Market Summary

SNEX Stock Price

SNEX RSI Chart

SNEX Valuation

SNEX Price/Sales (Trailing)

SNEX Profitability

SNEX Fundamentals

SNEX Revenue

SNEX Earnings

Breaking Down SNEX Revenue

Last 7 days

-2.2%

Last 30 days

17.5%

Last 90 days

12.9%

Trailing 12 Months

-10.7%

How does SNEX drawdown profile look like?

SNEX Financial Health

SNEX Investor Care

Historical Charts for Stock Metrics

| Year | Q1 | Q2 | Q3 | Q4 |

|---|---|---|---|---|

| 2024 | 73.4B | 0 | 0 | 0 |

| 2023 | 64.5B | 60.6B | 60.9B | 67.4B |

| 2022 | 52.8B | 61.5B | 66.0B | 64.7B |

| 2021 | 43.0B | 45.0B | 42.5B | 47.6B |

| 2020 | 50.8B | 51.1B | 54.1B | 52.1B |

| 2019 | 26.9B | 27.7B | 32.9B | 37.6B |

| 2018 | 32.3B | 33.9B | 27.6B | 26.3B |

| 2017 | 19.2B | 19.8B | 29.4B | 31.3B |

| 2016 | 13.7B | 14.6B | 14.8B | 17.4B |

| 2015 | 45.7B | 42.7B | 34.7B | 24.5B |

| 2014 | 34.9B | 32.3B | 34.0B | 39.7B |

| 2013 | 58.9B | 51.2B | 42.5B | 38.3B |

| 2012 | 78.9B | 75.7B | 69.3B | 64.1B |

| 2011 | 61.2B | 68.4B | 75.5B | 76.5B |

| 2010 | 0 | 45.3B | 46.9B | 54.1B |

| 2009 | 0 | 0 | 43.6B | 0 |

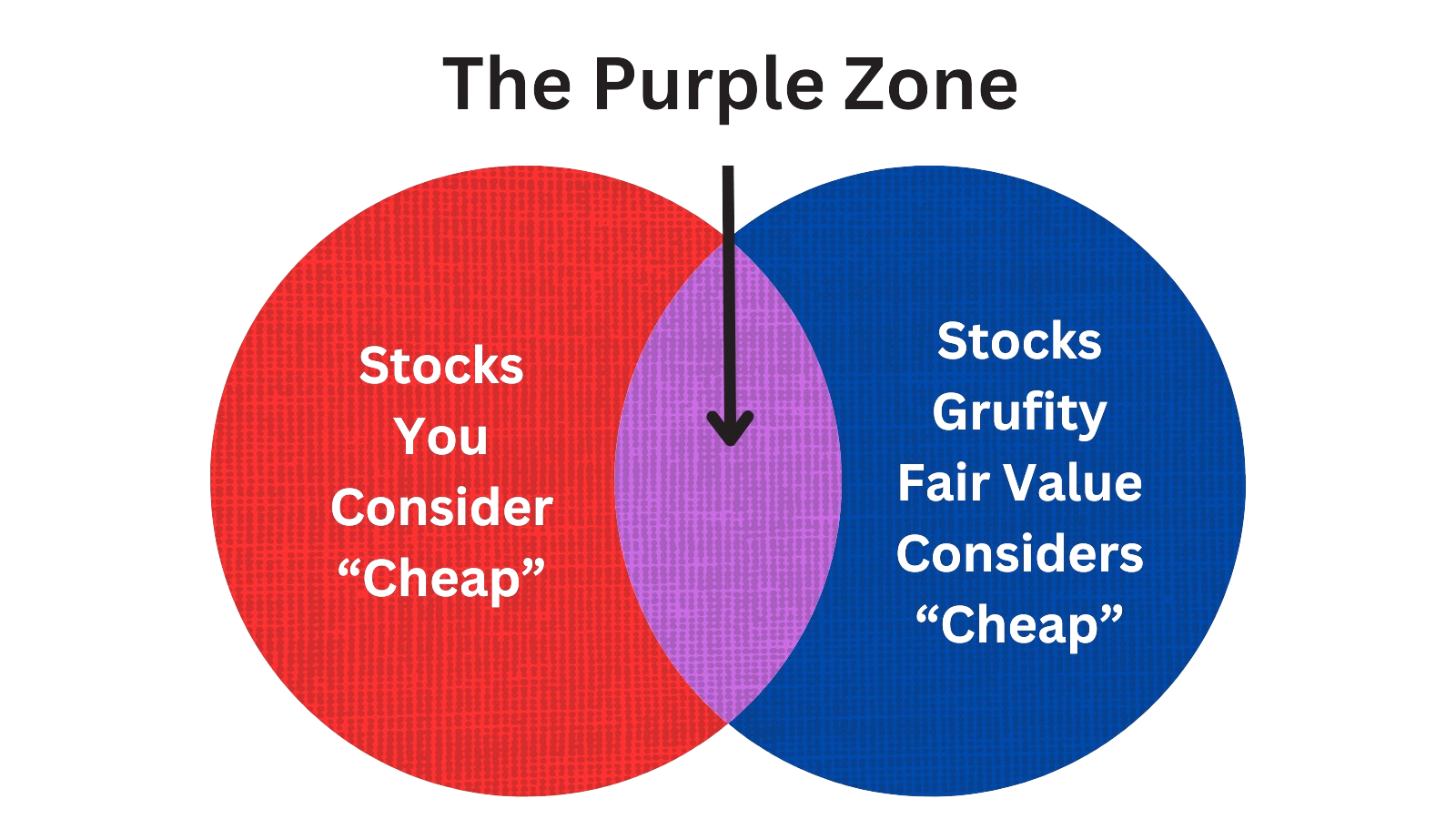

Stocks Marked 'Very Cheap' by Grufity's Fair Value Model Have Outperformed Russell 2000 Index

Small Caps and Mid Caps are mostly overlooked by investors as all the focus goes to Magnificent 7. These stocks that are not part of the beauty contest require a deeper look. However, all large cap stocks were once small caps. Grufity's Fair Value model opens up this unverse as it separates high-performing, rewarding stocks from low-performing risky stocks. <b>Russell 2000 stocks that were marked 'Very Cheap' by the model doubled in three years while the index was flat.</b>

Returns of $10,000 invested in:

Very Cheap Stocks: $21,859

Russell 2000 Index: $10,334

Very Expensive Stocks: $8,224

Russell 2000 stocks considered 'Very Cheap' by the model greatly outperformed Russell 2000 index and the 'Very Expensive' bucket over past three years.

Tracking the Latest Insider Buys and Sells of StoneX Group Inc.

Filter Transactions| Datesorted ascending | Name | Buy/Sell | $ Value | Avg. Price | # Shares | Title |

|---|---|---|---|---|---|---|

| May 03, 2024 | parthemore eric | sold | -168,008 | 74.67 | -2,250 | - |

| Apr 30, 2024 | fowler john moore | acquired | - | - | 184 | - |

| Apr 30, 2024 | radziwill john | acquired | - | - | 231 | chairman of the board |

| Apr 30, 2024 | kass steven a | acquired | - | - | 184 | - |

| Apr 30, 2024 | thamodaran dhamu r. | acquired | - | - | 150 | - |

| Mar 21, 2024 | smith philip andrew | sold | -488,142 | 69.7345 | -7,000 | - |

| Mar 13, 2024 | branch scott j | sold | -504,697 | 67.2929 | -7,500 | - |

| Mar 12, 2024 | lyon charles m | sold | -458,285 | 67.524 | -6,787 | - |

| Mar 12, 2024 | lyon charles m | acquired | 203,610 | 30.00 | 6,787 | - |

| Mar 11, 2024 | lyon charles m | acquired | 235,740 | 30.00 | 7,858 | - |

Which funds bought or sold SNEX recently?

View All Details| Datesorted ascending | Fund Name | Type | % Chg | $ Change | $ Held | % Portfolio |

|---|---|---|---|---|---|---|

| May 16, 2024 | JANE STREET GROUP, LLC | reduced | -6.76 | -34,339 | 270,431 | -% |

| May 16, 2024 | Motley Fool Asset Management LLC | reduced | -2.11 | -678,073 | 9,228,510 | 0.60% |

| May 16, 2024 | HANCOCK WHITNEY CORP | reduced | -10.41 | -56,392 | 326,639 | 0.01% |

| May 16, 2024 | Ancora Advisors LLC | unchanged | - | -51,837 | 1,020,180 | 0.02% |

| May 16, 2024 | CALIFORNIA STATE TEACHERS RETIREMENT SYSTEM | reduced | -4.95 | -207,448 | 1,965,660 | -% |

| May 16, 2024 | COMERICA BANK | reduced | -8.73 | -119,777 | 791,752 | -% |

| May 16, 2024 | Colony Group, LLC | added | 3.6 | -4,000 | 295,000 | -% |

| May 15, 2024 | AE Wealth Management LLC | sold off | -100 | -336,969 | - | -% |

| May 15, 2024 | Private Capital Management, LLC | reduced | -1.37 | -2,517,580 | 38,500,300 | 4.31% |

| May 15, 2024 | Nine Ten Capital Management LLC | reduced | -21.93 | -18,098,000 | 52,316,000 | 15.93% |

Are Funds Buying or Selling SNEX?

Unveiling StoneX Group Inc.'s Major ShareHolders

| Date Filed | Name of Filer | Percent of Class | No. of Shares | Form Type | |

|---|---|---|---|---|---|

| Feb 13, 2024 | vanguard group inc | 5.99% | 1,875,853 | SC 13G/A | |

| Jan 23, 2024 | blackrock inc. | 13.9% | 4,361,834 | SC 13G/A | |

| Feb 10, 2023 | nine ten capital management llc | 3.9% | 793,272 | SC 13G/A | |

| Feb 09, 2023 | vanguard group inc | 5.70% | 1,161,980 | SC 13G/A | |

| Jan 23, 2023 | blackrock inc. | 13.7% | 2,790,008 | SC 13G/A | |

| Feb 10, 2022 | vanguard group inc | 5.40% | 1,077,511 | SC 13G/A | |

| Feb 09, 2022 | nine ten capital management llc | 5.5% | 1,094,607 | SC 13G/A | |

| Jan 27, 2022 | blackrock inc. | 14.0% | 2,799,930 | SC 13G/A | |

| Jan 26, 2022 | blackrock inc. | 14.0% | 2,799,930 | SC 13G | |

| Feb 12, 2021 | nine ten capital management llc | 5.6% | 1,094,607 | SC 13G |

Recent SEC filings of StoneX Group Inc.

View All Filings| Date Filed | Form Type | Document | |

|---|---|---|---|

| May 17, 2024 | 144 | Notice of Insider Sale Intent | |

| May 17, 2024 | 4 | Insider Trading | |

| May 13, 2024 | 4 | Insider Trading | |

| May 10, 2024 | 144 | Notice of Insider Sale Intent | |

| May 09, 2024 | 10-Q | Quarterly Report | |

| May 09, 2024 | 144 | Notice of Insider Sale Intent | |

| May 08, 2024 | 8-K | Current Report | |

| May 06, 2024 | 4 | Insider Trading | |

| May 02, 2024 | 4 | Insider Trading | |

| May 02, 2024 | 4 | Insider Trading |

Peers (Alternatives to StoneX Group Inc.)

| Name | Mkt Capsorted ascending | Revenue | Price %, 1M | Returns, 1Y | P/E | P/S | Rev 1-Yr | Inc 1-Yr |

|---|---|---|---|---|---|---|---|---|

| LARGE-CAP | ||||||||

GS | 150.8B | 67.8B | 15.79% | 41.90% | 16.02 | 2.22 | 66.36% | -10.82% |

ICE | 79.4B | 9.7B | 5.89% | 27.54% | 32.02 | 8.17 | 0.75% | 71.75% |

CME | 76.5B | 5.7B | 2.20% | 17.16% | 23.72 | 13.5 | -1.46% | 19.89% |

COIN | 50.4B | 4.0B | -2.83% | 244.72% | 37.36 | 12.69 | 41.89% | 159.36% |

FDS | 17.1B | 2.2B | 4.56% | 14.05% | 34.96 | 7.94 | 7.26% | 9.28% |

IBKR | 13.3B | 6.1B | 13.36% | 63.50% | 4.56 | 2.18 | 64.44% | 33.59% |

| MID-CAP | ||||||||

JEF | 10.0B | 8.2B | 14.98% | 55.53% | 34.69 | 1.22 | 17.04% | -68.59% |

HLI | 8.6B | 1.8B | 9.27% | 51.05% | 33.31 | 4.69 | 0.16% | -0.33% |

EVR | 7.8B | 2.5B | 9.73% | 87.02% | 30.35 | 3.19 | -6.73% | -35.85% |

FRHC | 4.4B | 1.4B | 13.91% | -9.89% | 13.26 | 3.18 | 96.15% | 398.80% |

CLSK | 3.7B | 283.6M | 7.37% | 280.52% | 57.45 | 12.87 | 122.34% | 153.34% |

| SMALL-CAP | ||||||||

DFIN | 1.9B | 802.0M | 5.79% | 40.55% | 18.98 | 2.36 | -2.34% | 8.49% |

AMRK | 887.2M | 10.3B | 5.41% | 4.50% | 11.13 | 0.09 | 24.66% | -47.53% |

COHN | 21.0M | 92.7M | 71.65% | 67.62% | 3.38 | 0.23 | 72.05% | 185.64% |

AAMC | 7.0M | 3.2M | -14.60% | -97.24% | -0.22 | 2.22 | -44.67% | -114.57% |

StoneX Group Inc. News

StoneX Group Inc. Earnings Report: Key Takeaways & Analysis

| Income Statement (Quarterly) | (In Millions) | |||||||||||||||||||||

| Description | (%) Q/Q | 2024Q1 | 2023Q4 | 2023Q3 | 2023Q2 | 2023Q1 | 2022Q4 | 2022Q3 | 2022Q2 | 2022Q1 | 2021Q4 | 2021Q3 | 2021Q2 | 2021Q1 | 2020Q4 | 2020Q3 | 2020Q2 | 2020Q1 | 2019Q4 | 2019Q3 | 2019Q2 | 2019Q1 |

| Revenue | 12.9% | 22,106 | 19,573 | 16,636 | 15,048 | 16,161 | 13,012 | 16,381 | 18,931 | 16,383 | 14,341 | 11,847 | 10,192 | 11,245 | 9,251 | 14,285 | 8,243 | 20,366 | 11,245 | 11,280 | 7,873 | 7,192 |

| Gross Profit | 4.3% | 818 | 784 | 778 | 777 | 704 | 655 | 583 | 529 | 545 | 451 | 390 | 432 | 471 | 380 | 342 | 323 | 367 | 277 | 287 | 283 | 271 |

| S&GA Expenses | 33.3% | 16.00 | 12.00 | 13.00 | 14.00 | 14.00 | 13.00 | 14.00 | 16.00 | 14.00 | 11.00 | 10.00 | 8.00 | 7.00 | 9.00 | 6.00 | 1.00 | 4.00 | 1.00 | - | - | - |

| EBITDA Margin | -1.2% | 0.02* | 0.02* | 0.02* | 0.02* | 0.01* | 0.01* | 0.01* | 0.01* | 0.01* | 0.01* | - | - | - | - | - | - | - | - | - | - | - |

| Interest Expenses | 9.8% | 259 | 236 | 253 | 216 | 179 | 154 | 78.00 | 28.00 | 14.00 | 16.00 | 14.00 | 15.00 | 11.00 | 10.00 | 10.00 | 12.00 | 28.00 | 31.00 | 37.00 | 39.00 | 35.00 |

| Income Taxes | -27.8% | 19.00 | 27.00 | 25.00 | 25.00 | 16.00 | 19.00 | 14.00 | 22.00 | 23.00 | 11.00 | -2.40 | 12.00 | 21.00 | 7.00 | 3.00 | 12.00 | 17.00 | 5.00 | 7.00 | 5.00 | 8.00 |

| Earnings Before Taxes | -24.5% | 72.00 | 96.00 | 75.00 | 95.00 | 58.00 | 96.00 | 66.00 | 71.00 | 87.00 | 53.00 | 5.00 | 46.00 | 76.00 | 27.00 | 80.00 | 49.00 | 56.00 | 22.00 | 34.00 | 22.00 | 31.00 |

| EBT Margin | -3.9% | 0.00* | 0.00* | 0.01* | 0.01* | 0.00* | 0.00* | 0.00* | 0.00* | 0.00* | 0.00* | - | - | - | - | - | - | - | - | - | - | - |

| Net Income | -23.2% | 53.00 | 69.00 | 51.00 | 70.00 | 42.00 | 77.00 | 52.00 | 49.00 | 64.00 | 42.00 | 7.00 | 34.00 | 55.00 | 20.00 | 77.00 | 37.00 | 39.00 | 16.00 | 27.00 | 16.00 | 23.00 |

| Net Income Margin | -3.6% | 0.00* | 0.00* | 0.00* | 0.00* | 0.00* | 0.00* | 0.00* | 0.00* | 0.00* | 0.00* | - | - | - | - | - | - | - | - | - | - | - |

| Free Cashflow | 448.7% | 767 | 140 | 357 | 198 | -1,660 | 1,035 | 255 | -2,611 | 2,685 | -607 | - | - | - | - | - | - | - | - | - | - | - |

| Balance Sheet | (In Millions) | |||||||||||||||||||||

| Description | (%) Q/Q | 2024Q1 | 2023Q4 | 2023Q3 | 2023Q2 | 2023Q1 | 2022Q4 | 2022Q3 | 2022Q2 | 2022Q1 | 2021Q4 | 2021Q3 | 2021Q2 | 2021Q1 | 2020Q4 | 2020Q3 | 2020Q2 | 2020Q1 | 2019Q4 | 2019Q3 | 2019Q2 | 2019Q1 |

| Assets | 10.4% | 25,651 | 23,245 | 21,939 | 21,933 | 21,919 | 19,832 | 19,860 | 19,409 | 21,196 | 19,229 | 18,840 | 16,800 | 15,800 | 13,975 | 13,475 | 12,390 | 10,871 | 10,129 | 9,936 | 10,055 | 9,408 |

| Cash Equivalents | 540.2% | 7,411 | 1,158 | 1,108 | 1,401 | 1,264 | 1,252 | 6,285 | 1,364 | 1,300 | 983 | 1,110 | 1,076 | 1,002 | 1,034 | 4,468 | 4,099 | 3,690 | 3,069 | 2,451 | 2,629 | 2,110 |

| Inventory | - | 617 | - | 537 | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - |

| Net PPE | 5.7% | 134 | 127 | 124 | 118 | 118 | 116 | 113 | 110 | 105 | 95.00 | 93.00 | 91.00 | 86.00 | 73.00 | 62.00 | 52.00 | 43.00 | 43.00 | 44.00 | 46.00 | 46.00 |

| Liabilities | 10.8% | 24,108 | 21,762 | 20,560 | 20,603 | 20,672 | 18,656 | 18,790 | 18,362 | 20,190 | 18,276 | 17,936 | 15,898 | 14,940 | 13,175 | 12,707 | 11,701 | 10,222 | 9,514 | 9,342 | 9,484 | 8,856 |

| Shareholder's Equity | 4.0% | 1,543 | 1,483 | 1,379 | 1,330 | 1,247 | 1,177 | 1,070 | 1,047 | 1,006 | 953 | 904 | 901 | 860 | 800 | 768 | 689 | 649 | 615 | 594 | 571 | 552 |

| Retained Earnings | 4.4% | 1,250 | 1,197 | 1,128 | 1,077 | 1,008 | 966 | 890 | 837 | 788 | 724 | 683 | 675 | 641 | 586 | 572 | 495 | 458 | 419 | 402 | 375 | 359 |

| Additional Paid-In Capital | 3.2% | 391 | 379 | 372 | 365 | 359 | 347 | 340 | 335 | 330 | 324 | 316 | 311 | 304 | 297 | 293 | 289 | 286 | 281 | 277 | 274 | 272 |

| Shares Outstanding | 0.5% | 32.00 | 31.00 | 31.00 | 21.00 | 21.00 | 30.00 | 20.00 | 20.00 | 19.00 | 19.00 | 19.00 | 19.00 | - | - | - | - | - | - | - | - | - |

| Float | - | - | - | - | - | 1,547 | - | - | - | 1,063 | - | - | - | 794 | - | - | - | 430 | - | - | - | 454 |

| Cashflow (Quarterly) | (In Millions) | |||||||||||||||||||||

| Description | (%) Q/Q | 2024Q1 | 2023Q4 | 2023Q3 | 2023Q2 | 2023Q1 | 2022Q4 | 2022Q3 | 2022Q2 | 2022Q1 | 2021Q4 | 2021Q3 | 2021Q2 | 2021Q1 | 2020Q4 | 2020Q3 | 2020Q2 | 2020Q1 | 2019Q4 | 2019Q3 | 2019Q2 | 2019Q1 |

| Cashflow From Operations | 414.4% | 784 | 152 | 371 | 208 | -1,649 | 1,047 | 267 | -2,598 | 2,702 | -600 | 744 | 714 | 784 | -118 | 743 | 37.00 | 502 | 668 | -130 | 463 | 76.00 |

| Share Based Compensation | 21.1% | 9.00 | 8.00 | 7.00 | 6.00 | 9.00 | 6.00 | 5.00 | 5.00 | 4.00 | 4.00 | 4.00 | 4.00 | 3.00 | 3.00 | 3.00 | 2.00 | 2.00 | 3.00 | 2.00 | 2.00 | 2.00 |

| Cashflow From Investing | -5.5% | -13.40 | -12.70 | -14.10 | -10.30 | -10.80 | -17.80 | -11.90 | -13.50 | -16.80 | -7.30 | -9.00 | -10.40 | -17.60 | -22.80 | -226 | -3.00 | -5.40 | -6.90 | -2.50 | -23.20 | -9.90 |

| Cashflow From Financing | 394.3% | 380 | 77.00 | -81.70 | -140 | -36.20 | 89.00 | -25.40 | -131 | -19.30 | 242 | -35.00 | -47.00 | -58.10 | 105 | -146 | 374 | 128 | -43.70 | -141 | 79.00 | -7.60 |

| Buy Backs | - | - | - | - | - | - | - | - | - | - | - | 9.00 | 3.00 | - | - | - | - | 7.00 | 0.00 | 4.00 | - | - |

SNEX Income Statement

2024-03-31Condensed Consolidated Income Statements (Unaudited) - USD ($) $ in Millions | 3 Months Ended | 6 Months Ended | ||

|---|---|---|---|---|

Mar. 31, 2024 | Mar. 31, 2023 | Mar. 31, 2024 | Mar. 31, 2023 | |

| Revenues: | ||||

| Total revenues | $ 22,106.1 | $ 16,161.0 | $ 41,679.1 | $ 29,172.6 |

| Cost of sales of physical commodities | 21,287.9 | 15,456.6 | 40,076.7 | 27,813.4 |

| Operating revenues | 818.2 | 704.4 | 1,602.4 | 1,359.2 |

| Transaction-based clearing expenses | 78.5 | 69.2 | 152.8 | 136.5 |

| Introducing broker commissions | 42.0 | 42.2 | 81.1 | 79.0 |

| Interest expense | 259.2 | 178.7 | 495.2 | 333.0 |

| Interest expense on corporate funding | 16.2 | 14.9 | 29.4 | 29.3 |

| Net operating revenues | 422.3 | 399.4 | 843.9 | 781.4 |

| Compensation and other expenses: | ||||

| Compensation and benefits | 234.4 | 232.5 | 452.5 | 431.5 |

| Trading systems and market information | 19.4 | 17.8 | 38.1 | 35.5 |

| Professional fees | 19.3 | 11.3 | 35.0 | 27.2 |

| Non-trading technology and support | 18.0 | 16.2 | 34.9 | 31.0 |

| Occupancy and equipment rental | 13.6 | 10.6 | 21.3 | 19.5 |

| Selling and marketing | 15.6 | 14.2 | 27.3 | 27.1 |

| Travel and business development | 7.1 | 5.8 | 14.2 | 11.5 |

| Communications | 2.3 | 2.1 | 4.5 | 4.3 |

| Depreciation and amortization | 12.3 | 13.1 | 23.5 | 25.8 |

| Bad debts (recoveries), net | (0.4) | 3.0 | (0.7) | 3.7 |

| Other | 15.3 | 15.3 | 32.2 | 34.7 |

| Total compensation and other expenses | 356.9 | 341.9 | 682.8 | 651.8 |

| Gain on acquisition and other gains | 6.9 | 0.0 | 6.9 | 23.5 |

| Income before tax | 72.3 | 57.5 | 168.0 | 153.1 |

| Income tax expense | 19.2 | 15.8 | 45.8 | 34.8 |

| Net income | $ 53.1 | $ 41.7 | $ 122.2 | $ 118.3 |

| Earnings per share: | ||||

| Basic (in dollar per shares) | $ 1.68 | $ 1.35 | $ 3.88 | $ 3.85 |

| Diluted (in dollar per shares) | $ 1.63 | $ 1.30 | $ 3.76 | $ 3.71 |

| Weighted-average number of common shares outstanding: | ||||

| Basic (in shares) | 30,473,856 | 29,895,041 | 30,352,824 | 29,775,078 |

| Diluted (in shares) | 31,498,943 | 30,931,792 | 31,373,739 | 30,830,870 |

| Sales of physical commodities | ||||

| Revenues: | ||||

| Total revenues | $ 21,321.9 | $ 15,506.2 | $ 40,142.8 | $ 27,909.6 |

| Principal gains, net | ||||

| Revenues: | ||||

| Total revenues | 281.8 | 256.6 | 575.6 | 510.8 |

| Commission and clearing fees | ||||

| Revenues: | ||||

| Total revenues | 136.2 | 130.7 | 265.9 | 248.7 |

| Consulting, management, and account fees | ||||

| Revenues: | ||||

| Total revenues | 40.2 | 40.7 | 78.7 | 80.5 |

| Interest income | ||||

| Revenues: | ||||

| Total revenues | $ 326.0 | $ 226.8 | $ 616.1 | $ 423.0 |

SNEX Balance Sheet

2024-03-31Condensed Consolidated Balance Sheets (Unaudited) - USD ($) $ in Millions | Mar. 31, 2024 | Sep. 30, 2023 | |||

|---|---|---|---|---|---|

| ASSETS | |||||

| Cash and cash equivalents | $ 1,305.1 | $ 1,108.3 | |||

| Restricted cash | 363.0 | [1] | 0.0 | ||

| Cash, securities and other assets segregated under federal and other regulations (including $4.1 million and $5.8 million at fair value at March 31, 2024 and September 30, 2023, respectively) | 2,838.4 | 2,426.3 | |||

| Collateralized transactions: | |||||

| Securities purchased under agreements to resell | 3,744.6 | 2,979.5 | |||

| Securities borrowed | 1,430.6 | 1,129.1 | |||

| Deposits with and receivables from broker-dealers, clearing organizations and counterparties, net (including $4,157.3 million and $4,248.3 million at fair value at March 31, 2024 and September 30, 2023, respectively) | 7,706.5 | 7,443.8 | |||

| Receivable from clients, net (including $(3.4) million and $(7.9) million at fair value at March 31, 2024 and September 30, 2023, respectively) | 1,293.4 | 683.1 | |||

| Notes receivable, net | 0.0 | 5.2 | |||

| Income taxes receivable | 32.9 | 25.1 | |||

| Financial instruments owned, at fair value (includes securities pledged as collateral that can be sold or repledged of $1,860.8 million and $1,466.4 million at March 31, 2024 and September 30, 2023, respectively) | 5,666.5 | 5,044.8 | |||

| Physical commodities inventory, net (including $355.2 million and $386.5 million at fair value at March 31, 2024 and September 30, 2023, respectively) | 616.9 | 537.3 | |||

| Deferred tax asset | 42.3 | 45.4 | |||

| Property and equipment, net | 134.2 | 123.5 | |||

| Operating right of use assets | 146.4 | 122.1 | |||

| Goodwill and intangible assets, net | 79.5 | 82.4 | |||

| Other assets | 250.7 | 182.8 | |||

| Total assets | 25,651.0 | 21,938.7 | |||

| Liabilities: | |||||

| Accounts payable and other accrued liabilities (including $1.7 million and $1.5 million at fair value at March 31, 2024 and September 30, 2023, respectively) | 491.8 | 533.0 | |||

| Operating lease liabilities | 181.9 | 149.3 | |||

| Payables to: | |||||

| Clients (including $585.6 million and $79.8 million at fair value at March 31, 2024 and September 30, 2023, respectively) | 11,165.4 | 9,976.0 | |||

| Broker-dealers, clearing organizations and counterparties (including $(21.3) million and $10.2 million at fair value at March 31, 2024 and September 30, 2023, respectively) | 391.7 | 442.4 | |||

| Lenders under loans | 253.6 | 341.0 | |||

| Senior secured borrowings, net | 885.9 | 342.1 | |||

| Income taxes payable | 36.6 | 38.2 | |||

| Deferred tax liability | 8.2 | 8.1 | |||

| Collateralized transactions: | |||||

| Securities sold under agreements to repurchase | 6,011.7 | 4,526.6 | |||

| Securities loaned | 1,458.6 | 1,117.3 | |||

| Financial instruments sold, not yet purchased, at fair value | 3,223.0 | 3,085.6 | |||

| Total liabilities | 24,108.4 | 20,559.6 | |||

| Commitments and contingencies (Note 11) | |||||

| Stockholders' equity: | |||||

| Preferred stock, $0.01 par value. Authorized 1,000,000 shares; no shares issued or outstanding | 0.0 | 0.0 | |||

| Common stock, $0.01 par value. Authorized 200,000,000 shares; 35,561,232 issued and 31,650,247 outstanding at March 31, 2024 and 35,105,852 issued and 31,194,867 outstanding at September 30, 2023 | 0.4 | 0.4 | |||

| Common stock in treasury, at cost. 3,910,985 shares at March 31, 2024 and September 30, 2023 | (69.3) | (69.3) | |||

| Additional paid-in-capital | 390.8 | 371.7 | |||

| Retained earnings | 1,250.3 | 1,128.1 | |||

| Accumulated other comprehensive loss, net | (29.6) | (51.8) | |||

| Total equity | 1,542.6 | 1,379.1 | |||

| Total liabilities and stockholders' equity | $ 25,651.0 | $ 21,938.7 | |||

| |||||

| CEO | Mr. Sean Michael O'Connor |

|---|---|

| WEBSITE | stonex.com |

| INDUSTRY | Mortgage Finance |

| EMPLOYEES | 3972 |