Market Summary

FITB Stock Price

FITB RSI Chart

FITB Valuation

FITB Price/Sales (Trailing)

FITB Profitability

FITB Fundamentals

FITB Revenue

FITB Earnings

Breaking Down FITB Revenue

Last 7 days

-0.5%

Last 30 days

13.2%

Last 90 days

13.7%

Trailing 12 Months

53.3%

How does FITB drawdown profile look like?

FITB Financial Health

FITB Investor Care

Historical Charts for Stock Metrics

| Year | Q1 | Q2 | Q3 | Q4 |

|---|---|---|---|---|

| 2024 | 8.3B | 0 | 0 | 0 |

| 2023 | 7.5B | 8.4B | 9.2B | 9.8B |

| 2022 | 5.2B | 5.3B | 5.8B | 6.6B |

| 2021 | 5.3B | 5.3B | 5.2B | 5.2B |

| 2020 | 6.3B | 6.1B | 5.8B | 5.6B |

| 2019 | 5.4B | 5.8B | 6.1B | 6.3B |

| 2018 | 4.6B | 4.8B | 4.9B | 5.2B |

| 2017 | 4.2B | 4.3B | 4.4B | 4.5B |

| 2016 | 4.1B | 4.1B | 4.2B | 4.2B |

| 2015 | 4.0B | 4.0B | 4.0B | 4.0B |

| 2014 | 4.0B | 4.0B | 4.0B | 4.0B |

| 2013 | 4.1B | 4.0B | 4.0B | 4.0B |

| 2012 | 4.2B | 0 | 0 | 4.1B |

| 2011 | 4.7B | 0 | 0 | 4.2B |

| 2010 | 5.0B | 3.0B | 3.0B | 4.7B |

| 2009 | 4.9B | 6.7B | 6.0B | 5.0B |

| 2008 | 0 | 5.9B | 5.7B | 5.6B |

| 2007 | 0 | 0 | 0 | 6.0B |

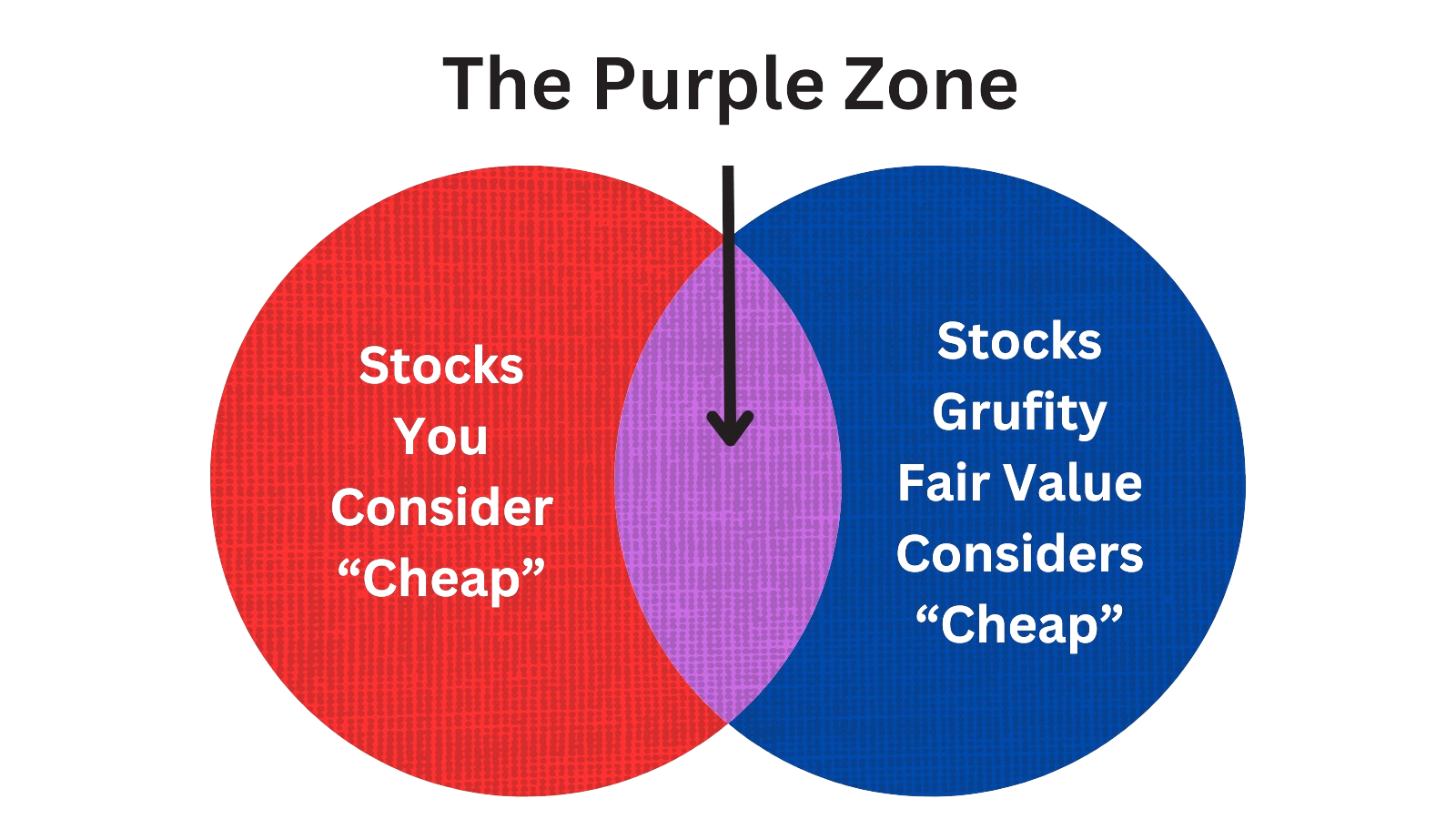

Stocks Marked 'Very Cheap' by Grufity's Fair Value Model Have Outperformed S&P 500 Index

Grufity's Fair Value model takes all the S&P 500 stocks and divides them into separate buckets based on their attractiveness. The 'Very Cheap' bucket of S&P 500 has greatly outperformed S&P 500 Index. Conversely, S&P500 stocks considered 'Very Expensive' by the model underperformed the S&P500 index in the past three years. Grufity Fair Value is available for 2300+ stocks, including 90% of S&P 500 stocks. Grufity's Fair Value Model separates high-return stocks from low-return stocks.

Returns of $10,000 invested in:

Very Cheap Stocks: $17,289

S&P 500 Index: $12,922

Very Expensive Stocks: $11,022

Grufity's Fair Value model does a great job in separating High Performing Stocks from Low Performing ones in the S&P 500 list.

Tracking the Latest Insider Buys and Sells of Fifth Third Bancorp

Filter Transactions| Datesorted ascending | Name | Buy/Sell | $ Value | Avg. Price | # Shares | Title |

|---|---|---|---|---|---|---|

| May 13, 2024 | feiger mitchell stuart | sold | -307,628 | 38.4535 | -8,000 | - |

| May 13, 2024 | feiger mitchell stuart | sold | -303,783 | 38.4535 | -7,900 | - |

| May 13, 2024 | feiger mitchell stuart | sold | -1,152,900 | 38.43 | -30,000 | - |

| May 13, 2024 | feiger mitchell stuart | sold | -267,159 | 38.4512 | -6,948 | - |

| May 13, 2024 | feiger mitchell stuart | sold | -890,849 | 38.46 | -23,163 | - |

| May 01, 2024 | schramm jude | sold | -93,750 | 37.5 | -2,500 | evp & cio |

| Apr 23, 2024 | garrett kristine r. | sold | -274,457 | 36.5942 | -7,500 | evp |

| Apr 22, 2024 | gibson kala | sold | -540,549 | 36.3834 | -14,857 | evp |

| Apr 16, 2024 | benitez jorge l. | acquired | - | - | 4,107 | - |

| Apr 16, 2024 | harvey thomas h | acquired | - | - | 4,107 | - |

Which funds bought or sold FITB recently?

View All Details| Datesorted ascending | Fund Name | Type | % Chg | $ Change | $ Held | % Portfolio |

|---|---|---|---|---|---|---|

| May 17, 2024 | Plato Investment Management Ltd | new | - | 639,045 | 639,045 | 0.07% |

| May 17, 2024 | Aspect Partners, LLC | unchanged | - | 179 | 2,456 | -% |

| May 17, 2024 | Advisory Resource Group | added | 3.51 | 470,899 | 4,503,410 | 1.03% |

| May 17, 2024 | New Covenant Trust Company, N.A. | new | - | 242,237 | 242,237 | 0.24% |

| May 16, 2024 | Dynasty Wealth Management, LLC | new | - | 265,438 | 265,438 | 0.01% |

| May 16, 2024 | B. Riley Wealth Advisors, Inc. | reduced | -2.27 | -280,080 | 721,471 | 0.02% |

| May 16, 2024 | Ancora Advisors LLC | reduced | -1.69 | 24,842 | 434,203 | 0.01% |

| May 16, 2024 | Tidal Investments LLC | reduced | -2.99 | 34,158 | 779,452 | 0.01% |

| May 16, 2024 | FSA Wealth Management LLC | reduced | -7.18 | 810 | 293,810 | 0.13% |

| May 16, 2024 | EJF Capital LLC | reduced | -10.57 | -23,459 | 644,440 | 0.45% |

Are Funds Buying or Selling FITB?

Unveiling Fifth Third Bancorp's Major ShareHolders

| Date Filed | Name of Filer | Percent of Class | No. of Shares | Form Type | |

|---|---|---|---|---|---|

| Feb 14, 2024 | price t rowe associates inc /md/ | 6.2% | 42,325,627 | SC 13G/A | |

| Feb 13, 2024 | vanguard group inc | 12.82% | 87,331,391 | SC 13G/A | |

| Feb 09, 2024 | capital world investors | 6.0% | 41,132,965 | SC 13G | |

| Jan 25, 2024 | blackrock inc. | 8.4% | 56,953,542 | SC 13G/A | |

| Feb 14, 2023 | price t rowe associates inc /md/ | 5.5% | 37,477,138 | SC 13G/A | |

| Feb 09, 2023 | vanguard group inc | 12.59% | 86,386,101 | SC 13G/A | |

| Feb 03, 2023 | blackrock inc. | 8.1% | 55,318,723 | SC 13G/A | |

| Feb 01, 2023 | state street corp | 4.58% | 31,431,281 | SC 13G/A | |

| Feb 14, 2022 | price t rowe associates inc /md/ | 6.9% | 47,228,752 | SC 13G/A | |

| Feb 11, 2022 | state street corp | 5.10% | 34,876,408 | SC 13G/A |

Recent SEC filings of Fifth Third Bancorp

View All Filings| Date Filed | Form Type | Document | |

|---|---|---|---|

| May 15, 2024 | 4 | Insider Trading | |

| May 13, 2024 | 144 | Notice of Insider Sale Intent | |

| May 07, 2024 | 10-Q | Quarterly Report | |

| May 02, 2024 | 4 | Insider Trading | |

| May 01, 2024 | 144 | Notice of Insider Sale Intent | |

| Apr 23, 2024 | 13F-HR | Fund Holdings Report | |

| Apr 23, 2024 | 144 | Notice of Insider Sale Intent | |

| Apr 23, 2024 | 4 | Insider Trading | |

| Apr 22, 2024 | 4 | Insider Trading | |

| Apr 22, 2024 | 144 | Notice of Insider Sale Intent |

- …

Peers (Alternatives to Fifth Third Bancorp)

| Name | Mkt Capsorted ascending | Revenue | Price %, 1M | Returns, 1Y | P/E | P/S | Rev 1-Yr | Inc 1-Yr |

|---|---|---|---|---|---|---|---|---|

| LARGE-CAP | ||||||||

JPM | 588.1B | 174.7B | 13.73% | 46.82% | 11.68 | 3.37 | 53.11% | 19.83% |

BAC | 307.4B | 137.9B | 11.58% | 38.08% | 12.28 | 2.23 | 56.12% | -12.56% |

WFC | 213.0B | 85.8B | 6.86% | 51.95% | 11.35 | 2.48 | 35.02% | 26.14% |

C | 122.2B | 125.0B | 10.16% | 38.13% | 15.29 | 0.98 | 37.85% | - |

CFG | 16.9B | 10.4B | 12.51% | 41.04% | 11.81 | 1.62 | 26.22% | -33.87% |

KEY | 14.5B | 8.1B | 6.72% | 53.23% | 16.61 | 1.78 | 32.15% | -50.93% |

| MID-CAP | ||||||||

CMA | 7.3B | 4.2B | 10.08% | 41.38% | 10.46 | 1.71 | 34.68% | -45.96% |

ZION | 6.6B | 4.1B | 14.23% | 65.05% | 10.55 | 1.63 | 32.93% | -30.73% |

ABCB | 3.5B | 1.3B | 13.35% | 57.95% | 12.32 | 2.65 | 30.60% | -12.99% |

ASB | 3.4B | 2.0B | 11.57% | 43.03% | 20.88 | 1.65 | 47.11% | -59.32% |

| SMALL-CAP | ||||||||

AMNB | 497.6M | 120.2M | 6.68% | 49.76% | 19.02 | 4.14 | 45.65% | -13.98% |

AROW | 417.1M | 173.1M | 15.06% | 27.00% | 14.3 | 2.41 | 26.54% | -34.86% |

ALRS | 390.4M | 152.4M | -0.90% | 32.84% | 39.27 | 2.56 | 16.94% | -73.84% |

ACNB | 295.5M | 98.7M | 10.19% | 20.01% | 10.04 | 2.99 | 6.27% | -22.90% |

ASRV | 48.0M | 62.5M | 8.95% | -1.75% | -16.24 | 0.77 | 18.83% | -145.18% |

Fifth Third Bancorp News

Fifth Third Bancorp Earnings Report: Key Takeaways & Analysis

| Income Statement (Quarterly) | (In Millions) | |||||||||||||||||||||

| Description | (%) Q/Q | 2024Q1 | 2023Q4 | 2023Q3 | 2023Q2 | 2023Q1 | 2022Q4 | 2022Q3 | 2022Q2 | 2022Q1 | 2021Q4 | 2021Q3 | 2021Q2 | 2021Q1 | 2020Q4 | 2020Q3 | 2020Q2 | 2020Q1 | 2019Q4 | 2019Q3 | 2019Q2 | 2019Q1 |

| Revenue | -73.2% | 710 | 2,648 | 2,529 | 2,370 | 2,213 | 2,075 | 1,760 | 1,464 | 1,289 | 1,295 | 1,292 | 1,323 | 1,302 | 1,315 | 1,329 | 1,403 | 1,525 | 1,560 | 1,625 | 1,636 | 1,433 |

| EBITDA Margin | 15.9% | 1.10* | 0.95* | 1.06* | 1.16* | 1.27* | 1.39* | 1.47* | 1.55* | 1.61* | 1.66* | 1.66* | - | - | - | - | - | - | - | - | - | - |

| Interest Expenses | -2.2% | 1,384 | 1,416 | 1,438 | 1,457 | 1,517 | 1,577 | 1,498 | 1,339 | 1,195 | 1,197 | 1,189 | 1,208 | 1,176 | 1,183 | 1,170 | 1,200 | 1,229 | 1,228 | 1,242 | 1,245 | 1,082 |

| Income Taxes | 15.5% | 138 | 120 | 186 | 174 | 160 | 176 | 192 | 162 | 118 | 165 | 191 | 202 | 189 | 142 | 165 | 49.00 | 14.00 | 206 | 140 | 124 | 221 |

| Earnings Before Taxes | 1.3% | 658 | 650 | 846 | 775 | 718 | 913 | 845 | 724 | 612 | 828 | 895 | 911 | 883 | 747 | 746 | 244 | 60.00 | 941 | 689 | 577 | 996 |

| EBT Margin | 15.8% | 0.35* | 0.31* | 0.35* | 0.39* | 0.43* | 0.47* | 0.52* | 0.57* | 0.62* | 0.67* | 0.66* | - | - | - | - | - | - | - | - | - | - |

| Net Income | -1.9% | 520 | 530 | 660 | 601 | 558 | 737 | 653 | 562 | 494 | 663 | 704 | 709 | 694 | 605 | 581 | 195 | 46.00 | 735 | 549 | 453 | 775 |

| Net Income Margin | 16.3% | 0.28* | 0.24* | 0.28* | 0.30* | 0.33* | 0.37* | 0.41* | 0.45* | 0.49* | 0.53* | 0.52* | - | - | - | - | - | - | - | - | - | - |

| Free Cashflow | -83.5% | 321 | 1,946 | 519 | 345 | 1,208 | 1,965 | 1,613 | 878 | 1,624 | 1,257 | 1,141 | - | - | - | - | - | - | - | - | - | - |

| Balance Sheet | (In Millions) | |||||||||||||||||||||

| Description | (%) Q/Q | 2024Q1 | 2023Q4 | 2023Q3 | 2023Q2 | 2023Q1 | 2022Q4 | 2022Q3 | 2022Q2 | 2022Q1 | 2021Q4 | 2021Q3 | 2021Q2 | 2021Q1 | 2020Q4 | 2020Q3 | 2020Q2 | 2020Q1 | 2019Q4 | 2019Q3 | 2019Q2 | 2019Q1 |

| Assets | 0.0% | 214,506 | 214,574 | 212,967 | 207,276 | 208,657 | 207,452 | 205,463 | 206,782 | 211,459 | 211,116 | 207,731 | 205,390 | 206,899 | 204,680 | 201,996 | 202,906 | 185,391 | 169,369 | 171,079 | 168,802 | 20,000 |

| Cash Equivalents | -11.0% | 2,796 | 3,142 | 2,837 | 2,594 | 2,780 | 3,466 | 3,068 | 3,437 | 3,049 | 2,994 | 3,213 | 3,285 | 3,122 | 3,147 | 2,996 | 3,221 | 3,282 | 3,278 | 3,261 | 2,764 | - |

| Net PPE | 1.1% | 2,376 | 2,349 | 2,303 | 2,275 | 2,219 | 2,187 | 2,155 | 2,118 | 2,102 | 2,120 | 2,101 | 2,073 | 2,072 | 2,088 | 2,090 | 2,053 | 2,009 | 1,995 | 2,053 | 2,074 | 2,092 |

| Goodwill | 0.0% | 4,918 | 4,919 | 4,919 | 4,919 | 4,915 | 4,915 | 4,925 | 4,926 | 4,514 | 4,514 | 4,514 | 4,259 | 4,259 | 4,258 | 4,261 | 4,261 | 4,261 | 4,252 | 4,290 | 4,284 | 1,786 |

| Liabilities | 0.0% | 195,488 | 195,402 | 196,423 | 189,467 | 190,293 | 190,125 | 188,727 | 187,812 | 191,282 | 188,906 | 185,207 | 182,464 | 184,304 | 181,569 | 179,045 | 180,571 | 163,518 | 148,166 | 149,675 | 148,131 | 148,009 |

| Long Term Debt | -5.7% | 15,444 | 16,380 | 16,310 | 12,278 | 12,893 | 13,714 | 11,712 | 10,990 | 10,815 | 11,821 | 11,419 | 12,364 | 14,743 | 14,973 | 15,123 | 16,327 | 16,282 | 14,970 | 14,474 | 15,784 | 15,483 |

| Shareholder's Equity | -0.8% | 19,018 | 19,172 | 16,544 | 17,809 | 18,364 | 17,327 | 16,736 | 18,970 | 20,177 | 22,210 | 22,524 | 22,926 | 22,595 | 23,111 | 22,951 | 22,335 | 21,873 | 21,203 | 21,404 | 20,671 | 19,844 |

| Retained Earnings | 1.0% | 23,224 | 22,997 | 22,747 | 22,366 | 22,032 | 21,689 | 21,219 | 20,818 | 20,501 | 20,236 | 19,817 | 19,343 | 18,863 | 18,384 | 18,010 | 17,643 | 17,677 | 18,315 | 17,786 | 17,431 | 17,184 |

| Additional Paid-In Capital | -0.4% | 3,742 | 3,757 | 3,733 | 3,708 | 3,682 | 3,684 | 3,660 | 3,636 | 3,615 | 3,624 | 3,611 | 3,602 | 3,592 | 3,635 | 3,624 | 3,603 | 3,597 | 3,599 | 3,589 | 3,572 | 3,444 |

| Shares Outstanding | 0.4% | 684 | 681 | 681 | 681 | 681 | 683 | 689 | 689 | 688 | 702 | 707 | 709 | - | - | - | - | - | - | - | - | - |

| Minority Interest | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | 197 | 197 |

| Float | - | - | - | - | 15,510 | - | - | - | 20,129 | - | - | - | 23,662 | - | - | - | 12,243 | - | - | - | 18,261 | - |

| Cashflow (Quarterly) | (In Millions) | |||||||||||||||||||||

| Description | (%) Q/Q | 2024Q1 | 2023Q4 | 2023Q3 | 2023Q2 | 2023Q1 | 2022Q4 | 2022Q3 | 2022Q2 | 2022Q1 | 2021Q4 | 2021Q3 | 2021Q2 | 2021Q1 | 2020Q4 | 2020Q3 | 2020Q2 | 2020Q1 | 2019Q4 | 2019Q3 | 2019Q2 | 2019Q1 |

| Cashflow From Operations | -81.4% | 386 | 2,072 | 636 | 480 | 1,321 | 2,073 | 1,710 | 958 | 1,687 | 1,342 | 1,239 | 489 | -366 | -1,644 | 63.00 | 1,519 | 433 | 1,379 | -363 | 274 | 534 |

| Share Based Compensation | 128.6% | 64.00 | 28.00 | 30.00 | 35.00 | 76.00 | 28.00 | 30.00 | 28.00 | 79.00 | 20.00 | 21.00 | 24.00 | 55.00 | 23.00 | 23.00 | 24.00 | 53.00 | 23.00 | 25.00 | 30.00 | 54.00 |

| Cashflow From Investing | 72.5% | -229 | -833 | -6,693 | 401 | -2,363 | -3,774 | -1,724 | 2,244 | -1,617 | -5,643 | -2,713 | 2,710 | -2,322 | -309 | 1,098 | -18,510 | -14,181 | 530 | -1,159 | 953 | -1,121 |

| Cashflow From Financing | 46.1% | -503 | -934 | 6,300 | -1,067 | 356 | 2,099 | -355 | -2,814 | -15.00 | 4,082 | 1,402 | -3,036 | 2,663 | 2,104 | -1,386 | 16,930 | 13,752 | -1,892 | 2,019 | -1,212 | 655 |

| Dividend Payments | 4.0% | 287 | 276 | 225 | 265 | 294 | 227 | 228 | 242 | 230 | 243 | 210 | 229 | 215 | 229 | 212 | 227 | 190 | 207 | 238 | 165 | 143 |

| Buy Backs | - | - | - | - | - | 200 | 100 | - | - | - | 316 | 550 | 347 | 180 | - | - | - | - | 300 | 350 | 200 | 913 |

FITB Income Statement

2024-03-31CONDENSED CONSOLIDATED STATEMENTS OF INCOME (unaudited) - USD ($) $ in Millions | 3 Months Ended | |

|---|---|---|

Mar. 31, 2024 | Mar. 31, 2023 | |

| Interest Income | ||

| Interest and fees on loans and leases | $ 1,859 | $ 1,714 |

| Interest on securities | 455 | 439 |

| Interest on other short-term investments | 294 | 60 |

| Total interest income | 2,608 | 2,213 |

| Interest Expense | ||

| Interest on deposits | 954 | 478 |

| Interest on federal funds purchased | 3 | 5 |

| Interest on other short-term borrowings | 47 | 57 |

| Interest on long-term debt | 220 | 156 |

| Total interest expense | 1,224 | 696 |

| Net Interest Income | 1,384 | 1,517 |

| Provision for credit losses | 94 | 164 |

| Net Interest Income After Provision for Credit Losses | 1,290 | 1,353 |

| Noninterest Income | ||

| Wealth and asset management revenue | 161 | 146 |

| Service charges on deposits | 151 | 137 |

| Commercial banking revenue | 143 | 161 |

| Card and processing revenue | 102 | 100 |

| Mortgage banking net revenue | 54 | 69 |

| Leasing business revenue | 39 | 57 |

| Other noninterest income | 50 | 22 |

| Securities gains, net | 10 | 4 |

| Securities gains, net – non-qualifying hedges on mortgage servicing rights | 0 | 0 |

| Total noninterest income | 710 | 696 |

| Noninterest Expense | ||

| Compensation and benefits | 753 | 757 |

| Technology and communications | 117 | 118 |

| Net occupancy expense | 87 | 81 |

| Equipment expense | 37 | 37 |

| Marketing expense | 25 | 34 |

| Leasing business expense | 32 | 29 |

| Card and processing expense | 20 | 22 |

| Other noninterest expense | 271 | 253 |

| Total noninterest expense | 1,342 | 1,331 |

| Income Before Income Taxes | 658 | 718 |

| Applicable income tax expense | 138 | 160 |

| Net Income | 520 | 558 |

| Dividends on preferred stock | 40 | 23 |

| Net Income Available to Common Shareholders | $ 480 | $ 535 |

| Shares Disclosures | ||

| Earnings per share - basic (in dollars per share) | $ 0.70 | $ 0.78 |

| Earnings per share - diluted (in dollars per share) | $ 0.70 | $ 0.78 |

| Average common shares outstanding - basic (in shares) | 685,749,673 | 684,017,462 |

| Average common shares outstanding - diluted (in shares) | 690,633,531 | 689,566,425 |

FITB Balance Sheet

2024-03-31CONDENSED CONSOLIDATED BALANCE SHEETS (unaudited) - USD ($) $ in Millions | Mar. 31, 2024 | Dec. 31, 2023 | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Assets | ||||||||||||||||

| Cash and due from banks | $ 2,796 | $ 3,142 | ||||||||||||||

| Other short-term investments | [1] | 22,840 | 22,082 | |||||||||||||

| Available-for-sale debt and other securities | [2] | 38,791 | 50,419 | |||||||||||||

| Held-to-maturity securities | [3] | 11,520 | 2 | |||||||||||||

| Trading debt securities | 1,151 | 899 | ||||||||||||||

| Equity securities | 380 | 613 | ||||||||||||||

| Total loans and leases held for sale | [4] | 339 | 378 | |||||||||||||

| Portfolio loans and leases | 116,485 | 117,234 | ||||||||||||||

| Allowance for loan and lease losses | [1] | (2,318) | (2,322) | |||||||||||||

| Portfolio loans and leases, net | 114,167 | 114,912 | ||||||||||||||

| Bank premises and equipment | [5] | 2,376 | 2,349 | |||||||||||||

| Operating lease equipment | 427 | 459 | ||||||||||||||

| Goodwill | 4,918 | 4,919 | ||||||||||||||

| Intangible assets | 115 | 125 | ||||||||||||||

| Servicing rights | 1,756 | 1,737 | ||||||||||||||

| Other assets | [1] | 12,930 | 12,538 | |||||||||||||

| Total Assets | 214,506 | 214,574 | ||||||||||||||

| Deposits: | ||||||||||||||||

| Noninterest-bearing deposits | 41,849 | 43,146 | ||||||||||||||

| Interest-bearing deposits | 127,738 | 125,766 | ||||||||||||||

| Total deposits | 169,587 | 168,912 | ||||||||||||||

| Federal funds purchased | 247 | 193 | ||||||||||||||

| Other short-term borrowings | 2,866 | 2,861 | ||||||||||||||

| Accrued taxes, interest and expenses | 1,965 | 2,195 | ||||||||||||||

| Other liabilities | [1] | 5,379 | 4,861 | |||||||||||||

| Long-term debt | [1] | 15,444 | 16,380 | |||||||||||||

| Total Liabilities | 195,488 | 195,402 | ||||||||||||||

| Equity | ||||||||||||||||

| Common stock | [6] | 2,051 | 2,051 | |||||||||||||

| Preferred stock | [7] | 2,116 | 2,116 | |||||||||||||

| Capital surplus | 3,742 | 3,757 | ||||||||||||||

| Retained earnings | 23,224 | 22,997 | ||||||||||||||

| Accumulated other comprehensive loss | (4,888) | (4,487) | ||||||||||||||

| Treasury stock | [6] | (7,227) | (7,262) | |||||||||||||

| Total Equity | 19,018 | 19,172 | ||||||||||||||

| Total Liabilities and Equity | $ 214,506 | $ 214,574 | ||||||||||||||

| ||||||||||||||||

| CEO | Mr. Timothy N. Spence |

|---|---|

| WEBSITE | 53.com |

| INDUSTRY | Banks Diversified |

| EMPLOYEES | 19225 |