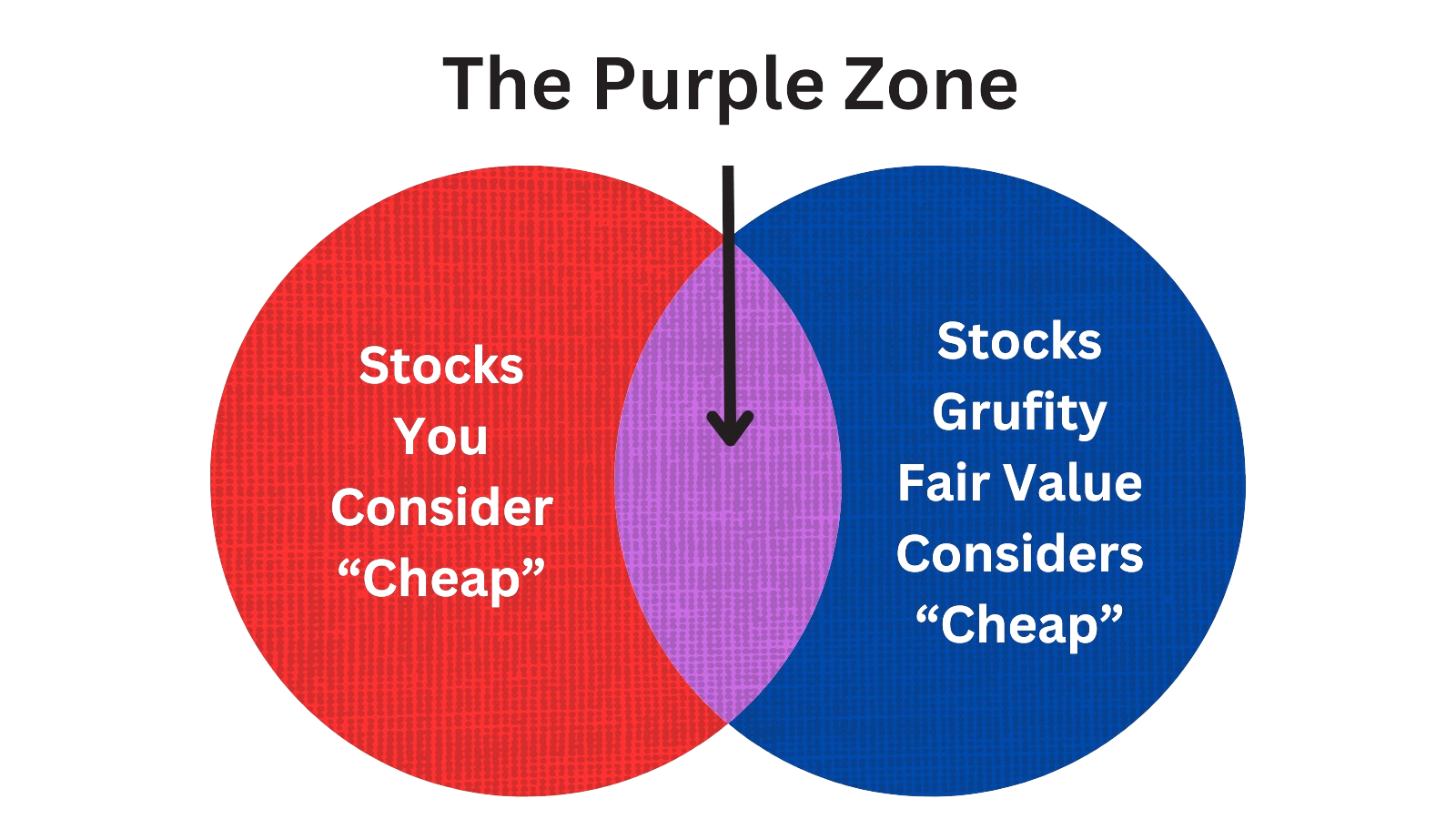

Stocks Marked 'Very Cheap' by Grufity's Fair Value Model Have Outperformed S&P 500 Index

Grufity's Fair Value model takes all the S&P 500 stocks and divides them into separate buckets based on their attractiveness. The 'Very Cheap' bucket of S&P 500 has greatly outperformed S&P 500 Index. Conversely, S&P500 stocks considered 'Very Expensive' by the model underperformed the S&P500 index in the past three years. Grufity Fair Value is available for 2300+ stocks, including 90% of S&P 500 stocks. Grufity's Fair Value Model separates high-return stocks from low-return stocks.

Returns of $10,000 invested in:

Very Cheap Stocks: $17,289

S&P 500 Index: $12,922

Very Expensive Stocks: $11,022

Grufity's Fair Value model does a great job in separating High Performing Stocks from Low Performing ones in the S&P 500 list.

Tracking the Latest Insider Buys and Sells of BlackRock Inc

Filter Transactions| Datesorted ascending | Name | Buy/Sell | $ Value | Avg. Price | # Shares | Title |

|---|---|---|---|---|---|---|

| Mar 28, 2024 | nixon gordon m. | acquired | - | - | 39.00 | - |

| Mar 28, 2024 | freda fabrizio | acquired | - | - | 30.00 | - |

| Mar 28, 2024 | peck kristin c | acquired | - | - | 33.00 | - |

| Mar 28, 2024 | ford william e | acquired | - | - | 39.00 | - |

| Mar 28, 2024 | robbins charles | acquired | - | - | 30.00 | - |

| Mar 28, 2024 | alsaad bader m. | acquired | - | - | 7.00 | - |

| Mar 28, 2024 | slim domit marco antonio | acquired | - | - | 13.00 | - |

| Mar 28, 2024 | nasser amin h. | acquired | - | - | 30.00 | - |

| Mar 28, 2024 | vestberg hans erik | acquired | - | - | 33.00 | - |

| Mar 28, 2024 | johnson margaret l | acquired | - | - | 38.00 | - |

Which funds bought or sold BLK recently?

View All Details| Datesorted ascending | Fund Name | Type | % Chg | $ Change | $ Held | % Portfolio |

|---|---|---|---|---|---|---|

| May 16, 2024 | Pineridge Advisors LLC | reduced | -68.57 | -19,242 | 9,171 | -% |

| May 16, 2024 | Brown Shipley& Co Ltd | reduced | -32.17 | -476,413 | 1,075,720 | 0.34% |

| May 16, 2024 | Ancora Advisors LLC | added | 0.54 | 712,215 | 22,626,300 | 0.51% |

| May 16, 2024 | Arete Wealth Advisors, LLC | sold off | -100 | -1,734,350 | - | -% |

| May 16, 2024 | Mubadala Investment Co PJSC | unchanged | - | 3,985,800 | 151,733,000 | 0.59% |

| May 16, 2024 | First Western Trust Bank | reduced | -3.57 | -48,132 | 4,935,670 | 0.22% |

| May 16, 2024 | B. Riley Wealth Advisors, Inc. | added | 22.89 | -57,950 | 2,648,990 | 0.07% |

| May 16, 2024 | Tidal Investments LLC | reduced | -22.00 | -3,600,070 | 14,496,600 | 0.24% |

| May 16, 2024 | HANCOCK WHITNEY CORP | reduced | -5.26 | -10,434 | 375,171 | 0.01% |

| May 16, 2024 | COMERICA BANK | added | 1.29 | 1,819,240 | 47,036,200 | 0.20% |

Are Funds Buying or Selling BLK?

BLK Alerts

Unveiling BlackRock Inc's Major ShareHolders

| Date Filed | Name of Filer | Percent of Class | No. of Shares | Form Type | |

|---|---|---|---|---|---|

| Feb 13, 2024 | vanguard group inc | 8.66% | 12,890,008 | SC 13G/A | |

| Feb 09, 2024 | blackrock inc. | 6.4% | 9,580,403 | SC 13G/A | |

| Feb 14, 2023 | blackrock inc. | 7.0% | 10,455,014 | SC 13G/A | |

| Feb 13, 2023 | capital world investors | 1.6% | 2,351,137 | SC 13G/A | |

| Feb 09, 2023 | vanguard group inc | 9.04% | 13,580,827 | SC 13G/A | |

| Feb 11, 2022 | capital world investors | 5.1% | 7,799,669 | SC 13G | |

| Feb 09, 2022 | vanguard group inc | 8.05% | 12,236,134 | SC 13G/A | |

| Feb 03, 2022 | blackrock inc. | 6.7% | 10,141,086 | SC 13G/A | |

| Sep 14, 2021 | wilshire advisors llc | - | 0 | SC 13G/A | |

| Feb 25, 2021 | van eck associates corp | 0.00% | 0 | SC 13G/A |

Recent SEC filings of BlackRock Inc

View All Filings| Date Filed | Form Type | Document | |

|---|---|---|---|

| May 17, 2024 | 8-K | Current Report | |

| May 14, 2024 | 4 | Insider Trading | |

| May 13, 2024 | PX14A6G | PX14A6G | |

| May 10, 2024 | 13F-HR | Fund Holdings Report | |

| May 10, 2024 | SC 13G/A | Major Ownership Report | |

| May 10, 2024 | 144 | Notice of Insider Sale Intent | |

| May 08, 2024 | SC 13G/A | Major Ownership Report | |

| May 08, 2024 | SC 13G/A | Major Ownership Report | |

| May 08, 2024 | SC 13G/A | Major Ownership Report | |

| May 08, 2024 | SC 13G/A | Major Ownership Report |

- …

Peers (Alternatives to BlackRock Inc)

| Name | Mkt Capsorted ascending | Revenue | Price %, 1M | Returns, 1Y | P/E | P/S | Rev 1-Yr | Inc 1-Yr |

|---|---|---|---|---|---|---|---|---|

| LARGE-CAP | ||||||||

BLK | 120.7B | 18.3B | 7.75% | 21.34% | 20.39 | 6.58 | 5.32% | 20.80% |

BX | 89.8B | 10.3B | 2.05% | 51.09% | 41.74 | 8.7 | 116.39% | 249.10% |

ARES | 45.1B | 3.6B | 10.55% | 75.18% | 95.05 | 12.68 | 12.70% | 183.11% |

BK | 44.5B | 19.6B | 9.27% | 44.86% | 13.33 | 2.27 | 78.39% | 20.24% |

BEN | 12.8B | 8.1B | -2.18% | -1.62% | 14.21 | 1.58 | 2.98% | 5.84% |

| MID-CAP | ||||||||

IVZ | 7.2B | 5.8B | 4.99% | 4.37% | -21.34 | 1.25 | -1.10% | -153.42% |

AMG | 5.1B | 2.0B | 0.28% | 11.53% | 7.38 | 2.49 | -8.91% | -39.33% |

AB | 3.9B | - | 4.19% | -3.10% | 14.21 | - | - | 7.16% |

CNS | 3.7B | 486.3M | 9.54% | 29.26% | 28.98 | 7.61 | -9.75% | -22.27% |

APAM | 3.6B | 1.0B | 6.30% | 36.32% | 15.6 | 3.59 | 6.21% | 20.27% |

AMK | 2.5B | 722.2M | -1.99% | 19.50% | 17.56 | 3.5 | 12.85% | 46.40% |

| SMALL-CAP | ||||||||

PX | 948.7M | 250.6M | 10.01% | -21.97% | -360.78 | 3.79 | 18.02% | -111.85% |

BSIG | 861.0M | 440.5M | 1.74% | - | 12.59 | 1.95 | 11.01% | -22.97% |

AINC | 16.6M | 770.8M | 0.62% | -50.36% | -3.82 | 0.02 | 10.81% | -208.39% |

AC | 733.0K | 23.1M | 5.94% | -11.35% | 0.02 | 0.03 | 53.41% | 323.95% |

BlackRock Inc News

BlackRock Inc Earnings Report: Key Takeaways & Analysis

| Income Statement (Quarterly) | (In Millions) | |||||||||||||||||||||

| Description | (%) Q/Q | 2024Q1 | 2023Q4 | 2023Q3 | 2023Q2 | 2023Q1 | 2022Q4 | 2022Q3 | 2022Q2 | 2022Q1 | 2021Q4 | 2021Q3 | 2021Q2 | 2021Q1 | 2020Q4 | 2020Q3 | 2020Q2 | 2020Q1 | 2019Q4 | 2019Q3 | 2019Q2 | 2019Q1 |

| Revenue | 2.1% | 4,728 | 4,631 | 4,522 | 4,463 | 4,243 | 4,337 | 4,311 | 4,526 | 4,699 | 5,106 | 5,050 | 4,820 | 4,398 | 4,478 | 4,369 | 3,648 | 3,710 | 3,977 | 3,692 | 3,524 | 3,346 |

| Operating Expenses | -0.4% | 3,035 | 3,046 | 2,885 | 2,848 | 2,805 | 2,910 | 2,785 | 2,858 | 2,935 | 3,067 | 3,115 | 2,889 | 2,853 | 2,630 | 2,612 | 2,242 | 3,026 | 2,439 | 2,190 | 2,246 | 2,113 |

| S&GA Expenses | -100.0% | - | 624 | 546 | 520 | 521 | 580 | 554 | 530 | 496 | 564 | 611 | 461 | 585 | 474 | 461 | 388 | 1,142 | 515 | 385 | 470 | 388 |

| EBITDA Margin | 2.3% | 0.45* | 0.44* | 0.43* | 0.43* | 0.39* | 0.39* | 0.40* | 0.41* | 0.45* | 0.45* | 0.47* | 0.47* | - | - | - | - | - | - | - | - | - |

| Interest Expenses | 12.2% | 92.00 | 82.00 | 82.00 | 69.00 | 59.00 | 54.00 | 50.00 | 54.00 | 54.00 | 50.00 | 48.00 | 52.00 | 55.00 | 54.00 | 54.00 | 51.00 | 46.00 | 51.00 | 54.00 | 52.00 | 46.00 |

| Income Taxes | -33.8% | 290 | 438 | 213 | 443 | 385 | 345 | 330 | 358 | 263 | 478 | 518 | 654 | 318 | 427 | 464 | 361 | -14.00 | 300 | 341 | 322 | 298 |

| Earnings Before Taxes | -0.7% | 1,913 | 1,927 | 1,808 | 1,866 | 1,554 | 1,652 | 1,691 | 1,321 | 1,626 | 2,110 | 2,271 | 2,201 | 1,591 | 2,167 | 1,981 | 1,763 | 613 | 1,634 | 1,460 | 1,335 | 1,358 |

| EBT Margin | 2.2% | 0.41* | 0.40* | 0.39* | 0.39* | 0.36* | 0.35* | 0.36* | 0.38* | 0.42* | 0.42* | 0.44* | 0.44* | - | - | - | - | - | - | - | - | - |

| Net Income | 14.4% | 1,573 | 1,375 | 1,604 | 1,366 | 1,157 | 1,259 | 1,406 | 1,077 | 1,436 | 1,643 | 1,681 | 1,378 | 1,199 | 1,548 | 1,364 | 1,214 | 806 | 1,301 | 1,119 | 1,003 | 1,053 |

| Net Income Margin | 4.7% | 0.32* | 0.31* | 0.31* | 0.30* | 0.28* | 0.29* | 0.30* | 0.30* | 0.31* | 0.30* | 0.31* | 0.30* | - | - | - | - | - | - | - | - | - |

| Free Cashflow | -125.2% | -472 | 1,874 | 1,498 | 924 | -475 | 1,839 | 1,624 | 1,529 | -569 | 1,791 | 1,737 | 1,696 | - | - | - | - | - | - | - | - | - |

| Balance Sheet | (In Millions) | |||||||||||||||||||||

| Description | (%) Q/Q | 2024Q1 | 2023Q4 | 2023Q3 | 2023Q2 | 2023Q1 | 2022Q4 | 2022Q3 | 2022Q2 | 2022Q1 | 2021Q4 | 2021Q3 | 2021Q2 | 2021Q1 | 2020Q4 | 2020Q3 | 2020Q2 | 2020Q1 | 2019Q4 | 2019Q3 | 2019Q2 | 2019Q1 |

| Assets | 0.6% | 123,988 | 123,211 | 118,585 | 122,644 | 121,398 | 117,628 | 115,430 | 125,966 | 143,327 | 152,648 | 169,636 | 176,962 | 173,859 | 176,982 | 165,118 | 157,342 | 149,020 | 168,622 | 163,872 | 163,347 | 165,008 |

| Cash Equivalents | 7.5% | 9,391 | 8,736 | 7,316 | 6,834 | 5,644 | 7,416 | 6,814 | 6,498 | 7,279 | 9,340 | 7,378 | 6,433 | 6,360 | 8,681 | 6,524 | 5,483 | 4,423 | 4,846 | 4,624 | 4,040 | 4,078 |

| Net PPE | -0.5% | 1,106 | 1,112 | 1,058 | 1,045 | 1,046 | 1,031 | 965 | 900 | 851 | 762 | 703 | 741 | 671 | 681 | 693 | 697 | 714 | 715 | 669 | 659 | 656 |

| Goodwill | 0.0% | 15,522 | 15,524 | 15,516 | 15,338 | 15,339 | 15,341 | 15,344 | 15,346 | 15,349 | 15,351 | 15,360 | 15,362 | 15,348 | 14,551 | 14,554 | 14,556 | 14,559 | 14,562 | 14,552 | 14,511 | 13,524 |

| Liabilities | 0.3% | 82,243 | 81,971 | 77,954 | 82,748 | 82,333 | 78,843 | 77,313 | 87,661 | 104,468 | 113,755 | 131,270 | 138,572 | 136,019 | 139,326 | 129,102 | 123,308 | 114,510 | 133,693 | 130,268 | 130,687 | 132,637 |

| Long Term Debt | 24.5% | 9,860 | 7,918 | 7,884 | 7,904 | 6,669 | 6,700 | 6,591 | 6,635 | 7,430 | 7,400 | 6,474 | 6,491 | 7,232 | 7,264 | 7,227 | 7,190 | 5,933 | 4,955 | 5,932 | 5,964 | 4,966 |

| Shareholder's Equity | 1.4% | 39,895 | 39,347 | 38,627 | 38,350 | 37,830 | 37,744 | 37,289 | 37,202 | 37,596 | 37,806 | 36,929 | 36,148 | 35,429 | 35,334 | 33,932 | 32,786 | 33,070 | 33,613 | 32,467 | 31,950 | 31,362 |

| Additional Paid-In Capital | -1.1% | 19,617 | 19,833 | 19,687 | 19,571 | 19,427 | 19,772 | 19,609 | 19,469 | 19,302 | 19,640 | 19,462 | 19,297 | 19,121 | 19,293 | 19,150 | 19,007 | 18,885 | 19,186 | 19,058 | 18,947 | 18,827 |

| Accumulated Depreciation | 4.2% | 1,499 | 1,439 | 1,487 | 1,434 | 1,374 | 1,390 | 1,393 | 1,344 | 1,309 | 1,256 | 1,257 | 1,211 | 1,150 | 1,098 | 1,040 | 979 | 923 | 880 | 876 | 836 | 794 |

| Shares Outstanding | 0.2% | 149 | 149 | 149 | 149 | 150 | 150 | 151 | 151 | 152 | 152 | 152 | 152 | - | - | - | - | - | - | - | - | - |

| Minority Interest | 11.1% | 170 | 153 | 153 | 142 | 118 | 132 | 127 | 113 | 107 | 113 | 112 | 115 | 49.00 | 51.00 | 59.00 | 56.00 | 57.00 | 66.00 | 60.00 | 57.00 | 53.00 |

| Float | - | - | - | - | 102,000 | - | - | - | 91,000 | - | - | - | 131,800 | - | - | - | 81,900 | - | - | - | 71,900 | - |

| Cashflow (Quarterly) | (In Millions) | |||||||||||||||||||||

| Description | (%) Q/Q | 2024Q1 | 2023Q4 | 2023Q3 | 2023Q2 | 2023Q1 | 2022Q4 | 2022Q3 | 2022Q2 | 2022Q1 | 2021Q4 | 2021Q3 | 2021Q2 | 2021Q1 | 2020Q4 | 2020Q3 | 2020Q2 | 2020Q1 | 2019Q4 | 2019Q3 | 2019Q2 | 2019Q1 |

| Cashflow From Operations | -120.4% | -408 | 1,998 | 1,576 | 985 | -394 | 1,973 | 1,760 | 1,645 | -422 | 1,917 | 1,774 | 1,826 | -573 | 1,979 | 995 | 1,707 | -938 | 1,256 | 931 | 922 | -225 |

| Share Based Compensation | 9.3% | 176 | 161 | 146 | 158 | 165 | 172 | 160 | 175 | 201 | 183 | 173 | 182 | 196 | 164 | 160 | 149 | 149 | 140 | 133 | 140 | 154 |

| Cashflow From Investing | 88.2% | -22.00 | -186 | -270 | -281 | -222 | -416 | -214 | -302 | -198 | -358 | -144 | -285 | -1,150 | -77.00 | -19.00 | -124 | -34.00 | 93.00 | -444 | -1,545 | -118 |

| Cashflow From Financing | 317.7% | 1,095 | -503 | -735 | 440 | -1,194 | -1,126 | -1,044 | -1,921 | -1,351 | 408 | -629 | -1,475 | -591 | 138 | - | -522 | 628 | -1,214 | 139 | 604 | -2,112 |

| Dividend Payments | -100.0% | - | 743 | 748 | 748 | 796 | 731 | 736 | 737 | 786 | 627 | 629 | 630 | 661 | 554 | 556 | 554 | 596 | 512 | 513 | 515 | 556 |

| Buy Backs | 65.1% | 634 | 384 | 396 | 383 | 721 | 505 | 384 | 507 | 936 | 303 | 309 | 305 | 568 | 17.00 | 10.00 | 1,125 | 657 | 7.00 | 109 | 7.00 | 1,788 |

BLK Income Statement

2024-03-31Condensed Consolidated Statements of Income - USD ($) $ in Millions | 3 Months Ended | |

|---|---|---|

Mar. 31, 2024 | Mar. 31, 2023 | |

| Revenue | ||

| Total revenue | $ 4,728 | $ 4,243 |

| Expense | ||

| Employee compensation and benefits | 1,580 | 1,427 |

| Total sales, asset and account expense | 888 | 846 |

| Distribution and servicing costs | 518 | 505 |

| Direct fund expense | 338 | 315 |

| Sub-advisory and other | 32 | 26 |

| General and administration expense | 529 | 495 |

| Amortization of intangible assets | 38 | 37 |

| Total expense | 3,035 | 2,805 |

| Operating income | 1,693 | 1,438 |

| Nonoperating income (expense) | ||

| Net gain (loss) on investments | 171 | 89 |

| Interest and dividend income | 141 | 86 |

| Interest expense | (92) | (59) |

| Total nonoperating income (expense) | 220 | 116 |

| Income before income taxes | 1,913 | 1,554 |

| Income tax expense | 290 | 385 |

| Net income | 1,623 | 1,169 |

| Net income (loss) attributable to noncontrolling interests | 50 | 12 |

| Net income attributable to BlackRock, Inc. | $ 1,573 | $ 1,157 |

| Earnings per share attributable to BlackRock, Inc. common stockholders: | ||

| Basic | $ 10.58 | $ 7.72 |

| Diluted | $ 10.48 | $ 7.64 |

| Weighted-average common shares outstanding: | ||

| Basic | 148,689,172 | 149,909,343 |

| Diluted | 150,125,182 | 151,349,829 |

| Investment Advisory, Administration Fees and Securities Lending Revenue [Member] | ||

| Revenue | ||

| Total revenue | $ 3,778 | $ 3,502 |

| Investment Advisory, Administration Fees and Securities Lending Revenue [Member] | Related Parties [Member] | ||

| Revenue | ||

| Total revenue | 2,847 | 2,611 |

| Investment Advisory, Administration Fees and Securities Lending Revenue [Member] | Other Third Parties [Member] | ||

| Revenue | ||

| Total revenue | 931 | 891 |

| Investment Advisory Performance Fees [Member] | ||

| Revenue | ||

| Total revenue | 204 | 55 |

| Technology Services Revenue [Member] | ||

| Revenue | ||

| Total revenue | 377 | 340 |

| Distribution Fees [Member] | ||

| Revenue | ||

| Total revenue | 310 | 319 |

| Advisory and Other Revenue [Member] | ||

| Revenue | ||

| Total revenue | $ 59 | $ 27 |

| CEO | Mr. Laurence Douglas Fink |

|---|---|

| WEBSITE | blackrock.com |

| INDUSTRY | Asset Management |

| EMPLOYEES | 19300 |