Market Summary

BR Stock Price

BR RSI Chart

BR Valuation

BR Price/Sales (Trailing)

BR Profitability

BR Fundamentals

BR Revenue

BR Earnings

Breaking Down BR Revenue

Last 7 days

4.0%

Last 30 days

5.2%

Last 90 days

2.8%

Trailing 12 Months

31.9%

How does BR drawdown profile look like?

BR Financial Health

BR Investor Care

Historical Charts for Stock Metrics

| Year | Q1 | Q2 | Q3 | Q4 |

|---|---|---|---|---|

| 2024 | 6.4B | 0 | 0 | 0 |

| 2023 | 5.9B | 6.1B | 6.2B | 6.3B |

| 2022 | 5.5B | 5.7B | 5.8B | 5.8B |

| 2021 | 4.8B | 5.0B | 5.2B | 5.4B |

| 2020 | 4.4B | 4.5B | 4.6B | 4.7B |

| 2019 | 4.5B | 4.4B | 4.3B | 4.4B |

| 2018 | 4.4B | 4.3B | 4.4B | 4.3B |

| 2017 | 3.8B | 4.1B | 4.2B | 4.3B |

| 2016 | 2.9B | 2.9B | 3.2B | 3.5B |

| 2015 | 2.7B | 2.7B | 2.7B | 2.8B |

| 2014 | 2.5B | 2.6B | 2.6B | 2.6B |

| 2013 | 2.4B | 2.4B | 2.5B | 2.5B |

| 2012 | 2.3B | 2.3B | 2.3B | 2.3B |

| 2011 | 2.1B | 2.2B | 2.2B | 2.3B |

| 2010 | 2.2B | 2.2B | 2.2B | 2.1B |

| 2009 | 0 | 2.1B | 2.1B | 2.1B |

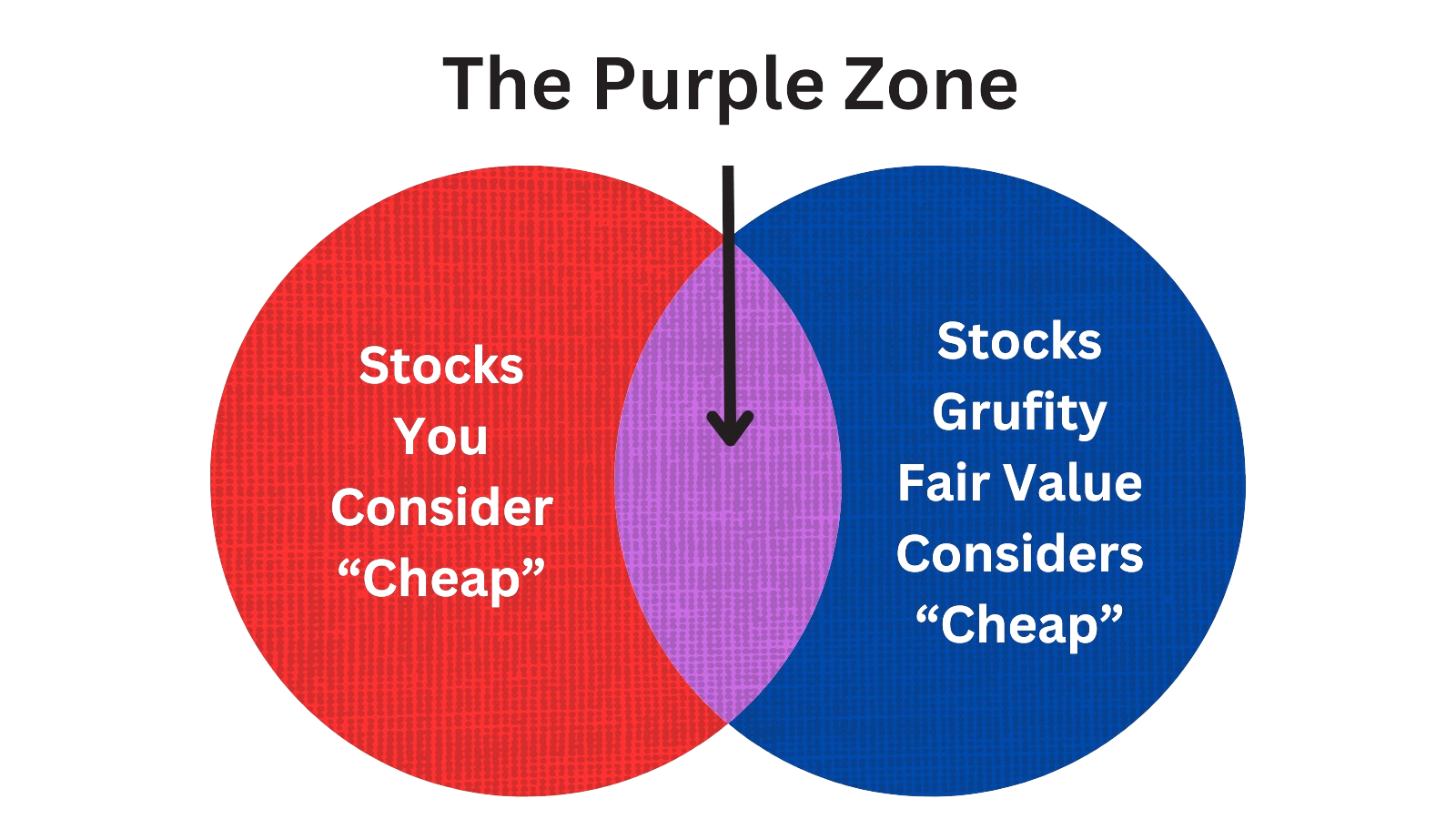

Stocks Marked 'Very Cheap' by Grufity's Fair Value Model Have Outperformed S&P 500 Index

Grufity's Fair Value model takes all the S&P 500 stocks and divides them into separate buckets based on their attractiveness. The 'Very Cheap' bucket of S&P 500 has greatly outperformed S&P 500 Index. Conversely, S&P500 stocks considered 'Very Expensive' by the model underperformed the S&P500 index in the past three years. Grufity Fair Value is available for 2300+ stocks, including 90% of S&P 500 stocks. Grufity's Fair Value Model separates high-return stocks from low-return stocks.

Returns of $10,000 invested in:

Very Cheap Stocks: $17,289

S&P 500 Index: $12,922

Very Expensive Stocks: $11,022

Grufity's Fair Value model does a great job in separating High Performing Stocks from Low Performing ones in the S&P 500 list.

Tracking the Latest Insider Buys and Sells of Broadridge Financial Solutions Inc

Filter Transactions| Datesorted ascending | Name | Buy/Sell | $ Value | Avg. Price | # Shares | Title |

|---|---|---|---|---|---|---|

| May 10, 2024 | stingi richard john | back to issuer | -77,612 | 194 | -400 | corporate vp and chro |

| Apr 08, 2024 | carey thomas p | sold (taxes) | -292,366 | 202 | -1,442 | corporate vp |

| Apr 05, 2024 | flowers melvin l | acquired | - | - | 6.00 | - |

| Apr 05, 2024 | markus maura a. | acquired | - | - | 65.00 | - |

| Apr 05, 2024 | nazareth annette l. | acquired | - | - | 12.00 | - |

| Apr 05, 2024 | zavery amit | acquired | - | - | 24.00 | - |

| Apr 05, 2024 | carter pamela l | acquired | - | - | 18.00 | - |

| Apr 05, 2024 | brun leslie a | acquired | - | - | 110 | - |

| Apr 05, 2024 | murray eileen k | acquired | - | - | 6.00 | - |

| Apr 05, 2024 | keller brett | acquired | - | - | 42.00 | - |

Which funds bought or sold BR recently?

View All Details| Datesorted ascending | Fund Name | Type | % Chg | $ Change | $ Held | % Portfolio |

|---|---|---|---|---|---|---|

| May 16, 2024 | CALIFORNIA STATE TEACHERS RETIREMENT SYSTEM | added | 1.39 | 380,090 | 40,286,700 | 0.05% |

| May 16, 2024 | Tidal Investments LLC | added | 99.63 | 1,802,310 | 3,627,310 | 0.06% |

| May 16, 2024 | Brown Shipley& Co Ltd | added | 0.49 | -402 | 41,983 | 0.01% |

| May 16, 2024 | LBP AM SA | new | - | 4,143,500 | 4,143,500 | 0.16% |

| May 16, 2024 | B. Riley Wealth Advisors, Inc. | added | 44.41 | 176,139 | 859,488 | 0.02% |

| May 16, 2024 | Dynasty Wealth Management, LLC | new | - | 1,258,540 | 1,258,540 | 0.04% |

| May 16, 2024 | FSA Wealth Management LLC | unchanged | - | -528 | 37,472 | 0.02% |

| May 16, 2024 | COMERICA BANK | added | 5.00 | 408,394 | 9,382,180 | 0.04% |

| May 16, 2024 | JANE STREET GROUP, LLC | reduced | -56.32 | -1,771,670 | 1,363,340 | -% |

| May 16, 2024 | Motley Fool Asset Management LLC | reduced | -2.64 | -309,642 | 9,800,710 | 0.63% |

Are Funds Buying or Selling BR?

Unveiling Broadridge Financial Solutions Inc's Major ShareHolders

| Date Filed | Name of Filer | Percent of Class | No. of Shares | Form Type | |

|---|---|---|---|---|---|

| Feb 13, 2024 | vanguard group inc | 11.86% | 13,950,662 | SC 13G/A | |

| Jan 25, 2024 | blackrock inc. | 8.3% | 9,754,088 | SC 13G/A | |

| Dec 11, 2023 | morgan stanley | 4.3% | 5,081,333 | SC 13G/A | |

| Feb 09, 2023 | vanguard group inc | 12.12% | 14,255,958 | SC 13G/A | |

| Feb 08, 2023 | morgan stanley | 5.6% | 6,577,256 | SC 13G | |

| Jan 25, 2023 | blackrock inc. | 9.0% | 10,628,720 | SC 13G | |

| Feb 09, 2022 | vanguard group inc | 11.67% | 13,606,219 | SC 13G/A | |

| Feb 03, 2022 | blackrock inc. | 8.2% | 9,566,678 | SC 13G/A | |

| Feb 11, 2021 | janus henderson group plc | 5.5% | 6,354,526 | SC 13G/A | |

| Feb 10, 2021 | vanguard group inc | 11.65% | 13,469,527 | SC 13G/A |

Recent SEC filings of Broadridge Financial Solutions Inc

View All Filings| Date Filed | Form Type | Document | |

|---|---|---|---|

| May 17, 2024 | 8-K | Current Report | |

| May 16, 2024 | 8-K | Current Report | |

| May 10, 2024 | 144 | Notice of Insider Sale Intent | |

| May 10, 2024 | 4 | Insider Trading | |

| May 08, 2024 | 10-Q | Quarterly Report | |

| May 08, 2024 | 8-K | Current Report | |

| Apr 08, 2024 | 4 | Insider Trading | |

| Apr 08, 2024 | 4 | Insider Trading | |

| Apr 08, 2024 | 4 | Insider Trading | |

| Apr 08, 2024 | 4 | Insider Trading |

- …

Peers (Alternatives to Broadridge Financial Solutions Inc)

| Name | Mkt Capsorted ascending | Revenue | Price %, 1M | Returns, 1Y | P/E | P/S | Rev 1-Yr | Inc 1-Yr |

|---|---|---|---|---|---|---|---|---|

| LARGE-CAP | ||||||||

ACN | 191.1B | 64.6B | -3.43% | 5.66% | 27.17 | 2.96 | 2.26% | 1.32% |

IBM | 155.0B | 62.1B | -7.68% | 33.99% | 18.95 | 2.5 | 2.45% | 346.26% |

CTSH | 34.2B | 19.3B | 1.82% | 8.09% | 16.34 | 1.77 | -0.58% | -9.32% |

CDW | 30.1B | 21.1B | -5.54% | 28.00% | 27.57 | 1.42 | -7.67% | -0.37% |

BR | 24.0B | 6.4B | 5.16% | 31.93% | 34.39 | 3.76 | 7.68% | 26.07% |

| MID-CAP | ||||||||

CACI | 9.5B | 7.3B | 17.76% | 40.72% | 24.22 | 1.3 | 10.28% | 6.24% |

EXLS | 5.1B | 1.7B | 6.05% | 0.91% | 27.84 | 3.04 | 12.34% | 15.10% |

ASGN | 4.6B | 4.4B | 6.73% | 49.39% | 22.32 | 1.06 | -5.37% | -17.11% |

DXC | 3.0B | 13.7B | -16.57% | -30.75% | 32.46 | 0.22 | -5.29% | 116.02% |

XRX | 1.7B | 6.7B | -13.84% | -4.58% | -9.47 | 0.26 | -6.72% | 6.15% |

| SMALL-CAP | ||||||||

CTG | 1.7B | 302.0M | 13.51% | 1525.39% | 2.8K | 4.93 | -16.01% | -96.16% |

GDYN | 782.8M | 312.6M | 0.29% | 24.76% | 346.84 | 2.5 | -2.04% | 106.54% |

CNDT | 779.5M | 3.7B | 26.16% | 6.72% | -2.63 | 0.21 | -2.41% | -62.64% |

DMRC | 538.6M | 36.9M | 11.26% | -16.91% | -12.75 | 14.58 | 20.62% | 24.62% |

CSPI | 140.7M | 62.1M | -11.69% | 31.99% | 25.89 | 2.27 | 0.80% | 60.81% |

Broadridge Financial Solutions Inc News

Broadridge Financial Solutions Inc Earnings Report: Key Takeaways & Analysis

| Income Statement (Quarterly) | (In Millions) | |||||||||||||||||||||

| Description | (%) Q/Q | 2024Q1 | 2023Q4 | 2023Q3 | 2023Q2 | 2023Q1 | 2022Q4 | 2022Q3 | 2022Q2 | 2022Q1 | 2021Q4 | 2021Q3 | 2021Q2 | 2021Q1 | 2020Q4 | 2020Q3 | 2020Q2 | 2020Q1 | 2019Q4 | 2019Q3 | 2019Q2 | 2019Q1 |

| Revenue | 22.9% | 1,727 | 1,405 | 1,431 | 1,839 | 1,646 | 1,293 | 1,283 | 1,723 | 1,534 | 1,260 | 1,193 | 1,532 | 1,390 | 1,055 | 1,017 | 1,362 | 1,250 | 969 | 949 | 1,211 | 1,225 |

| Costs and Expenses | 11.2% | 1,424 | 1,281 | 1,283 | 1,385 | 1,359 | 1,185 | 1,196 | 1,381 | 1,288 | 1,191 | 1,090 | 1,250 | 1,151 | 976 | 939 | 1,063 | 1,024 | 942 | 875 | 970 | 991 |

| S&GA Expenses | 5.7% | 236 | 223 | 207 | 226 | 221 | 197 | 205 | 234 | 210 | 212 | 176 | 234 | 190 | 169 | 152 | 179 | 151 | 161 | 148 | 159 | 144 |

| EBITDA Margin | -0.2% | 0.12* | 0.12* | 0.12* | 0.12* | 0.12* | 0.12* | 0.12* | 0.12* | 0.12* | 0.12* | 0.12* | 0.13* | - | - | - | - | - | - | - | - | - |

| Interest Expenses | -50.3% | 25.00 | 51.00 | 20.00 | 51.00 | 26.00 | 47.00 | 13.00 | 36.00 | 5.00 | 36.00 | 5.00 | 23.00 | 2.00 | 21.00 | 10.00 | 21.00 | 10.00 | 14.00 | 14.00 | 12.00 | 11.00 |

| Income Taxes | 204.0% | 53.00 | 17.00 | 22.00 | 93.00 | 52.00 | 14.00 | 5.00 | 71.00 | 47.00 | 5.00 | 11.00 | 76.00 | 52.00 | 13.00 | 8.00 | 65.00 | 44.00 | 0.00 | 8.00 | 47.00 | 51.00 |

| Earnings Before Taxes | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | 211 | 11.00 | 64.00 | 230 | 224 |

| EBT Margin | -1.3% | 0.08* | 0.08* | 0.08* | 0.08* | 0.09* | 0.09* | 0.09* | 0.09* | 0.09* | 0.10* | 0.10* | 0.10* | - | - | - | - | - | - | - | - | - |

| Net Income | 204.0% | 214 | 70.00 | 91.00 | 324 | 199 | 58.00 | 50.00 | 248 | 177 | 47.00 | 67.00 | 260 | 165 | 56.00 | 66.00 | 230 | 167 | 10.00 | 56.00 | 183 | 172 |

| Net Income Margin | 0.9% | 0.11* | 0.11* | 0.11* | 0.10* | 0.09* | 0.09* | 0.09* | 0.09* | 0.10* | 0.10* | 0.11* | 0.11* | - | - | - | - | - | - | - | - | - |

| Free Cashflow | 3.9% | 185 | 178 | -66.70 | 712 | 170 | 113 | -210 | 450 | 70.00 | 35.00 | -141 | 440 | - | - | - | - | - | - | - | - | - |

| Balance Sheet | (In Millions) | |||||||||||||||||||||

| Description | (%) Q/Q | 2024Q1 | 2023Q4 | 2023Q3 | 2023Q2 | 2023Q1 | 2022Q4 | 2022Q3 | 2022Q2 | 2022Q1 | 2021Q4 | 2021Q3 | 2021Q2 | 2021Q1 | 2020Q4 | 2020Q3 | 2020Q2 | 2020Q1 | 2019Q4 | 2019Q3 | 2019Q2 | 2019Q1 |

| Assets | 2.7% | 8,215 | 8,000 | 8,071 | 8,233 | 8,432 | 8,051 | 8,091 | 8,169 | 8,350 | 8,116 | 8,028 | 8,120 | 5,187 | 4,858 | 4,750 | 4,890 | 4,914 | 4,385 | 4,220 | 3,881 | 3,602 |

| Current Assets | 14.8% | 1,565 | 1,364 | 1,327 | 1,393 | 1,568 | 1,283 | 1,222 | 1,328 | 1,495 | 1,267 | 1,211 | 1,261 | 1,379 | 1,149 | 1,120 | 1,328 | 1,361 | 1,011 | 1,095 | 1,042 | 1,195 |

| Cash Equivalents | -14.9% | 236 | 277 | 234 | 252 | 332 | 280 | 227 | 225 | 277 | 281 | 317 | 275 | 356 | 366 | 357 | 477 | 402 | 234 | 358 | 273 | 292 |

| Net PPE | 8.2% | 155 | 143 | 144 | 146 | 138 | 143 | 145 | 151 | 165 | 170 | 167 | 177 | 167 | 167 | 162 | 162 | 154 | 138 | 186 | 189 | 183 |

| Goodwill | 0.7% | 3,452 | 3,429 | 3,445 | 3,462 | 3,447 | 3,388 | 3,434 | 3,485 | 3,578 | 3,664 | 3,677 | 27.00 | 1,723 | 1,706 | 1,701 | 18.00 | 1,705 | 1,661 | 1,495 | 27.00 | 1,257 |

| Liabilities | 0.3% | 5,948 | 5,932 | 5,958 | 5,993 | 6,433 | 6,265 | 6,187 | 6,250 | 6,528 | 6,368 | 6,275 | 6,311 | 3,597 | 3,424 | 3,336 | 3,543 | 3,711 | 3,259 | 3,077 | 2,753 | 2,337 |

| Current Liabilities | 15.6% | 1,122 | 971 | 924 | 2,398 | 1,163 | 1,019 | 992 | 1,313 | 1,177 | 1,088 | 967 | 1,288 | 1,003 | 838 | 744 | 1,341 | 1,255 | 1,125 | 1,041 | 803 | 705 |

| Long Term Debt | -3.8% | 3,514 | 3,653 | 3,682 | 2,235 | 4,077 | 4,105 | 4,064 | 3,793 | 4,167 | 4,157 | 4,166 | 3,888 | 1,738 | 1,771 | 1,776 | 1,388 | 1,680 | 1,449 | 1,369 | 1,470 | 1,174 |

| LT Debt, Current | - | - | - | - | 1,179 | - | - | - | - | - | - | - | - | - | - | - | 400 | 400 | 400 | 399 | - | - |

| LT Debt, Non Current | -100.0% | - | 3,653 | 3,682 | 2,235 | 4,077 | 4,105 | 4,064 | 3,793 | 4,167 | 4,157 | 4,166 | 3,888 | 1,738 | 1,771 | 1,776 | 1,388 | 1,680 | 1,449 | 1,369 | 1,470 | 1,174 |

| Shareholder's Equity | 9.7% | 2,267 | 2,068 | 2,113 | 2,241 | 1,999 | 1,787 | 1,904 | 1,919 | 1,821 | 1,748 | 1,754 | 1,809 | 1,589 | 1,434 | 1,414 | 1,347 | 1,203 | 1,125 | 1,143 | 1,128 | 1,266 |

| Retained Earnings | 3.9% | 3,205 | 3,086 | 3,110 | 3,113 | 2,875 | 2,761 | 2,789 | 2,824 | 2,651 | 2,549 | 2,577 | 2,584 | 2,390 | 2,292 | 2,302 | 2,303 | 2,135 | 2,030 | 2,082 | 2,088 | 1,960 |

| Additional Paid-In Capital | 2.5% | 1,545 | 1,507 | 1,481 | 1,437 | 1,424 | 1,402 | 1,380 | 1,345 | 1,333 | 1,308 | 1,264 | 1,246 | 1,241 | 1,220 | 1,199 | 1,179 | 1,169 | 1,150 | 1,131 | 1,109 | 1,108 |

| Shares Outstanding | 0.3% | 118 | 118 | 118 | 118 | 118 | 118 | 118 | 117 | 117 | 116 | 116 | 116 | - | - | - | - | - | - | - | - | - |

| Float | - | - | - | - | - | - | 15,677 | - | - | - | 21,192 | - | - | - | 17,614 | - | - | - | 14,073 | - | - | - |

| Cashflow (Quarterly) | (In Thousands) | |||||||||||||||||||||

| Description | (%) Q/Q | 2024Q1 | 2023Q4 | 2023Q3 | 2023Q2 | 2023Q1 | 2022Q4 | 2022Q3 | 2022Q2 | 2022Q1 | 2021Q4 | 2021Q3 | 2021Q2 | 2021Q1 | 2020Q4 | 2020Q3 | 2020Q2 | 2020Q1 | 2019Q4 | 2019Q3 | 2019Q2 | 2019Q1 |

| Cashflow From Operations | 9.3% | 207,400 | 189,800 | -62,000 | 729,200 | 175,500 | 123,100 | -204,500 | 457,400 | 80,700 | 40,800 | -135,400 | 450,600 | 106,200 | 127,500 | -44,200 | 442,600 | 144,100 | 97,900 | -86,400 | 399,100 | 135,800 |

| Share Based Compensation | -100.0% | - | 20,500 | 16,400 | 15,700 | 20,900 | 20,900 | 15,600 | 13,600 | 18,500 | 22,700 | 13,600 | 12,250 | 17,600 | 18,300 | 10,400 | 13,200 | 17,300 | 18,500 | 11,800 | 11,650 | 17,400 |

| Cashflow From Investing | -82.7% | -40,200 | -22,000 | -14,400 | -31,300 | -14,000 | -21,500 | -13,600 | -29,400 | -27,100 | -17,500 | -36,400 | -2,588,700 | -21,100 | -35,200 | -8,700 | -13,800 | -96,700 | -244,900 | -86,300 | -384,400 | -17,100 |

| Cashflow From Financing | -69.1% | -208,900 | -123,500 | 57,300 | -778,000 | -113,600 | -45,900 | 222,800 | -474,400 | -55,600 | -57,800 | 217,000 | 2,052,900 | -98,500 | -83,900 | -72,700 | -350,400 | 121,100 | 22,400 | 258,100 | -34,300 | -76,900 |

| Dividend Payments | 0.1% | 94,200 | 94,100 | 85,600 | 85,300 | 85,400 | 85,300 | 75,000 | 74,800 | 74,700 | 74,400 | 66,800 | 66,600 | 66,600 | 66,300 | 62,200 | 61,800 | 62,000 | 61,800 | 55,400 | 56,100 | 56,100 |

| Buy Backs | -25.0% | 300 | 400 | 161,100 | 20,600 | 1,200 | 400 | 2,100 | 20,700 | 400 | 1,700 | - | 20,500 | 200 | - | 800 | 18,800 | 50,500 | - | - | 277,500 | - |

BR Income Statement

2024-03-31Condensed Consolidated Statements of Earnings - USD ($) shares in Millions, $ in Millions | 3 Months Ended | 9 Months Ended | ||

|---|---|---|---|---|

Mar. 31, 2024 | Mar. 31, 2023 | Mar. 31, 2024 | Mar. 31, 2023 | |

| Income Statement [Abstract] | ||||

| Revenues | $ 1,726.5 | $ 1,645.7 | $ 4,562.5 | $ 4,221.9 |

| Operating expenses: | ||||

| Cost of revenues | 1,187.3 | 1,137.7 | 3,319.8 | 3,116.4 |

| Selling, general and administrative expenses | 236.2 | 221.2 | 667.0 | 623.3 |

| Total operating expenses | 1,423.6 | 1,358.9 | 3,986.8 | 3,739.7 |

| Operating income | 302.9 | 286.8 | 575.7 | 482.2 |

| Interest expense, net | (35.3) | (38.5) | (105.1) | (99.5) |

| Other non-operating income (expenses), net | (0.9) | 1.8 | (3.5) | (5.3) |

| Earnings before income taxes | 266.7 | 250.1 | 467.2 | 377.4 |

| Provision for income taxes | 52.9 | 51.6 | 92.3 | 70.9 |

| Net earnings | $ 213.7 | $ 198.5 | $ 374.9 | $ 306.5 |

| Basic earnings per share (in dollars per share) | $ 1.81 | $ 1.69 | $ 3.18 | $ 2.61 |

| Diluted earnings per share (in dollars per share) | $ 1.79 | $ 1.67 | $ 3.14 | $ 2.58 |

| Weighted-average shares outstanding: | ||||

| Basic (in shares) | 117.8 | 117.7 | 117.8 | 117.6 |

| Diluted (in shares) | 119.4 | 119.1 | 119.2 | 118.9 |

BR Balance Sheet

2024-03-31Condensed Consolidated Balance Sheets - USD ($) $ in Millions | Mar. 31, 2024 | Jun. 30, 2023 |

|---|---|---|

| Current assets: | ||

| Cash and cash equivalents | $ 235.6 | $ 252.3 |

| Accounts receivable, net of allowance for doubtful accounts of $7.9 and $7.2, respectively | 1,165.1 | 974.0 |

| Other current assets | 164.3 | 166.2 |

| Total current assets | 1,565.1 | 1,392.5 |

| Property, plant and equipment, net | 155.0 | 145.7 |

| Goodwill | 3,451.9 | 3,461.6 |

| Intangible assets, net | 1,317.2 | 1,467.2 |

| Deferred client conversion and start-up costs | 905.2 | 937.0 |

| Other non-current assets | 821.0 | 829.2 |

| Total assets | 8,215.4 | 8,233.2 |

| Current liabilities: | ||

| Current portion of long-term debt | 0.0 | 1,178.5 |

| Payables and accrued expenses | 893.5 | 1,019.5 |

| Contract liabilities | 229.0 | 199.8 |

| Total current liabilities | 1,122.4 | 2,397.8 |

| Long-term debt | 3,513.9 | 2,234.7 |

| Deferred taxes | 329.5 | 391.3 |

| Contract liabilities | 483.9 | 492.8 |

| Other non-current liabilities | 498.4 | 476.0 |

| Total liabilities | 5,948.2 | 5,992.6 |

| Commitments and contingencies | ||

| Stockholders’ equity: | ||

| Preferred stock: Authorized, 25.0 shares; issued and outstanding, none | 0.0 | 0.0 |

| Common stock, $0.01 par value: 650.0 shares authorized; 154.5 and 154.5 shares issued, respectively; and 118.0 and 118.1 shares outstanding, respectively | 1.6 | 1.6 |

| Additional paid-in capital | 1,545.2 | 1,436.8 |

| Retained earnings | 3,205.3 | 3,113.0 |

| Treasury stock, at cost: 36.5 and 36.4 shares, respectively | (2,171.1) | (2,026.1) |

| Accumulated other comprehensive income (loss) | (313.6) | (284.7) |

| Total stockholders’ equity | 2,267.2 | 2,240.6 |

| Total liabilities and stockholders’ equity | $ 8,215.4 | $ 8,233.2 |

| CEO | Mr. Timothy C. Gokey |

|---|---|

| WEBSITE | broadridge.com |

| INDUSTRY | IT Services |

| EMPLOYEES | 14700 |