Market Summary

PHR Alerts

PHR Stock Price

PHR RSI Chart

PHR Valuation

PHR Price/Sales (Trailing)

PHR Profitability

PHR Fundamentals

PHR Revenue

PHR Earnings

Breaking Down PHR Revenue

Last 7 days

13.9%

Last 30 days

5.1%

Last 90 days

-11.6%

Trailing 12 Months

-20.6%

How does PHR drawdown profile look like?

PHR Financial Health

PHR Investor Care

Historical Charts for Stock Metrics

| Year | Q1 | Q2 | Q3 | Q4 |

|---|---|---|---|---|

| 2024 | 356.3M | 0 | 0 | 0 |

| 2023 | 280.9M | 301.4M | 319.4M | 337.9M |

| 2022 | 213.2M | 228.3M | 245.2M | 262.3M |

| 2021 | 148.7M | 163.6M | 179.6M | 197.0M |

| 2020 | 124.8M | 129.9M | 134.1M | 139.7M |

| 2019 | 99.9M | 104.3M | 110.4M | 118.5M |

| 2018 | 79.8M | 84.8M | 89.9M | 94.9M |

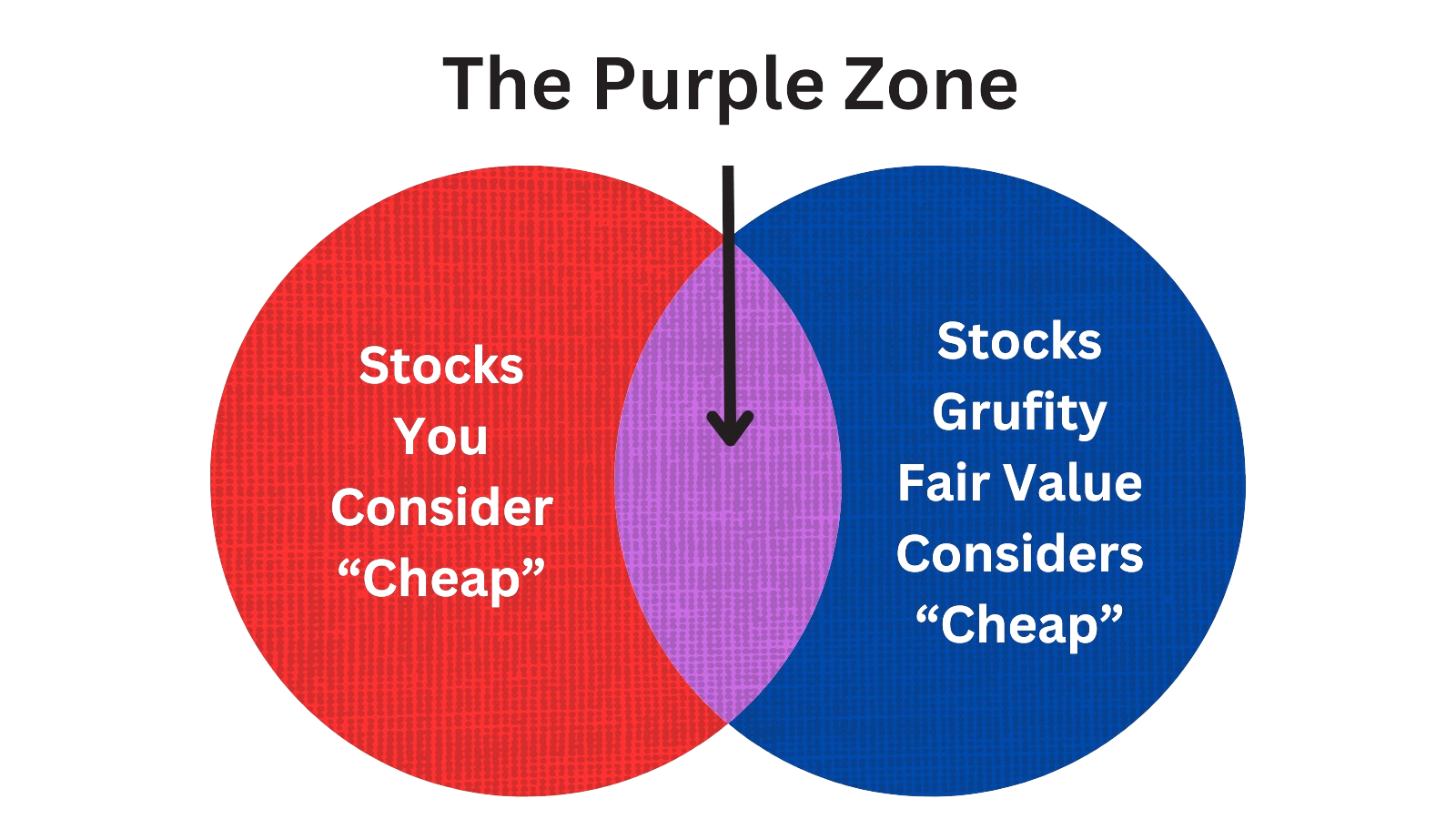

Stocks Marked 'Very Cheap' by Grufity's Fair Value Model Have Outperformed Russell 2000 Index

Small Caps and Mid Caps are mostly overlooked by investors as all the focus goes to Magnificent 7. These stocks that are not part of the beauty contest require a deeper look. However, all large cap stocks were once small caps. Grufity's Fair Value model opens up this unverse as it separates high-performing, rewarding stocks from low-performing risky stocks. <b>Russell 2000 stocks that were marked 'Very Cheap' by the model doubled in three years while the index was flat.</b>

Returns of $10,000 invested in:

Very Cheap Stocks: $21,859

Russell 2000 Index: $10,334

Very Expensive Stocks: $8,224

Russell 2000 stocks considered 'Very Cheap' by the model greatly outperformed Russell 2000 index and the 'Very Expensive' bucket over past three years.

Tracking the Latest Insider Buys and Sells of Phreesia Inc

Filter Transactions| Datesorted ascending | Name | Buy/Sell | $ Value | Avg. Price | # Shares | Title |

|---|---|---|---|---|---|---|

| May 01, 2024 | gunzburg janet | sold | -6,005 | 20.9987 | -286 | principal accounting officer |

| Apr 30, 2024 | cahill edward l | acquired | 9,996 | 20.74 | 482 | - |

| Apr 30, 2024 | munson gillian | acquired | 9,996 | 20.74 | 482 | - |

| Apr 30, 2024 | goldstein lainie | acquired | 9,996 | 20.74 | 482 | - |

| Apr 18, 2024 | linetsky david | sold | -6,145 | 22.847 | -269 | svp, life sciences |

| Apr 18, 2024 | gunzburg janet | sold | -20,836 | 22.847 | -912 | principal accounting officer |

| Apr 15, 2024 | linetsky david | sold | -50,560 | 22.8574 | -2,212 | svp, life sciences |

| Apr 15, 2024 | indig chaim | sold | -77,532 | 22.8574 | -3,392 | chief executive officer |

| Apr 15, 2024 | hoffman allison c | sold | -28,297 | 22.8574 | -1,238 | general counsel & secretary |

| Apr 15, 2024 | gandhi balaji | sold | -21,668 | 22.8574 | -948 | chief financial officer |

Which funds bought or sold PHR recently?

View All Details| Datesorted ascending | Fund Name | Type | % Chg | $ Change | $ Held | % Portfolio |

|---|---|---|---|---|---|---|

| May 16, 2024 | COMERICA BANK | added | 50.23 | 8,307 | 23,331 | -% |

| May 16, 2024 | JANE STREET GROUP, LLC | reduced | -46.48 | -917,259 | 1,136,050 | -% |

| May 16, 2024 | CALIFORNIA STATE TEACHERS RETIREMENT SYSTEM | reduced | -4.61 | -17,890 | 1,265,080 | -% |

| May 15, 2024 | TWO SIGMA INVESTMENTS, LP | sold off | -100 | -717,997 | - | -% |

| May 15, 2024 | Capital Impact Advisors, LLC | unchanged | - | 16,899 | 518,467 | 0.67% |

| May 15, 2024 | DIKER MANAGEMENT LLC | unchanged | - | 39,000 | 1,196,500 | 0.97% |

| May 15, 2024 | Point72 Asset Management, L.P. | reduced | -77.37 | -5,588,360 | 1,706,210 | -% |

| May 15, 2024 | AQR CAPITAL MANAGEMENT LLC | new | - | 266,245 | 266,245 | -% |

| May 15, 2024 | Gotham Asset Management, LLC | added | 182 | 606,566 | 922,286 | 0.01% |

| May 15, 2024 | SILVERCREST ASSET MANAGEMENT GROUP LLC | added | 4.54 | 799,517 | 10,712,000 | 0.07% |

Are Funds Buying or Selling PHR?

PHR Alerts

Unveiling Phreesia Inc's Major ShareHolders

| Date Filed | Name of Filer | Percent of Class | No. of Shares | Form Type | |

|---|---|---|---|---|---|

| Feb 16, 2024 | t. rowe price investment management, inc. | 3.3% | 1,811,531 | SC 13G/A | |

| Feb 14, 2024 | t. rowe price investment management, inc. | 3.3% | 1,811,531 | SC 13G | |

| Feb 13, 2024 | vanguard group inc | 8.32% | 4,628,441 | SC 13G/A | |

| Feb 09, 2024 | fmr llc | - | 0 | SC 13G/A | |

| Feb 09, 2024 | brown advisory inc | 7% | 3,898,859 | SC 13G/A | |

| Jan 26, 2024 | blackrock inc. | 7.6% | 4,251,588 | SC 13G/A | |

| Feb 14, 2023 | t. rowe price investment management, inc. | 5.1% | 2,676,879 | SC 13G | |

| Feb 14, 2023 | price t rowe associates inc /md/ | 0.3% | 180,384 | SC 13G/A | |

| Feb 09, 2023 | fmr llc | - | 0 | SC 13G/A | |

| Feb 09, 2023 | brown advisory inc | 5.8% | 3,068,782 | SC 13G |

Recent SEC filings of Phreesia Inc

View All Filings| Date Filed | Form Type | Document | |

|---|---|---|---|

| May 14, 2024 | ARS | ARS | |

| May 14, 2024 | DEF 14A | DEF 14A | |

| May 14, 2024 | DEFA14A | DEFA14A | |

| May 02, 2024 | 4 | Insider Trading | |

| May 02, 2024 | 4 | Insider Trading | |

| May 02, 2024 | 4 | Insider Trading | |

| May 02, 2024 | 4 | Insider Trading | |

| May 01, 2024 | 144 | Notice of Insider Sale Intent | |

| Apr 19, 2024 | 4 | Insider Trading | |

| Apr 19, 2024 | 4 | Insider Trading |

- …

Peers (Alternatives to Phreesia Inc)

| Name | Mkt Capsorted ascending | Revenue | Price %, 1M | Returns, 1Y | P/E | P/S | Rev 1-Yr | Inc 1-Yr |

|---|---|---|---|---|---|---|---|---|

| LARGE-CAP | ||||||||

UNH | 482.9B | 379.5B | 9.53% | 9.48% | 31.44 | 1.27 | 12.96% | -25.81% |

CI | 96.2B | 206.0B | -2.11% | 32.08% | 24.97 | 0.47 | 12.55% | -43.95% |

HCA | 84.6B | 66.7B | 3.80% | 15.55% | 15.46 | 1.27 | 9.59% | -4.59% |

CVS | 72.4B | 360.9B | -15.92% | -16.78% | 9.89 | 0.2 | 9.07% | 78.49% |

CNC | 41.7B | 155.5B | 8.44% | 18.66% | 15.24 | 0.27 | 6.34% | 84.42% |

DVA | 12.3B | 12.3B | 9.53% | 38.52% | 15.03 | 0.99 | 5.77% | 58.74% |

UHS | 11.9B | 14.7B | 11.04% | 30.82% | 14.63 | 0.81 | 7.99% | 19.23% |

| MID-CAP | ||||||||

CHE | 8.5B | 2.3B | -6.47% | 5.37% | 30.15 | 3.73 | 5.96% | 18.29% |

ACHC | 6.2B | 3.0B | -5.49% | -7.73% | -545.12 | 2.06 | 10.92% | -104.06% |

AMEH | 2.3B | 1.5B | 9.06% | 20.53% | 36.62 | 1.57 | 19.34% | 40.15% |

AMN | 2.2B | 3.5B | 4.01% | -38.44% | 15.49 | 0.64 | -27.67% | -62.43% |

| SMALL-CAP | ||||||||

ADUS | 1.8B | 1.1B | 14.53% | 25.72% | 27.59 | 1.67 | 11.45% | 30.74% |

BKD | 1.3B | 3.0B | 6.97% | 85.25% | -7.66 | 0.44 | 4.98% | 4.88% |

BEAT | 54.5M | - | -4.17% | -6.33% | -3.61 | - | - | -1.05% |

AMS | 22.0M | 21.6M | 16.05% | 23.93% | 39.79 | 1.02 | 9.04% | -50.63% |

Phreesia Inc News

Phreesia Inc Earnings Report: Key Takeaways & Analysis

| Income Statement (Quarterly) | ||||||||||||||||||||||

| Description | (%) Q/Q | 2024Q1 | 2023Q4 | 2023Q3 | 2023Q2 | 2023Q1 | 2022Q4 | 2022Q3 | 2022Q2 | 2022Q1 | 2021Q4 | 2021Q3 | 2021Q2 | 2021Q1 | 2020Q4 | 2020Q3 | 2020Q2 | 2020Q1 | 2019Q4 | 2019Q3 | 2019Q2 | 2019Q1 |

| Revenue | 3.7% | 95,005,000 | 91,619,000 | 85,830,000 | 83,845,000 | 76,586,000 | 73,103,000 | 67,867,000 | 63,354,000 | 58,020,000 | 55,915,000 | 51,007,000 | 48,291,000 | 41,808,000 | 38,464,000 | 35,009,000 | 33,396,000 | 32,815,000 | 32,843,000 | 30,817,000 | 28,310,000 | 26,483,000 |

| Costs and Expenses | 0.7% | 124,583,000 | 123,664,000 | 122,785,000 | 121,746,000 | 116,399,000 | 112,914,000 | 114,202,000 | 113,947,000 | 104,636,000 | 91,655,000 | 74,815,000 | 58,944,000 | 50,089,000 | 44,578,000 | 41,319,000 | 38,362,000 | 37,487,500 | 35,074,000 | 34,957,000 | 32,564,000 | 29,781,000 |

| S&GA Expenses | -1.7% | 35,873,000 | 36,478,000 | 37,244,000 | 37,413,000 | 36,260,000 | 36,631,000 | 38,341,000 | 40,031,000 | 37,206,000 | 32,036,000 | 22,167,000 | 15,012,000 | 12,959,000 | 10,481,000 | 10,098,000 | 9,434,000 | 8,187,000 | 8,348,000 | 8,120,000 | 7,702,000 | 6,396,000 |

| R&D Expenses | 4.6% | 29,862,000 | 28,544,000 | 27,471,000 | 26,469,000 | 25,398,000 | 22,669,000 | 22,542,000 | 20,635,000 | 17,495,000 | 15,273,000 | 11,443,000 | 8,054,000 | 6,355,000 | 5,732,000 | 5,530,000 | 5,005,000 | 4,860,500 | 4,774,000 | 4,690,000 | 4,299,000 | 4,205,000 |

| EBITDA Margin | 12.4% | -0.30 | -0.34 | -0.39 | -0.45 | -0.54 | -0.62 | -0.66 | -0.61 | -0.47 | -0.32 | -0.19 | - | - | - | - | - | - | - | - | - | - |

| Interest Expenses | -64.8% | 184,000 | 523,000 | 786,000 | 718,000 | 1,592,000 | 61,000 | -206,000 | -383,000 | -328,000 | -311,000 | -207,000 | -238,000 | -367,000 | -467,000 | -419,000 | -320,000 | -676,500 | -219,000 | -745,000 | -804,000 | -1,045,000 |

| Income Taxes | -41.7% | 217,000 | 372,000 | 648,000 | 306,000 | -171,000 | 206,000 | 213,000 | 235,000 | -433,000 | 178,000 | 288,000 | 149,000 | -322,000 | 194,000 | 66,000 | 111,000 | -1,963,000 | 64,000 | 51,000 | 68,000 | - |

| Earnings Before Taxes | 3.6% | -30,429,000 | -31,569,000 | -36,119,000 | -37,225,000 | -38,192,000 | -39,961,000 | -46,503,000 | -51,007,000 | -46,884,000 | -36,165,000 | -24,105,000 | -10,825,000 | -8,418,000 | -6,519,000 | -6,305,000 | -6,001,000 | -5,631,000 | -2,373,000 | -7,442,000 | -6,627,000 | -5,079,000 |

| EBT Margin | 10.3% | -0.38 | -0.42 | -0.47 | -0.54 | -0.63 | -0.70 | -0.74 | -0.69 | -0.55 | -0.40 | -0.28 | - | - | - | - | - | - | - | - | - | - |

| Net Income | 4.1% | -30,646,000 | -31,941,000 | -36,767,000 | -37,531,000 | -38,021,000 | -40,167,000 | -46,716,000 | -51,242,000 | -46,451,000 | -36,343,000 | -24,393,000 | -10,974,000 | -8,096,000 | -6,713,000 | -6,371,000 | -6,112,000 | -3,668,000 | -2,437,000 | -7,493,000 | -6,695,000 | -5,080,000 |

| Net Income Margin | 10.0% | -0.38 | -0.43 | -0.48 | -0.54 | -0.63 | -0.70 | -0.74 | -0.69 | -0.55 | -0.41 | -0.28 | - | - | - | - | - | - | - | - | - | - |

| Free Cashflow | 26.6% | -5,540,000 | -7,552,000 | -10,086,000 | -15,006,000 | -16,603,000 | -22,142,000 | -20,692,000 | -35,418,000 | -39,803,000 | -36,095,000 | -7,776,000 | - | - | - | - | - | - | - | - | - | - |

| Balance Sheet | (In Millions) | |||||||||||||||||||||

| Description | (%) Q/Q | 2024Q1 | 2023Q4 | 2023Q3 | 2023Q2 | 2023Q1 | 2022Q4 | 2022Q3 | 2022Q2 | 2022Q1 | 2021Q4 | 2021Q3 | 2021Q2 | 2021Q1 | 2020Q4 | 2020Q3 | 2020Q2 | 2020Q1 | 2019Q4 | 2019Q3 | 2019Q2 | 2019Q1 |

| Assets | -1.2% | 370 | 375 | 340 | 354 | 370 | 397 | 426 | 459 | 494 | 529 | 551 | 561 | 327 | 338 | 160 | 161 | 159 | 156 | 163 | 111 | 59.00 |

| Current Assets | -1.8% | 196 | 199 | 219 | 240 | 262 | 287 | 316 | 349 | 386 | 464 | 494 | 507 | 272 | 303 | 128 | 130 | 132 | 129 | 136 | - | 33.00 |

| Cash Equivalents | -15.3% | 88.00 | 103 | 128 | 150 | 177 | 210 | 241 | 269 | 314 | 400 | 440 | 451 | 219 | 254 | 84.00 | 90.00 | 90.00 | 91.00 | 100 | 6.00 | 2.00 |

| Net PPE | - | - | - | - | - | - | - | - | - | - | - | - | - | 27.00 | 19.00 | 17.00 | 15.00 | 14.00 | 14.00 | 15.00 | - | 14.00 |

| Goodwill | 0.5% | 76.00 | 75.00 | 23.00 | 34.00 | 34.00 | 34.00 | 34.00 | 34.00 | 34.00 | 8.00 | 8.00 | 8.00 | 8.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | - | 0.00 |

| Liabilities | 8.0% | 119 | 110 | 93.00 | 90.00 | 82.00 | 77.00 | 78.00 | 78.00 | 77.00 | 71.00 | 65.00 | 58.00 | 63.00 | 68.00 | 63.00 | 61.00 | 57.00 | 53.00 | 60.00 | 62.00 | 64.00 |

| Current Liabilities | 11.9% | 110 | 98.00 | 85.00 | 83.00 | 79.00 | 73.00 | 72.00 | 71.00 | 68.00 | 65.00 | 58.00 | 51.00 | 55.00 | 42.00 | 38.00 | 38.00 | 35.00 | 32.00 | 39.00 | - | 28.00 |

| Long Term Debt | -21.1% | 5.00 | 7.00 | 8.00 | 7.00 | 3.00 | 4.00 | 5.00 | 6.00 | 7.00 | 5.00 | 6.00 | 6.00 | 6.00 | 24.00 | 23.00 | 19.00 | 22.00 | 19.00 | 19.00 | - | 28.00 |

| LT Debt, Current | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | 0.00 |

| LT Debt, Non Current | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | 19.00 | 19.00 | 19.00 | 19.00 | - | 28.00 |

| Shareholder's Equity | -5.0% | 251 | 265 | 247 | 264 | 288 | 320 | 348 | 381 | 417 | 458 | 487 | 503 | 263 | 270 | 98.00 | 100 | 102 | 102 | 103 | - | - |

| Retained Earnings | -4.3% | -742 | -712 | -680 | -643 | -606 | -568 | -527 | -481 | -429 | -383 | -347 | -322 | -311 | -303 | -296 | -290 | -284 | -280 | -278 | - | -210 |

| Additional Paid-In Capital | 1.7% | 1,039 | 1,022 | 971 | 947 | 927 | 912 | 896 | 881 | 861 | 849 | 840 | 832 | 580 | 574 | 395 | 391 | 386 | 383 | 381 | - | - |

| Accumulated Depreciation | - | - | - | - | - | - | - | - | - | - | - | - | - | 40.00 | 43.00 | 40.00 | 38.00 | 36.00 | 34.00 | 32.00 | - | 28.00 |

| Shares Outstanding | -1.2% | 55.00 | 55.00 | 54.00 | 53.00 | 52.00 | 52.00 | 52.00 | 52.00 | 50.00 | 50.00 | 48.00 | 45.00 | - | - | - | - | - | - | - | - | - |

| Float | - | - | - | 1,617 | - | - | - | 1,157 | - | - | - | 3,561 | - | - | - | 1,139 | - | - | - | 511 | - | - |

| Cashflow (Quarterly) | (In Thousands) | |||||||||||||||||||||

| Description | (%) Q/Q | 2024Q1 | 2023Q4 | 2023Q3 | 2023Q2 | 2023Q1 | 2022Q4 | 2022Q3 | 2022Q2 | 2022Q1 | 2021Q4 | 2021Q3 | 2021Q2 | 2021Q1 | 2020Q4 | 2020Q3 | 2020Q2 | 2020Q1 | 2019Q4 | 2019Q3 | 2019Q2 | 2019Q1 |

| Cashflow From Operations | 51.2% | -3,078 | -6,310 | -9,331 | -13,659 | -15,899 | -20,748 | -19,843 | -33,633 | -37,979 | -24,529 | -6,729 | -5,473 | 4,077 | -667 | -2,423 | 1,903 | 1,274 | -3,033 | 552 | 2,033 | -3,798 |

| Share Based Compensation | -0.6% | 17,864 | 17,963 | 18,648 | 17,138 | 15,284 | 14,782 | 14,558 | 14,151 | 10,168 | 12,929 | 7,273 | 5,774 | 3,873 | 3,316 | 3,428 | 2,872 | 2,345 | 1,765 | 1,468 | 599 | 497 |

| Cashflow From Investing | 48.1% | -8,158 | -15,717 | -9,716 | -6,079 | -6,599 | -6,728 | -5,852 | -7,024 | -40,670 | -14,505 | -3,154 | -6,899 | -13,982 | -3,707 | -4,319 | -3,077 | -3,165 | -3,523 | -2,907 | -2,725 | -3,882 |

| Cashflow From Financing | -101.8% | -4,610 | -2,284 | -3,043 | -7,178 | -10,408 | -3,664 | -2,766 | -3,965 | -7,934 | -425 | -943 | 244,271 | -25,432 | 174,293 | 689 | 1,111 | 817 | -2,107 | 96,494 | 5,062 | 6,614 |

PHR Income Statement

2024-01-31Consolidated Statements of Operations - USD ($) $ in Thousands | 12 Months Ended | ||

|---|---|---|---|

Jan. 31, 2024 | Jan. 31, 2023 | Jan. 31, 2022 | |

| Revenue: | |||

| Total revenues | $ 356,299 | $ 280,910 | $ 213,233 |

| Expenses: | |||

| Cost of revenue (excluding depreciation and amortization) | 61,025 | 58,944 | 42,669 |

| Payment processing expense | 62,986 | 50,323 | 38,719 |

| Sales and marketing | 147,008 | 151,263 | 106,421 |

| Research and development | 112,346 | 91,244 | 52,265 |

| General and administrative | 79,926 | 80,384 | 68,674 |

| Depreciation | 17,584 | 17,988 | 14,985 |

| Amortization | 11,903 | 7,316 | 6,317 |

| Total expenses | 492,778 | 457,462 | 330,050 |

| Operating loss | (136,479) | (176,552) | (116,817) |

| Other income (expense), net | 44 | (175) | (78) |

| Loss on extinguishment of debt | (1,118) | 0 | 0 |

| Interest income (expense), net | 2,211 | 1,064 | (1,084) |

| Total other income (expense), net | 1,137 | 889 | (1,162) |

| Loss before provision for income taxes | (135,342) | (175,663) | (117,979) |

| Provision for income taxes | (1,543) | (483) | (182) |

| Net loss | $ (136,885) | $ (176,146) | $ (118,161) |

| Net loss per share attributable to common stockholders - basic (in dollars per share) | $ (2.51) | $ (3.36) | $ (2.37) |

| Net loss per share attributable to common stockholders - diluted (in dollars per share) | $ (2.51) | $ (3.36) | $ (2.37) |

| Weighted-average common shares outstanding - basic (in shares) | 54,561,449 | 52,440,067 | 49,888,436 |

| Weighted-average common shares outstanding - diluted (in shares) | 54,561,449 | 52,440,067 | 49,888,436 |

| Subscription and related services | |||

| Revenue: | |||

| Total revenues | $ 165,436 | $ 128,975 | $ 95,514 |

| Payment processing fees | |||

| Revenue: | |||

| Total revenues | 94,610 | 78,368 | 65,201 |

| Network solutions | |||

| Revenue: | |||

| Total revenues | $ 96,253 | $ 73,567 | $ 52,518 |

PHR Balance Sheet

2024-01-31Consolidated Balance Sheets - USD ($) | Jan. 31, 2024 | Jan. 31, 2023 |

|---|---|---|

| Current: | ||

| Cash and cash equivalents | $ 87,520,000 | $ 176,683,000 |

| Settlement assets | 28,072,000 | 22,599,000 |

| Accounts receivable, net of allowance for doubtful accounts of $1,392 and $1,053 as of January 31, 2024 and 2023, respectively | 64,863,000 | 51,394,000 |

| Deferred contract acquisition costs | 768,000 | 1,056,000 |

| Prepaid expenses and other current assets | 14,461,000 | 10,709,000 |

| Total current assets | 195,684,000 | 262,441,000 |

| Property and equipment, net of accumulated depreciation and amortization of $76,859 and $59,847 as of January 31, 2024 and 2023, respectively | 16,902,000 | 21,670,000 |

| Capitalized internal-use software, net of accumulated amortization of $45,769 and $37,236 as of January 31, 2024 and 2023, respectively | 46,139,000 | 35,150,000 |

| Operating lease right-of-use assets | 266,000 | 569,000 |

| Deferred contract acquisition costs | 986,000 | 1,754,000 |

| Intangible assets, net of accumulated amortization of $4,925 and $2,549 as of January 31, 2024 and 2023, respectively | 31,625,000 | 11,401,000 |

| Deferred tax asset | 0 | 81,000 |

| Goodwill | 75,845,000 | 33,736,000 |

| Other assets | 2,879,000 | 3,255,000 |

| Total Assets | 370,326,000 | 370,057,000 |

| Current: | ||

| Settlement obligations | 28,072,000 | 22,599,000 |

| Current portion of finance lease liabilities and other debt | 6,056,000 | 5,172,000 |

| Current portion of operating lease liabilities | 393,000 | 934,000 |

| Accounts payable | 8,480,000 | 10,836,000 |

| Accrued expenses | 37,130,000 | 21,810,000 |

| Deferred revenue | 24,113,000 | 17,688,000 |

| Other current liabilities | 5,875,000 | 0 |

| Total current liabilities | 110,119,000 | 79,039,000 |

| Long-term finance lease liabilities and other debt | 5,400,000 | 2,725,000 |

| Operating lease liabilities, non-current | 134,000 | 349,000 |

| Long-term deferred revenue | 97,000 | 125,000 |

| Long-term deferred tax liabilities | 270,000 | 0 |

| Other long-term liabilities | 2,857,000 | 0 |

| Total Liabilities | 118,877,000 | 82,238,000 |

| Commitments and contingencies (Note 11) | ||

| Stockholders’ Equity: | ||

| Preferred stock, undesignated, $0.01 par value—20,000,000 shares authorized as of both January 31, 2024 and 2023; no shares issued or outstanding as of January 31, 2024 and 2023, respectively | 0 | 0 |

| Common stock, $0.01 par value—500,000,000 shares authorized as of both January 31, 2024 and 2023; 57,709,762 and 54,187,172 shares issued as of January 31, 2024 and 2023, respectively | 577,000 | 542,000 |

| Additional paid-in capital | 1,039,361,000 | 926,957,000 |

| Accumulated deficit | (742,969,000) | (606,084,000) |

| Treasury stock, at cost, 1,355,169 and 971,236 shares as of January 31, 2024 and 2023, respectively | (45,520,000) | (33,596,000) |

| Total Stockholders’ Equity | 251,449,000 | 287,819,000 |

| Total Liabilities and Stockholders’ Equity | $ 370,326,000 | $ 370,057,000 |

| CEO | Mr. Chaim Indig |

|---|---|

| WEBSITE | phreesia.com |

| INDUSTRY | Healthcare Plans |

| EMPLOYEES | 1576 |