Market Summary

MSI Stock Price

MSI RSI Chart

MSI Valuation

MSI Price/Sales (Trailing)

MSI Profitability

MSI Fundamentals

MSI Revenue

MSI Earnings

Breaking Down MSI Revenue

Last 7 days

1.4%

Last 30 days

8.1%

Last 90 days

14.8%

Trailing 12 Months

24.1%

How does MSI drawdown profile look like?

MSI Financial Health

MSI Investor Care

Historical Charts for Stock Metrics

| Year | Q1 | Q2 | Q3 | Q4 |

|---|---|---|---|---|

| 2024 | 10.2B | 0 | 0 | 0 |

| 2023 | 9.4B | 9.7B | 9.8B | 10.0B |

| 2022 | 8.3B | 8.5B | 8.7B | 9.1B |

| 2021 | 7.5B | 7.9B | 8.1B | 8.2B |

| 2020 | 7.9B | 7.6B | 7.5B | 7.4B |

| 2019 | 7.5B | 7.6B | 7.8B | 7.9B |

| 2018 | 6.6B | 6.8B | 7.0B | 7.3B |

| 2017 | 6.1B | 6.2B | 6.3B | 6.4B |

| 2016 | 5.7B | 5.7B | 5.8B | 6.0B |

| 2015 | 5.9B | 5.9B | 5.8B | 5.7B |

| 2014 | 6.1B | 6.0B | 5.9B | 5.9B |

| 2013 | 6.3B | 6.2B | 6.2B | 6.2B |

| 2012 | 7.8B | 7.3B | 6.8B | 6.3B |

| 2011 | 7.8B | 7.9B | 8.1B | 8.2B |

| 2010 | 7.2B | 7.3B | 7.4B | 7.6B |

| 2009 | 7.9B | 7.7B | 7.4B | 7.2B |

| 2008 | 0 | 27.1B | 17.6B | 8.1B |

| 2007 | 0 | 0 | 0 | 36.6B |

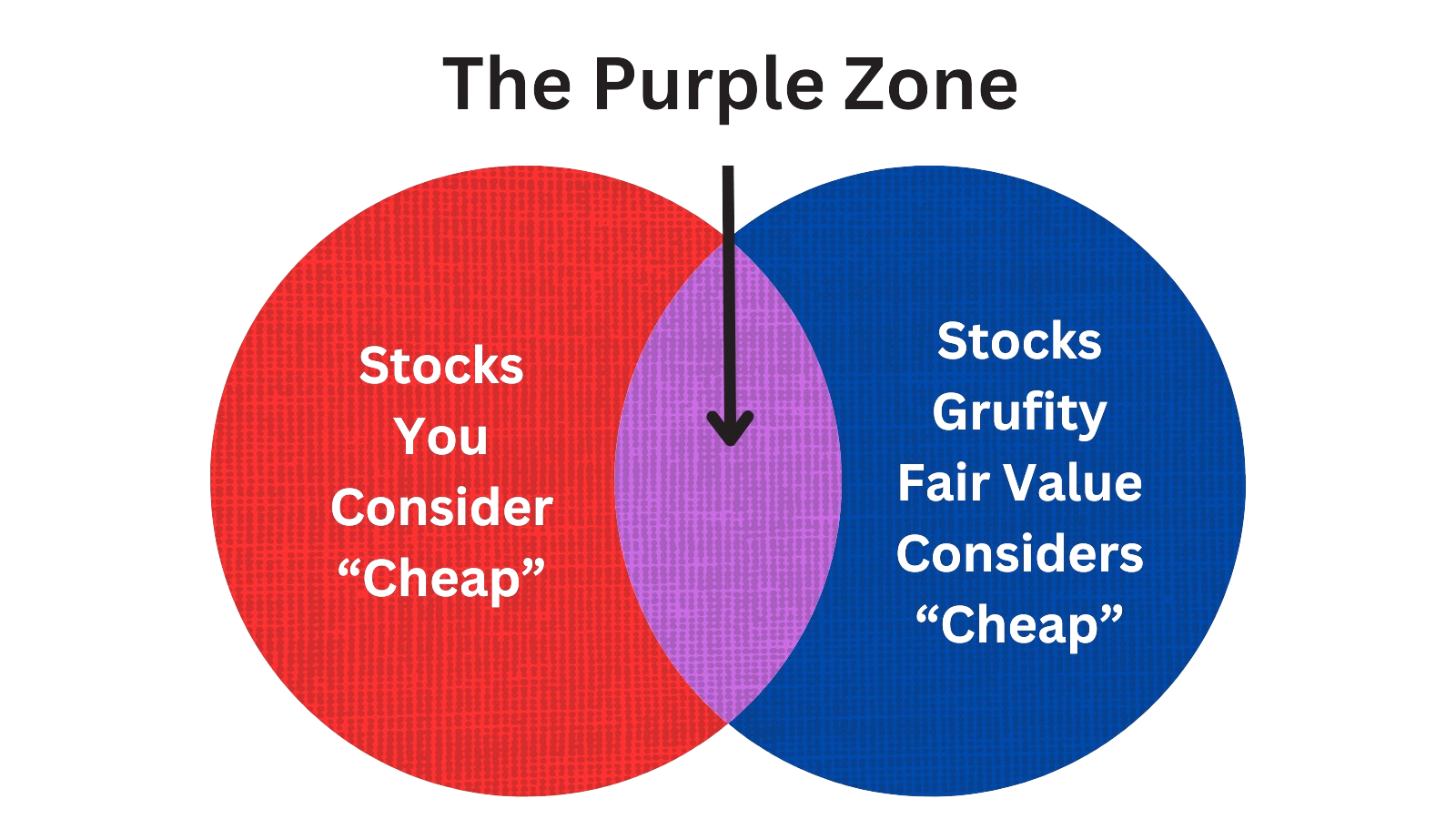

Stocks Marked 'Very Cheap' by Grufity's Fair Value Model Have Outperformed S&P 500 Index

Grufity's Fair Value model takes all the S&P 500 stocks and divides them into separate buckets based on their attractiveness. The 'Very Cheap' bucket of S&P 500 has greatly outperformed S&P 500 Index. Conversely, S&P500 stocks considered 'Very Expensive' by the model underperformed the S&P500 index in the past three years. Grufity Fair Value is available for 2300+ stocks, including 90% of S&P 500 stocks. Grufity's Fair Value Model separates high-return stocks from low-return stocks.

Returns of $10,000 invested in:

Very Cheap Stocks: $17,289

S&P 500 Index: $12,922

Very Expensive Stocks: $11,022

Grufity's Fair Value model does a great job in separating High Performing Stocks from Low Performing ones in the S&P 500 list.

Tracking the Latest Insider Buys and Sells of Motorola Solutions Inc

Filter Transactions| Datesorted ascending | Name | Buy/Sell | $ Value | Avg. Price | # Shares | Title |

|---|---|---|---|---|---|---|

| May 14, 2024 | lewent judy c | acquired | - | - | 679 | - |

| May 14, 2024 | anasenes nicole | acquired | - | - | 679 | - |

| May 14, 2024 | dunning karen e | acquired | 236,037 | 208 | 1,134 | svp, human resources |

| May 14, 2024 | tucci joseph m | acquired | - | - | 679 | - |

| May 14, 2024 | dunning karen e | sold | -1,148,380 | 361 | -3,173 | svp, human resources |

| May 14, 2024 | mondre greg | acquired | 245,153 | 361 | 679 | - |

| May 14, 2024 | jones clayton m | acquired | - | - | 679 | - |

| May 14, 2024 | howard ayanna | acquired | - | - | 679 | - |

| May 14, 2024 | denman kenneth d | acquired | - | - | 679 | - |

| May 10, 2024 | winkler jason j | sold | -2,665,050 | 361 | -7,364 | evp and cfo |

Which funds bought or sold MSI recently?

View All Details| Datesorted ascending | Fund Name | Type | % Chg | $ Change | $ Held | % Portfolio |

|---|---|---|---|---|---|---|

| May 17, 2024 | Lummis Asset Management, LP | unchanged | - | 4,901 | 41,533 | 0.06% |

| May 17, 2024 | Plato Investment Management Ltd | added | 10,374 | 2,875,770 | 2,900,190 | 0.30% |

| May 17, 2024 | Aspect Partners, LLC | unchanged | - | 1,885 | 15,974 | 0.01% |

| May 17, 2024 | CITIZENS FINANCIAL GROUP INC/RI | added | 52.22 | 260,674 | 619,667 | 0.02% |

| May 16, 2024 | LBP AM SA | sold off | -100 | -6,946,220 | - | -% |

| May 16, 2024 | Beacon Capital Management, LLC | added | 8.33 | 4,044 | 13,844 | -% |

| May 16, 2024 | CALIFORNIA STATE TEACHERS RETIREMENT SYSTEM | added | 1.15 | 12,737,000 | 99,465,400 | 0.13% |

| May 16, 2024 | HANCOCK WHITNEY CORP | added | 0.03 | 241,335 | 2,039,720 | 0.07% |

| May 16, 2024 | Clear Point Advisors Inc. | unchanged | - | 1,236 | 10,235 | 0.01% |

| May 16, 2024 | Meiji Yasuda Life Insurance Co | reduced | -12.14 | -10,073 | 2,631,470 | 0.06% |

Are Funds Buying or Selling MSI?

Unveiling Motorola Solutions Inc's Major ShareHolders

| Date Filed | Name of Filer | Percent of Class | No. of Shares | Form Type | |

|---|---|---|---|---|---|

| Feb 13, 2024 | vanguard group inc | 12.29% | 20,396,567 | SC 13G/A | |

| Feb 09, 2024 | capital world investors | 7.4% | 12,354,919 | SC 13G/A | |

| Jan 25, 2024 | blackrock inc. | 8.2% | 13,627,859 | SC 13G/A | |

| Feb 13, 2023 | capital world investors | 8.3% | 13,901,205 | SC 13G/A | |

| Feb 09, 2023 | vanguard group inc | 12.03% | 20,108,198 | SC 13G/A | |

| Jan 24, 2023 | blackrock inc. | 9.3% | 15,537,336 | SC 13G | |

| Feb 11, 2022 | capital world investors | 6.1% | 10,248,698 | SC 13G | |

| Feb 09, 2022 | vanguard group inc | 10.98% | 18,547,606 | SC 13G/A | |

| Feb 01, 2022 | blackrock inc. | 8.5% | 14,324,480 | SC 13G/A | |

| Feb 10, 2021 | vanguard group inc | 10.84% | 18,373,703 | SC 13G/A |

Recent SEC filings of Motorola Solutions Inc

View All Filings| Date Filed | Form Type | Document | |

|---|---|---|---|

| May 17, 2024 | 8-K | Current Report | |

| May 16, 2024 | 4 | Insider Trading | |

| May 16, 2024 | 4 | Insider Trading | |

| May 16, 2024 | 4 | Insider Trading | |

| May 16, 2024 | 4 | Insider Trading | |

| May 16, 2024 | 4 | Insider Trading | |

| May 16, 2024 | 4 | Insider Trading | |

| May 16, 2024 | 4 | Insider Trading | |

| May 16, 2024 | 4 | Insider Trading | |

| May 14, 2024 | 144 | Notice of Insider Sale Intent |

- …

Peers (Alternatives to Motorola Solutions Inc)

| Name | Mkt Capsorted ascending | Revenue | Price %, 1M | Returns, 1Y | P/E | P/S | Rev 1-Yr | Inc 1-Yr |

|---|---|---|---|---|---|---|---|---|

| LARGE-CAP | ||||||||

CSCO | 195.2B | 57.2B | 0.84% | -0.02% | 14.52 | 3.41 | 7.66% | 18.93% |

ANET | 100.2B | 6.1B | 23.38% | 126.13% | 43.8 | 16.49 | 25.22% | 50.89% |

HPQ | 30.6B | 53.1B | 12.68% | 1.50% | 8.95 | 0.58 | -11.04% | 34.01% |

HPE | 23.2B | 29.1B | 4.87% | 23.94% | 11.47 | 0.8 | 2.24% | 133.29% |

LOGI | 13.8B | 4.3B | 13.89% | 41.09% | 22.55 | 3.21 | -5.30% | 67.91% |

JNPR | 11.3B | 5.3B | -5.04% | 17.70% | 50.26 | 2.11 | -2.96% | -55.26% |

| MID-CAP | ||||||||

UI | 8.8B | 1.9B | 37.99% | -15.28% | 25.3 | 4.63 | 1.03% | -11.76% |

BDC | 3.8B | 2.4B | 13.60% | 9.12% | 21.17 | 1.58 | -8.79% | -36.23% |

LITE | 3.1B | 1.4B | 9.65% | -2.83% | -8.78 | 2.19 | -21.81% | -865.12% |

| SMALL-CAP | ||||||||

EXTR | 1.5B | 1.2B | 4.94% | -36.59% | -239.63 | 1.24 | -0.19% | -110.91% |

AAOI | 456.4M | 205.3M | -2.09% | 570.29% | -7.25 | 2.22 | -8.19% | 5.55% |

ADTN | 417.7M | 1.1B | 13.55% | -38.68% | -0.76 | 0.4 | -12.01% | -1246.95% |

ALOT | 135.5M | 148.1M | 4.92% | 16.09% | 28.87 | 0.92 | 3.90% | 76.40% |

AIRG | 56.5M | 53.8M | -4.90% | - | -4.7 | 1.05 | -28.06% | -33.67% |

AKTS | 34.5M | 29.9M | -30.00% | -88.82% | -0.45 | 1.16 | 39.86% | -24.01% |

Motorola Solutions Inc News

Motorola Solutions Inc Earnings Report: Key Takeaways & Analysis

| Income Statement (Quarterly) | (In Millions) | |||||||||||||||||||||

| Description | (%) Q/Q | 2024Q1 | 2023Q4 | 2023Q3 | 2023Q2 | 2023Q1 | 2022Q4 | 2022Q3 | 2022Q2 | 2022Q1 | 2021Q4 | 2021Q3 | 2021Q2 | 2021Q1 | 2020Q4 | 2020Q3 | 2020Q2 | 2020Q1 | 2019Q4 | 2019Q3 | 2019Q2 | 2019Q1 |

| Revenue | -16.1% | 2,389 | 2,849 | 2,556 | 2,403 | 2,171 | 2,707 | 2,373 | 2,140 | 1,892 | 2,320 | 2,107 | 1,971 | 1,773 | 2,273 | 1,868 | 1,618 | 1,655 | 2,377 | 1,994 | 1,860 | 1,657 |

| Gross Profit | -18.1% | 1,192 | 1,455 | 1,280 | 1,189 | 1,046 | 1,351 | 1,031 | 990 | 857 | 1,183 | 1,045 | 952 | 860 | 1,146 | 909 | 766 | 787 | 1,220 | 1,007 | 931 | 773 |

| S&GA Expenses | -6.1% | 397 | 423 | 380 | 390 | 368 | 380 | 378 | 356 | 338 | 368 | 351 | 331 | 303 | 343 | 313 | 297 | 341 | 368 | 359 | 351 | 327 |

| R&D Expenses | 0% | 218 | 218 | 215 | 215 | 210 | 203 | 197 | 191 | 188 | 190 | 183 | 181 | 180 | 182 | 175 | 161 | 168 | 182 | 172 | 170 | 162 |

| EBITDA Margin | -19.1% | 0.22* | 0.27* | 0.28* | 0.26* | 0.25* | 0.24* | 0.23* | 0.25* | 0.26* | 0.27* | 0.27* | 0.26* | 0.25* | - | - | - | - | - | - | - | - |

| Interest Expenses | -47.8% | 36.00 | 69.00 | 48.00 | 70.00 | 47.00 | 69.00 | 48.00 | 56.00 | 53.00 | 52.00 | 53.00 | 43.00 | 59.00 | 39.00 | 69.00 | 48.00 | 61.00 | 45.00 | 64.00 | 40.00 | 72.00 |

| Income Taxes | -146.6% | -52.00 | 112 | 127 | 114 | 79.00 | 73.00 | 53.00 | 71.00 | -49.00 | 116 | 97.00 | 46.00 | 44.00 | 110 | 45.00 | 40.00 | 26.00 | -50.00 | 80.00 | 67.00 | 33.00 |

| Earnings Before Taxes | -112.7% | -90.00 | 709 | 592 | 487 | 358 | 663 | 333 | 300 | 219 | 518 | 405 | 340 | 289 | 523 | 251 | 176 | 224 | 193 | 348 | 275 | 185 |

| EBT Margin | -22.6% | 0.17* | 0.22* | 0.21* | 0.19* | 0.18* | 0.17* | 0.16* | 0.17* | 0.18* | 0.19* | 0.19* | 0.18* | 0.16* | - | - | - | - | - | - | - | - |

| Net Income | -106.5% | -39.00 | 596 | 464 | 371 | 278 | 703 | 279 | 1.00 | 267 | 401 | 307 | 293 | 244 | 412 | 205 | 1.00 | 197 | 244 | 267 | 207 | 151 |

| Net Income Margin | -20.3% | 0.14* | 0.17* | 0.18* | 0.17* | 0.13* | 0.14* | 0.11* | 0.12* | 0.15* | 0.15* | 0.15* | 0.15* | 0.11* | - | - | - | - | - | - | - | - |

| Free Cashflow | -69.3% | 382 | 1,245 | 714 | 93.00 | -8.00 | 1,273 | 388 | 10.00 | 152 | 703 | 376 | 388 | 370 | - | - | - | - | - | - | - | - |

| Balance Sheet | (In Millions) | |||||||||||||||||||||

| Description | (%) Q/Q | 2024Q1 | 2023Q4 | 2023Q3 | 2023Q2 | 2023Q1 | 2022Q4 | 2022Q3 | 2022Q2 | 2022Q1 | 2021Q4 | 2021Q3 | 2021Q2 | 2021Q1 | 2020Q4 | 2020Q3 | 2020Q2 | 2020Q1 | 2019Q4 | 2019Q3 | 2019Q2 | 2019Q1 |

| Assets | -0.1% | 13,326 | 13,336 | 12,436 | 12,252 | 12,353 | 12,814 | 11,625 | 11,672 | 11,649 | 12,189 | 11,422 | 11,131 | 10,423 | 10,876 | 10,361 | 10,374 | 10,716 | 10,642 | 10,373 | 9,974 | 9,993 |

| Current Assets | -3.6% | 5,521 | 5,725 | 5,032 | 4,626 | 4,826 | 5,255 | 4,707 | 4,411 | 4,280 | 5,412 | 4,735 | 4,660 | 3,942 | 4,327 | 3,971 | 4,086 | 4,481 | 4,178 | 4,154 | 3,831 | 3,714 |

| Cash Equivalents | -11.3% | 1,512 | 1,705 | 910 | 710 | 1,022 | 1,325 | 822 | 717 | 878 | 1,874 | 1,653 | 1,921 | 1,320 | 1,254 | 1,007 | 1,341 | 1,672 | 1,001 | 1,140 | 964 | 897 |

| Inventory | 1.6% | 840 | 827 | 959 | 1,020 | 1,082 | 1,055 | 1,157 | 1,071 | 952 | 788 | 604 | 559 | 530 | 508 | 489 | 449 | 442 | 447 | 460 | 424 | 425 |

| Net PPE | - | - | - | - | - | - | - | - | - | - | - | - | - | - | 1,022 | - | - | 932 | 992 | 963 | 940 | 937 |

| Goodwill | 0.3% | 3,410 | 3,401 | 3,278 | 3,295 | 3,287 | 3,312 | 2,851 | 2,873 | 47.00 | 2,565 | 2,449 | 234 | 2,221 | 2,219 | 2,207 | - | - | - | - | - | - |

| Current Liabilities | -19.4% | 4,626 | 5,736 | 5,288 | 3,766 | 3,966 | 4,560 | 3,768 | 3,801 | 3,886 | 4,063 | 3,429 | 3,184 | 3,095 | 3,489 | 3,312 | 3,480 | 3,879 | 3,439 | 3,656 | 2,876 | 2,979 |

| Long Term Debt | 27.4% | 5,994 | 4,705 | 4,704 | 6,015 | 6,014 | 6,013 | 6,012 | 6,011 | 5,689 | 5,688 | 5,687 | 5,686 | 5,164 | 5,163 | 5,162 | 5,111 | 5,111 | 5,113 | 5,112 | 5,315 | 5,287 |

| LT Debt, Current | -76.2% | 313 | 1,313 | - | - | - | 1.00 | - | - | - | 5.00 | - | - | - | 12.00 | - | - | - | 16.00 | - | - | - |

| LT Debt, Non Current | -100.0% | - | 4,705 | 4,704 | 6,015 | 6,014 | 6,013 | 6,012 | 6,011 | 5,689 | 5,688 | 5,687 | 5,686 | 5,164 | 5,163 | 5,162 | 5,111 | 5,111 | 5,113 | 5,112 | 5,315 | 5,287 |

| Shareholder's Equity | -28.0% | 521 | 724 | 362 | 1,333 | 1,333 | 116 | - | 936 | 18.00 | 1,350 | 15.00 | 879 | 834 | 17.00 | - | 628 | 544 | 501 | - | 16.00 | 963 |

| Retained Earnings | -14.7% | 1,399 | 1,640 | 1,326 | 1,333 | 1,333 | 1,343 | 989 | 936 | 1,002 | 1,350 | 1,201 | 1,151 | 1,080 | 1,127 | 1,008 | 1,017 | 1,074 | 1,239 | 1,220 | 1,051 | 963 |

| Additional Paid-In Capital | 3.1% | 1,673 | 1,622 | 1,539 | 1,449 | 1,386 | 1,306 | 1,239 | 1,110 | 1,064 | 987 | 950 | 877 | 832 | 759 | 667 | 626 | 542 | 499 | 436 | 714 | 651 |

| Shares Outstanding | 0.4% | 167 | 166 | 166 | 167 | 168 | 168 | 167 | 167 | 168 | 169 | 169 | 169 | 169 | - | - | - | - | - | - | - | - |

| Minority Interest | 6.7% | 16.00 | 15.00 | 14.00 | 14.00 | 15.00 | 15.00 | 14.00 | 13.00 | 18.00 | 17.00 | 15.00 | 14.00 | 18.00 | 17.00 | 16.00 | 15.00 | 18.00 | 17.00 | 17.00 | 16.00 | 18.00 |

| Float | - | - | - | - | 43,000 | - | - | - | 31,000 | - | - | - | 33,200 | - | - | - | 18,000 | - | - | - | 21,400 | - |

| Cashflow (Quarterly) | (In Millions) | |||||||||||||||||||||

| Description | (%) Q/Q | 2024Q1 | 2023Q4 | 2023Q3 | 2023Q2 | 2023Q1 | 2022Q4 | 2022Q3 | 2022Q2 | 2022Q1 | 2021Q4 | 2021Q3 | 2021Q2 | 2021Q1 | 2020Q4 | 2020Q3 | 2020Q2 | 2020Q1 | 2019Q4 | 2019Q3 | 2019Q2 | 2019Q1 |

| Cashflow From Operations | -69.3% | 382 | 1,245 | 714 | 93.00 | -8.00 | 1,273 | 388 | 10.00 | 152 | 703 | 376 | 388 | 370 | 704 | 392 | 209 | 308 | 795 | 526 | 251 | 251 |

| Share Based Compensation | 7.7% | 56.00 | 52.00 | 52.00 | 53.00 | 55.00 | 46.00 | 45.00 | 44.00 | 37.00 | 35.00 | 34.00 | 31.00 | 29.00 | 29.00 | 31.00 | 31.00 | 38.00 | 31.00 | 30.00 | 30.00 | 27.00 |

| Cashflow From Investing | 80.6% | -47.00 | -242 | -61.00 | -58.00 | -53.00 | -652 | -62.00 | -116 | -557 | -217 | -411 | -62.00 | -52.00 | -68.00 | -228 | -115 | -26.00 | -132 | -312 | -58.00 | -432 |

| Cashflow From Financing | -103.2% | -512 | -252 | -414 | -366 | -263 | -202 | -140 | 13.00 | -577 | -250 | -209 | 286 | -256 | -434 | -515 | -456 | 439 | -815 | -18.00 | -110 | -201 |

| Dividend Payments | -100.0% | - | 146 | 147 | 148 | 148 | 132 | 132 | 132 | 134 | 120 | 120 | 121 | 121 | 109 | 109 | 109 | 109 | 98.00 | 94.00 | 94.00 | 93.00 |

| Buy Backs | -70.9% | 39.00 | 134 | 306 | 224 | 140 | 87.00 | 94.00 | 162 | 493 | 125 | 137 | 102 | 170 | 171 | 105 | 83.00 | 253 | 145 | - | 25.00 | 145 |

MSI Income Statement

2024-03-30Condensed Consolidated Statements of Operations (Unaudited) - USD ($) shares in Millions, $ in Millions | 3 Months Ended | |

|---|---|---|

Mar. 30, 2024 | Apr. 01, 2023 | |

| Net sales | $ 2,389 | $ 2,171 |

| Costs of sales | 1,197 | 1,125 |

| Gross margin | 1,192 | 1,046 |

| Selling, general and administrative expenses | 397 | 368 |

| Research and development expenditures | 218 | 210 |

| Other charges | 58 | 69 |

| Operating earnings | 519 | 399 |

| Other income (expense): | ||

| Interest expense, net | (44) | (54) |

| Gain on sales of investments and businesses, net | 0 | 1 |

| Other, net | (565) | 12 |

| Total other expense | (609) | (41) |

| Earnings (loss) before income taxes | (90) | 358 |

| Income tax expense (benefit) | (52) | 79 |

| Net earnings (loss) | (38) | 279 |

| Less: Earnings attributable to non-controlling interests | 1 | 1 |

| Net earnings (loss) attributable to Motorola Solutions, Inc. | $ (39) | $ 278 |

| Earnings (loss) per common share: | ||

| Basic (in USD per share) | $ (0.23) | $ 1.66 |

| Diluted (in USD per share) | $ (0.23) | $ 1.61 |

| Weighted average common shares outstanding: | ||

| Basic (in shares) | 166.3 | 167.4 |

| Diluted (in shares) | 166.3 | 172.6 |

| Products | ||

| Net sales | $ 1,405 | $ 1,224 |

| Costs of sales | 600 | 576 |

| Services | ||

| Net sales | 984 | 947 |

| Costs of sales | $ 597 | $ 549 |

MSI Balance Sheet

2024-03-30Condensed Consolidated Balance Sheets (Unaudited) - USD ($) $ in Millions | Mar. 30, 2024 | Dec. 31, 2023 |

|---|---|---|

| ASSETS | ||

| Cash and cash equivalents | $ 1,512 | $ 1,705 |

| Accounts receivable, net | 1,592 | 1,710 |

| Contract assets | 1,127 | 1,102 |

| Inventories, net | 840 | 827 |

| Other current assets | 450 | 357 |

| Current assets held for disposition | 0 | 24 |

| Total current assets | 5,521 | 5,725 |

| Property, plant and equipment, net | 957 | 964 |

| Operating lease assets | 534 | 495 |

| Investments | 141 | 143 |

| Deferred income taxes | 1,244 | 1,062 |

| Goodwill | 3,410 | 3,401 |

| Intangible assets, net | 1,232 | 1,255 |

| Other assets | 287 | 274 |

| Non-current assets held for disposition | 0 | 17 |

| Total assets | 13,326 | 13,336 |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | ||

| Current portion of long-term debt | 313 | 1,313 |

| Accounts payable | 822 | 881 |

| Contract liabilities | 1,890 | 2,037 |

| Accrued liabilities | 1,601 | 1,504 |

| Current liabilities held for disposition | 0 | 1 |

| Total current liabilities | 4,626 | 5,736 |

| Long-term debt | 5,994 | 4,705 |

| Operating lease liabilities | 447 | 407 |

| Other liabilities | 1,722 | 1,741 |

| Non-current liabilities held for disposition | 0 | 8 |

| Stockholders’ Equity | ||

| Preferred stock, $100 par value: 0.5 shares authorized; none issued and outstanding | 0 | 0 |

| Common stock, $0.01 par value: | 2 | 2 |

| Additional paid-in capital | 1,673 | 1,622 |

| Retained earnings | 1,399 | 1,640 |

| Accumulated other comprehensive loss | (2,553) | (2,540) |

| Total Motorola Solutions, Inc. stockholders’ equity | 521 | 724 |

| Non-controlling interests | 16 | 15 |

| Total stockholders’ equity | 537 | 739 |

| Total liabilities and stockholders’ equity | $ 13,326 | $ 13,336 |

| CEO | Mr. Gregory Q. Brown |

|---|---|

| WEBSITE | motorolasolutions.com |

| INDUSTRY | Computer Hardware |

| EMPLOYEES | 20000 |