Market Summary

KBH Alerts

KBH Stock Price

KBH RSI Chart

KBH Valuation

KBH Price/Sales (Trailing)

KBH Profitability

KBH Fundamentals

KBH Revenue

KBH Earnings

Breaking Down KBH Revenue

52 Week Range

Last 7 days

7.8%

Last 30 days

3.6%

Last 90 days

16.4%

Trailing 12 Months

55.8%

How does KBH drawdown profile look like?

KBH Financial Health

KBH Investor Care

Historical Charts for Stock Metrics

| Year | Q1 | Q2 | Q3 | Q4 |

|---|---|---|---|---|

| 2024 | 6.5B | 0 | 0 | 0 |

| 2023 | 6.9B | 6.9B | 6.7B | 6.4B |

| 2022 | 6.0B | 6.3B | 6.6B | 6.9B |

| 2021 | 4.2B | 4.8B | 5.2B | 5.7B |

| 2020 | 4.8B | 4.7B | 4.5B | 4.2B |

| 2019 | 4.5B | 4.4B | 4.3B | 4.6B |

| 2018 | 4.4B | 4.5B | 4.6B | 4.5B |

| 2017 | 3.7B | 3.9B | 4.2B | 4.4B |

| 2016 | 3.1B | 3.3B | 3.4B | 3.6B |

| 2015 | 2.5B | 2.6B | 2.8B | 3.0B |

| 2014 | 2.1B | 2.2B | 2.2B | 2.4B |

| 2013 | 1.7B | 1.9B | 2.1B | 2.1B |

| 2012 | 1.4B | 1.4B | 1.5B | 1.6B |

| 2011 | 1.5B | 1.4B | 1.3B | 1.3B |

| 2010 | 1.8B | 1.7B | 1.6B | 1.6B |

| 2009 | 0 | 0 | 2.4B | 1.8B |

| 2008 | 0 | 0 | 0 | 3.0B |

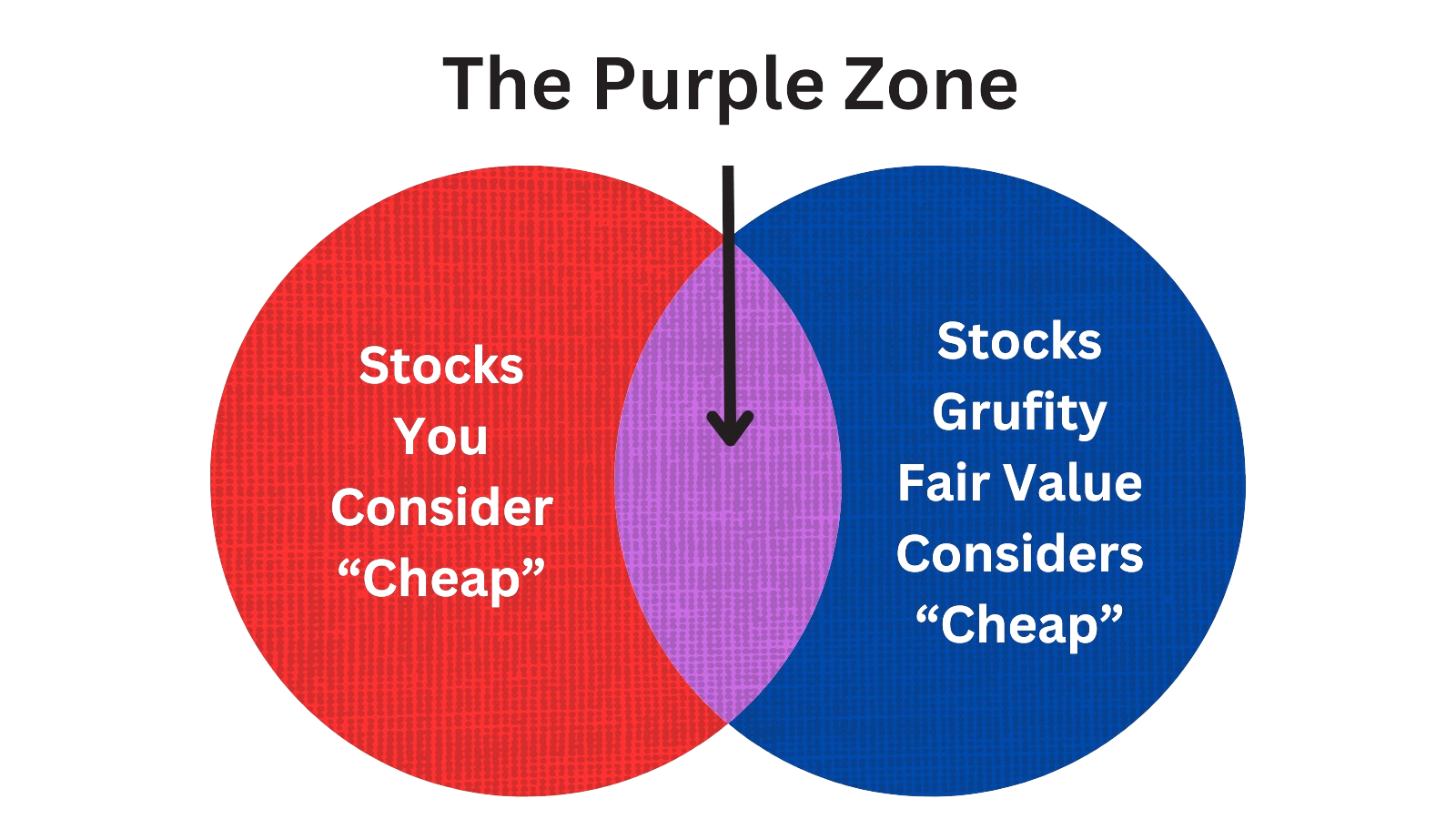

Stocks Marked 'Very Cheap' by Grufity's Fair Value Model Have Outperformed Russell 2000 Index

Small Caps and Mid Caps are mostly overlooked by investors as all the focus goes to Magnificent 7. These stocks that are not part of the beauty contest require a deeper look. However, all large cap stocks were once small caps. Grufity's Fair Value model opens up this unverse as it separates high-performing, rewarding stocks from low-performing risky stocks. <b>Russell 2000 stocks that were marked 'Very Cheap' by the model doubled in three years while the index was flat.</b>

Returns of $10,000 invested in:

Very Cheap Stocks: $21,859

Russell 2000 Index: $10,334

Very Expensive Stocks: $8,224

Russell 2000 stocks considered 'Very Cheap' by the model greatly outperformed Russell 2000 index and the 'Very Expensive' bucket over past three years.

Tracking the Latest Insider Buys and Sells of KB Home

Filter Transactions| Datesorted ascending | Name | Buy/Sell | $ Value | Avg. Price | # Shares | Title |

|---|---|---|---|---|---|---|

| Apr 18, 2024 | dominguez dorene | acquired | - | - | 2,895 | - |

| Apr 18, 2024 | collins arthur reginald | acquired | - | - | 3,020 | - |

| Apr 18, 2024 | eltife kevin paul | acquired | - | - | 2,689 | - |

| Apr 18, 2024 | kozlak jodee a | acquired | - | - | 3,351 | - |

| Apr 18, 2024 | barras jose miguel | acquired | - | - | 3,061 | - |

| Apr 18, 2024 | gabriel stuart a | acquired | - | - | 2,689 | - |

| Apr 18, 2024 | gilligan thomas w. | acquired | - | - | 2,689 | - |

| Apr 18, 2024 | weaver james c. | acquired | - | - | 2,689 | - |

| Apr 09, 2024 | kaminski jeff | sold | -2,555,150 | 66.5646 | -38,386 | evp & chief financial officer |

| Feb 28, 2024 | woram brian j | acquired | - | - | 42,436 | evp and general counsel |

Which funds bought or sold KBH recently?

View All Details| Datesorted ascending | Fund Name | Type | % Chg | $ Change | $ Held | % Portfolio |

|---|---|---|---|---|---|---|

| May 06, 2024 | LSV ASSET MANAGEMENT | reduced | -11.43 | 175,000 | 34,278,000 | 0.07% |

| May 06, 2024 | Advisory Services Network, LLC | sold off | -100 | -58,150 | - | -% |

| May 06, 2024 | Candriam S.C.A. | new | - | 446,615 | 446,615 | -% |

| May 06, 2024 | Jefferies Financial Group Inc. | reduced | -93.41 | -2,670,400 | 260,833 | -% |

| May 06, 2024 | SG Americas Securities, LLC | added | 1,333 | 2,817,000 | 3,001,000 | 0.01% |

| May 06, 2024 | TEXAS PERMANENT SCHOOL FUND CORP | reduced | -2.75 | 427,810 | 4,558,790 | 0.04% |

| May 06, 2024 | Quantbot Technologies LP | new | - | 608,930 | 608,930 | 0.03% |

| May 06, 2024 | Metis Global Partners, LLC | unchanged | - | 46,503 | 391,470 | 0.01% |

| May 06, 2024 | NEW YORK LIFE INVESTMENT MANAGEMENT LLC | reduced | -39.15 | -166,142 | 370,702 | -% |

| May 06, 2024 | LEUTHOLD GROUP, LLC | reduced | -0.73 | 510,675 | 4,547,590 | 0.51% |

Are Funds Buying or Selling KBH?

KBH Alerts

Unveiling KB Home's Major ShareHolders

| Date Filed | Name of Filer | Percent of Class | No. of Shares | Form Type | |

|---|---|---|---|---|---|

| Feb 12, 2024 | vanguard group inc | 10.26% | 7,784,840 | SC 13G/A | |

| Feb 12, 2024 | vanguard group inc | 9.84% | 7,802,422 | SC 13G/A | |

| Feb 09, 2024 | fmr llc | - | 0 | SC 13G/A | |

| Jan 23, 2024 | blackrock inc. | 13.5% | 10,694,328 | SC 13G/A | |

| Sep 11, 2023 | vanguard group inc | 10.01% | 8,071,353 | SC 13G/A | |

| Jun 12, 2023 | fmr llc | - | 0 | SC 13G/A | |

| Feb 09, 2023 | fmr llc | - | 0 | SC 13G | |

| Feb 09, 2023 | vanguard group inc | 8.99% | 7,690,798 | SC 13G/A | |

| Jan 26, 2023 | blackrock inc. | 12.0% | 10,281,343 | SC 13G/A | |

| Jan 20, 2023 | blackrock inc. | 12.0% | 10,281,343 | SC 13G/A |

Recent SEC filings of KB Home

View All Filings| Date Filed | Form Type | Document | |

|---|---|---|---|

| Apr 24, 2024 | 8-K | Current Report | |

| Apr 22, 2024 | 4 | Insider Trading | |

| Apr 22, 2024 | 4 | Insider Trading | |

| Apr 22, 2024 | 4 | Insider Trading | |

| Apr 22, 2024 | 4 | Insider Trading | |

| Apr 22, 2024 | 4 | Insider Trading | |

| Apr 22, 2024 | 4 | Insider Trading | |

| Apr 22, 2024 | 4 | Insider Trading | |

| Apr 22, 2024 | 4 | Insider Trading | |

| Apr 11, 2024 | 4 | Insider Trading |

Peers (Alternatives to KB Home)

| Name | Mkt Capsorted ascending | Revenue | Price %, 1M | Returns, 1Y | P/E | P/S | Rev 1-Yr | Inc 1-Yr |

|---|---|---|---|---|---|---|---|---|

| LARGE-CAP | ||||||||

HD | 337.6B | 152.7B | -4.81% | 18.32% | 22.29 | 2.21 | -3.01% | -11.47% |

LOW | 132.4B | 86.4B | -3.30% | 13.41% | 17.14 | 1.53 | -11.01% | 20.02% |

DHI | 49.8B | 37.1B | -4.54% | 39.47% | 10.03 | 1.34 | 10.12% | -4.19% |

NVR | 24.3B | 9.7B | -1.94% | 32.48% | 14.8 | 2.51 | -6.32% | -0.14% |

FND | 12.5B | 4.4B | -1.90% | 27.03% | 55.74 | 2.85 | 0.72% | -24.86% |

| MID-CAP | ||||||||

MHK | 7.5B | 11.0B | -3.48% | 18.23% | -18.19 | 0.69 | -4.50% | -196.49% |

IBP | 6.7B | 2.8B | -8.39% | 107.42% | 27.58 | 2.42 | 4.08% | 9.09% |

WHR | 5.2B | 19.3B | -17.63% | -30.58% | 12.93 | 0.27 | -0.81% | 119.97% |

CVCO | 3.2B | 1.9B | -0.37% | 23.89% | 18.46 | 1.71 | -14.77% | -30.65% |

CCS | 2.7B | 3.9B | -3.92% | 27.22% | 9.24 | 0.69 | -8.36% | -30.22% |

LEG | 1.8B | 4.7B | -29.48% | -60.00% | -12.87 | 0.37 | -8.19% | -144.16% |

| SMALL-CAP | ||||||||

AMWD | 1.5B | 1.9B | -7.18% | 86.13% | 12.52 | 0.8 | -10.13% | 53.07% |

BZH | 913.3M | 2.1B | -6.19% | 38.98% | 5.69 | 0.43 | -8.40% | -19.84% |

BSET | 125.2M | 369.0M | 0.14% | -1.39% | -21.55 | 0.34 | -22.39% | -109.49% |

CRWS | 51.7M | 86.7M | -3.44% | -3.63% | 10.96 | 0.6 | 9.53% | -34.99% |

KB Home News

KB Home Earnings Report: Key Takeaways & Analysis

| Income Statement (Quarterly) | (In Millions) | |||||||||||||||||||||

| Description | (%) Q/Q | 2024Q1 | 2023Q4 | 2023Q3 | 2023Q2 | 2023Q1 | 2022Q4 | 2022Q3 | 2022Q2 | 2022Q1 | 2021Q4 | 2021Q3 | 2021Q2 | 2021Q1 | 2020Q4 | 2020Q3 | 2020Q2 | 2020Q1 | 2019Q4 | 2019Q3 | 2019Q2 | 2019Q1 |

| Revenue | -12.3% | 1,468 | 1,674 | 1,587 | 1,765 | 1,384 | 1,940 | 1,845 | 1,720 | 1,399 | 1,675 | 1,467 | 1,441 | 1,142 | 1,194 | 999 | 914 | 1,076 | 1,559 | 1,161 | 1,022 | 811 |

| Interest Expenses | - | - | - | - | -11.50 | 13.00 | -4.33 | -0.86 | 7.00 | -7.61 | 10.00 | -2.77 | 4.00 | -3.86 | 4.00 | -3.79 | -3.68 | 4.00 | -14.64 | 11.00 | -12.51 | 15.00 |

| Income Taxes | -27.0% | 36.00 | 49.00 | 45.00 | 51.00 | 37.00 | 69.00 | 71.00 | 72.00 | 44.00 | 50.00 | 24.00 | 30.00 | 27.00 | 20.00 | 23.00 | 16.00 | 9.00 | 42.00 | 24.00 | 9.00 | 5.00 |

| Net Income | -7.7% | 139 | 150 | 150 | 164 | 126 | 216 | 255 | 211 | 134 | 174 | 150 | 143 | 97.00 | 106 | 78.00 | 52.00 | 60.00 | 123 | 68.00 | 47.00 | 30.00 |

| Net Income Margin | 0.9% | 0.09* | 0.09* | 0.10* | 0.11* | 0.12* | 0.12* | 0.12* | 0.11* | 0.10* | 0.10* | 0.09* | 0.09* | 0.08* | 0.07* | 0.07* | 0.06* | 0.06* | 0.06* | 0.06* | 0.06* | - |

| Free Cashflow | -93.7% | 19.00 | 301 | 156 | 505 | 85.00 | 396 | 79.00 | -75.34 | -261 | 132 | -172 | 52.00 | -88.36 | -26.22 | 169 | 156 | -16.54 | 395 | 18.00 | - | - |

| Balance Sheet | (In Millions) | |||||||||||||||||||||

| Description | (%) Q/Q | 2024Q1 | 2023Q4 | 2023Q3 | 2023Q2 | 2023Q1 | 2022Q4 | 2022Q3 | 2022Q2 | 2022Q1 | 2021Q4 | 2021Q3 | 2021Q2 | 2021Q1 | 2020Q4 | 2020Q3 | 2020Q2 | 2020Q1 | 2019Q4 | 2019Q3 | 2019Q2 | 2019Q1 |

| Assets | 0.5% | 6,683 | 6,648 | 6,577 | 6,483 | 6,514 | 6,652 | 6,731 | 6,579 | 6,188 | 5,836 | 5,756 | 5,619 | 5,427 | 5,356 | 5,177 | 5,042 | 5,053 | 5,015 | 5,035 | 4,920 | 5,174 |

| Cash Equivalents | -8.1% | 668 | 727 | 612 | 557 | 261 | 330 | 197 | 247 | 243 | 292 | 351 | 609 | 571 | 683 | 723 | 576 | 431 | 455 | 185 | 180 | 512 |

| Net PPE | -100.0% | - | 88.00 | - | - | - | 89.00 | - | - | - | 76.00 | 72.00 | 69.00 | 68.00 | 66.00 | 65.00 | 66.00 | 64.00 | 65.00 | 64.00 | 61.00 | 55.00 |

| Shareholder's Equity | 1.9% | 3,883 | 3,810 | 3,830 | 3,766 | 3,695 | 3,661 | 3,491 | 3,291 | 3,134 | 3,019 | 2,842 | 2,887 | 2,748 | 2,666 | 2,565 | 2,490 | 2,443 | 2,383 | 2,262 | 2,195 | 2,128 |

| Retained Earnings | 3.3% | 3,799 | 3,677 | 3,542 | 3,408 | 3,257 | 3,144 | 2,940 | 2,697 | 2,499 | 2,379 | 2,218 | 2,081 | 1,952 | 1,869 | 2,326 | 2,256 | 2,212 | 2,157 | 2,042 | 1,982 | 1,937 |

| Additional Paid-In Capital | -0.7% | 840 | 846 | 843 | 831 | 820 | 836 | 842 | 835 | 828 | 849 | 842 | 836 | 827 | 824 | 811 | 807 | 803 | 794 | 782 | 776 | 755 |

| Shares Outstanding | -6.1% | 76.00 | 81.00 | 80.00 | 83.00 | 83.00 | 87.00 | 86.00 | 88.00 | 88.00 | 90.00 | 91.00 | 92.00 | 92.00 | 90.00 | 91.00 | 90.00 | 90.00 | 88.00 | 88.00 | 88.00 | - |

| Float | - | - | - | - | 3,783 | - | - | - | 3,238 | - | - | - | 4,627 | - | - | - | 3,237 | - | - | - | 2,415 | - |

| Cashflow (Quarterly) | (In Thousands) | |||||||||||||||||||||

| Description | (%) Q/Q | 2024Q1 | 2023Q4 | 2023Q3 | 2023Q2 | 2023Q1 | 2022Q4 | 2022Q3 | 2022Q2 | 2022Q1 | 2021Q4 | 2021Q3 | 2021Q2 | 2021Q1 | 2020Q4 | 2020Q3 | 2020Q2 | 2020Q1 | 2019Q4 | 2019Q3 | 2019Q2 | 2019Q1 |

| Cashflow From Operations | -90.8% | 28,518 | 310,176 | 163,793 | 514,813 | 93,917 | 407,417 | 90,813 | -63,777 | -251,035 | 142,929 | -162,158 | 61,198 | -79,265 | -18,533 | 174,517 | 164,560 | -9,866 | 403,186 | 28,190 | 17,876 | -198,210 |

| Share Based Compensation | -25.8% | 7,921 | 10,678 | 9,248 | 8,819 | 5,867 | 6,520 | 7,056 | 9,021 | 6,867 | 9,136 | 6,114 | 8,082 | 5,572 | 8,764 | 4,636 | 3,181 | 4,950 | 3,833 | 4,513 | 5,814 | 4,152 |

| Cashflow From Investing | 5.2% | -12,592 | -13,289 | -13,836 | -13,976 | -16,961 | -17,653 | -16,877 | -19,367 | -17,876 | -11,532 | -4,484 | -10,345 | -11,723 | -8,177 | -76.00 | -10,471 | -7,839 | -11,882 | -13,358 | -13,957 | -1,747 |

| Cashflow From Financing | 58.8% | -74,973 | -181,942 | -95,017 | -204,207 | -146,327 | -256,823 | -123,260 | 86,988 | 219,512 | -190,606 | -91,060 | -12,765 | -20,582 | -13,887 | -27,348 | -8,983 | -6,226 | -121,283 | -9,759 | -336,562 | 137,245 |

| Dividend Payments | 7.6% | 16,355 | 15,196 | 15,928 | 13,231 | 12,476 | 12,538 | 12,772 | 13,012 | 14,130 | 13,087 | 13,168 | 13,733 | 14,064 | 13,637 | 8,097 | 8,098 | 8,233 | 8,018 | 7,897 | 2,189 | 2,266 |

| Buy Backs | -69.1% | 50,000 | 161,850 | 82,500 | 92,088 | 75,000 | 50,000 | 50,000 | 50,000 | - | - | 188,175 | - | - | - | - | - | - | - | - | - | - |

KBH Income Statement

2024-02-29Consolidated Statements of Operations - USD ($) shares in Thousands, $ in Thousands | 3 Months Ended | |

|---|---|---|

Feb. 29, 2024 | Feb. 28, 2023 | |

| Revenues | $ 1,467,766 | $ 1,384,314 |

| Equity in loss of unconsolidated joint ventures | 6,610 | 825 |

| Total pretax income | 174,665 | 162,200 |

| Income tax expense | (36,000) | (36,700) |

| Net income | $ 138,665 | $ 125,500 |

| Earnings per share: | ||

| Basic (in dollars per share) | $ 1.81 | $ 1.49 |

| Diluted (in dollars per share) | $ 1.76 | $ 1.45 |

| Weighted average shares outstanding: | ||

| Basic (in shares) | 75,894 | 83,468 |

| Diluted (in shares) | 78,264 | 85,995 |

| Homebuilding | ||

| Revenues | $ 1,461,698 | $ 1,378,537 |

| Construction and land costs | (1,146,528) | (1,082,821) |

| Selling, general and administrative expenses | (157,494) | (139,227) |

| Operating income | 157,676 | 156,489 |

| Interest income | 5,857 | 467 |

| Equity in loss of unconsolidated joint ventures | (445) | (757) |

| Total pretax income | 163,088 | 156,199 |

| Financial services | ||

| Revenues | 6,068 | 5,777 |

| Selling, general and administrative expenses | (1,546) | (1,358) |

| Operating income | 4,522 | 4,419 |

| Equity in loss of unconsolidated joint ventures | 7,055 | 1,582 |

| Total pretax income | $ 11,577 | $ 6,001 |

KBH Balance Sheet

2024-02-29Consolidated Balance Sheets - USD ($) $ in Thousands | Feb. 29, 2024 | Nov. 30, 2023 | ||

|---|---|---|---|---|

| Assets | ||||

| Inventories | $ 5,243,581 | $ 5,133,646 | ||

| Total assets | 6,683,492 | 6,648,362 | ||

| Liabilities and stockholders’ equity | ||||

| Accrued expenses and other liabilities | 728,328 | 758,227 | ||

| Notes payable | 1,692,729 | 1,689,898 | ||

| Stockholders’ equity: | ||||

| Common stock — 101,861,682 and 101,275,979 shares issued at February 29, 2024 and November 30, 2023, respectively | 101,862 | 101,276 | ||

| Paid-in capital | 839,772 | 845,693 | ||

| Retained earnings | 3,799,234 | 3,676,924 | ||

| Accumulated other comprehensive loss | (3,671) | (3,671) | ||

| Grantor stock ownership trust, at cost: 6,705,247 shares at February 29, 2024 and November 30, 2023 | (72,718) | (72,718) | ||

| Treasury stock, at cost: 19,241,230 and 18,703,704 at February 29, 2024 and November 30, 2023, respectively | (781,809) | (737,364) | ||

| Total stockholders’ equity | 3,882,670 | 3,810,140 | ||

| Total liabilities and stockholders’ equity | 6,683,492 | 6,648,362 | ||

| Homebuilding | ||||

| Assets | ||||

| Cash and cash equivalents | 668,084 | 727,076 | ||

| Receivables | 354,728 | 366,862 | ||

| Inventories | 5,243,581 | 5,133,646 | ||

| Investments in unconsolidated joint ventures | 59,674 | 59,128 | ||

| Property and equipment, net | 88,433 | 88,309 | ||

| Deferred tax assets, net | 117,175 | 119,475 | ||

| Other assets | 93,411 | 96,987 | ||

| Total assets | 6,625,086 | 6,591,483 | ||

| Liabilities and stockholders’ equity | ||||

| Accounts payable | 378,906 | 388,452 | ||

| Accrued expenses and other liabilities | 728,328 | 758,227 | ||

| Notes payable | 1,692,729 | 1,689,898 | ||

| Total Homebuilding | 2,799,963 | 2,836,577 | ||

| Financial services | ||||

| Assets | ||||

| Cash and cash equivalents | 211 | 266 | ||

| Receivables | 2,545 | 2,783 | ||

| Investments in unconsolidated joint ventures | 19,909 | 19,354 | ||

| Other assets | [1] | 35,741 | 34,476 | |

| Total assets | 58,406 | 56,879 | ||

| Liabilities and stockholders’ equity | ||||

| Financial services | $ 859 | $ 1,645 | ||

| ||||

| CEO | Mr. Jeffrey T. Mezger |

|---|---|

| WEBSITE | kbhome.com |

| INDUSTRY | Home Improvement Retail |

| EMPLOYEES | 2366 |