Market Summary

XRAY Alerts

XRAY Stock Price

XRAY RSI Chart

XRAY Valuation

XRAY Price/Sales (Trailing)

XRAY Profitability

XRAY Fundamentals

XRAY Revenue

XRAY Earnings

Breaking Down XRAY Revenue

52 Week Range

Last 7 days

-5.8%

Last 30 days

-12.5%

Last 90 days

-16.2%

Trailing 12 Months

-31.6%

How does XRAY drawdown profile look like?

XRAY Financial Health

XRAY Investor Care

Historical Charts for Stock Metrics

| Year | Q1 | Q2 | Q3 | Q4 |

|---|---|---|---|---|

| 2024 | 3.9B | 0 | 0 | 0 |

| 2023 | 3.9B | 3.9B | 3.9B | 4.0B |

| 2022 | 4.2B | 4.1B | 4.0B | 3.9B |

| 2021 | 3.5B | 4.0B | 4.2B | 4.2B |

| 2020 | 4.0B | 3.5B | 3.4B | 3.3B |

| 2019 | 4.0B | 3.9B | 4.0B | 4.0B |

| 2018 | 4.0B | 4.1B | 4.0B | 4.0B |

| 2017 | 3.9B | 3.8B | 3.9B | 4.0B |

| 2016 | 2.8B | 3.1B | 3.4B | 3.7B |

| 2015 | 2.8B | 2.8B | 2.7B | 2.7B |

| 2014 | 2.9B | 3.0B | 3.0B | 2.9B |

| 2013 | 2.9B | 2.9B | 3.0B | 3.0B |

| 2012 | 2.7B | 2.8B | 2.9B | 2.9B |

| 2011 | 2.2B | 2.3B | 2.4B | 2.5B |

| 2010 | 2.2B | 2.2B | 2.2B | 2.2B |

| 2009 | 2.1B | 2.1B | 2.1B | 2.2B |

| 2008 | 0 | 2.1B | 2.1B | 2.2B |

| 2007 | 0 | 0 | 0 | 2.0B |

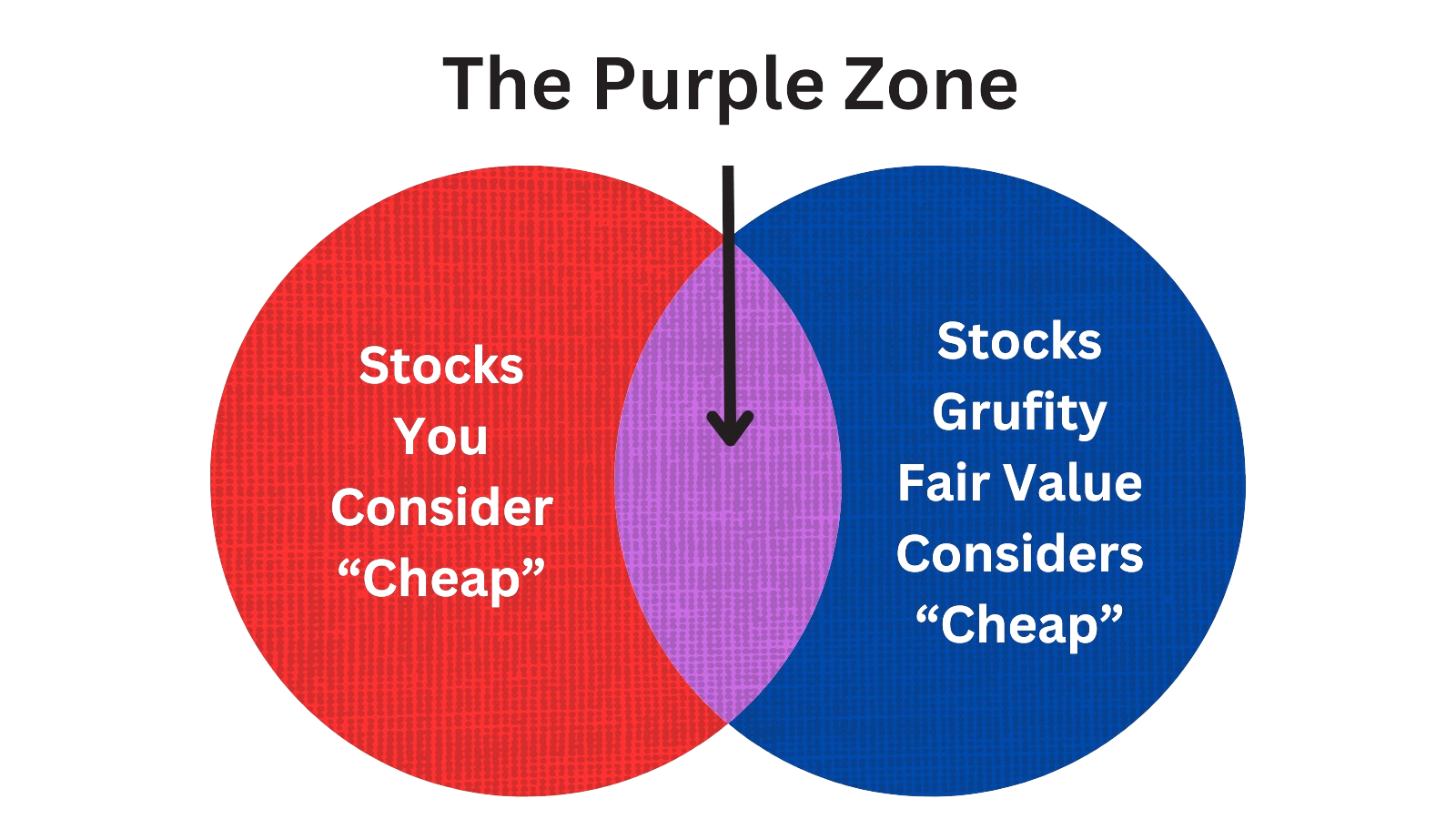

Stocks Marked 'Very Cheap' by Grufity's Fair Value Model Have Outperformed S&P 500 Index

Grufity's Fair Value model takes all the S&P 500 stocks and divides them into separate buckets based on their attractiveness. The 'Very Cheap' bucket of S&P 500 has greatly outperformed S&P 500 Index. Conversely, S&P500 stocks considered 'Very Expensive' by the model underperformed the S&P500 index in the past three years. Grufity Fair Value is available for 2300+ stocks, including 90% of S&P 500 stocks. Grufity's Fair Value Model separates high-return stocks from low-return stocks.

Returns of $10,000 invested in:

Very Cheap Stocks: $17,289

S&P 500 Index: $12,922

Very Expensive Stocks: $11,022

Grufity's Fair Value model does a great job in separating High Performing Stocks from Low Performing ones in the S&P 500 list.

Tracking the Latest Insider Buys and Sells of DENTSPLY SIRONA Inc

Filter Transactions| Datesorted ascending | Name | Buy/Sell | $ Value | Avg. Price | # Shares | Title |

|---|---|---|---|---|---|---|

| Apr 12, 2024 | johnson robert anthony | acquired | - | - | 354 | svp, chief supply chain office |

| Apr 12, 2024 | lucier gregory t | acquired | - | - | 26.426 | - |

| Apr 12, 2024 | frank andreas g | acquired | - | - | 503 | exec vp/chief business officer |

| Apr 12, 2024 | mazelsky jonathan jay | acquired | - | - | 26.426 | - |

| Apr 12, 2024 | campion simon d | acquired | - | - | 1,088 | president, ceo & member of bod |

| Apr 12, 2024 | brandt eric | acquired | - | - | 72.546 | - |

| Apr 12, 2024 | rosenzweig richard c | acquired | - | - | 215 | svp, corp dev, gc & secretary |

| Apr 12, 2024 | coleman glenn | acquired | - | - | 302 | executive vp & cfo |

| Apr 12, 2024 | wagner richard m | acquired | - | - | 41.653 | vp, chief accounting officer |

| Apr 12, 2024 | holden betsy d | acquired | - | - | 129 | - |

Which funds bought or sold XRAY recently?

View All Details| Datesorted ascending | Fund Name | Type | % Chg | $ Change | $ Held | % Portfolio |

|---|---|---|---|---|---|---|

| May 06, 2024 | Savant Capital, LLC | reduced | -3.42 | -126,130 | 1,143,310 | 0.01% |

| May 06, 2024 | Hardman Johnston Global Advisors LLC | added | 8.14 | 186,989 | 22,352,400 | 0.77% |

| May 06, 2024 | DUALITY ADVISERS, LP | new | - | 1,166,330 | 1,166,330 | 0.12% |

| May 06, 2024 | Envestnet Portfolio Solutions, Inc. | added | 6.56 | -2,253 | 356,716 | -% |

| May 06, 2024 | Jefferies Financial Group Inc. | sold off | -100 | -2,045,090 | - | -% |

| May 06, 2024 | TEACHER RETIREMENT SYSTEM OF TEXAS | added | 28.24 | 342,000 | 2,087,000 | 0.01% |

| May 06, 2024 | JOHN G ULLMAN & ASSOCIATES INC | added | 31.69 | 1,053,260 | 5,670,350 | 0.87% |

| May 06, 2024 | Quantbot Technologies LP | added | 121 | 1,321,550 | 2,563,930 | 0.14% |

| May 06, 2024 | SG Americas Securities, LLC | added | 2,959 | 43,986,000 | 45,584,000 | 0.22% |

| May 06, 2024 | Sciencast Management LP | sold off | -100 | -575,882 | - | -% |

Are Funds Buying or Selling XRAY?

XRAY Alerts

Unveiling DENTSPLY SIRONA Inc's Major ShareHolders

| Date Filed | Name of Filer | Percent of Class | No. of Shares | Form Type | |

|---|---|---|---|---|---|

| Feb 13, 2024 | vanguard group inc | 11.89% | 25,187,041 | SC 13G/A | |

| Feb 12, 2024 | artisan partners limited partnership | 6.1% | 12,944,034 | SC 13G/A | |

| Feb 05, 2024 | nuance investments, llc | 5.48% | 11,603,889 | SC 13G/A | |

| Jan 29, 2024 | blackrock inc. | 6.2% | 13,136,945 | SC 13G/A | |

| Feb 13, 2023 | generation investment management llp | 2.21% | 4,747,746 | SC 13G/A | |

| Feb 10, 2023 | artisan partners limited partnership | 6.3% | 13,582,284 | SC 13G/A | |

| Feb 09, 2023 | vanguard group inc | 11.69% | 25,121,756 | SC 13G/A | |

| Feb 08, 2023 | nuance investments, llc | 5.88% | 12,642,319 | SC 13G | |

| Feb 03, 2023 | blackrock inc. | 7.9% | 16,978,584 | SC 13G/A | |

| Mar 09, 2022 | blackrock inc. | 10.9% | 23,745,567 | SC 13G/A |

Recent SEC filings of DENTSPLY SIRONA Inc

View All Filings| Date Filed | Form Type | Document | |

|---|---|---|---|

| May 02, 2024 | 10-Q | Quarterly Report | |

| May 02, 2024 | 8-K | Current Report | |

| Apr 15, 2024 | 4 | Insider Trading | |

| Apr 15, 2024 | 4 | Insider Trading | |

| Apr 15, 2024 | 4 | Insider Trading | |

| Apr 15, 2024 | 4 | Insider Trading | |

| Apr 15, 2024 | 4 | Insider Trading | |

| Apr 15, 2024 | 4 | Insider Trading | |

| Apr 15, 2024 | 4 | Insider Trading | |

| Apr 15, 2024 | 4 | Insider Trading |

- …

Peers (Alternatives to DENTSPLY SIRONA Inc)

| Name | Mkt Capsorted ascending | Revenue | Price %, 1M | Returns, 1Y | P/E | P/S | Rev 1-Yr | Inc 1-Yr |

|---|---|---|---|---|---|---|---|---|

| LARGE-CAP | ||||||||

ABT | 184.5B | 40.3B | -4.60% | -4.35% | 32.81 | 4.58 | -2.84% | -3.08% |

BDX | 68.5B | 19.7B | -3.65% | -5.69% | 51.42 | 3.48 | 4.82% | -17.56% |

ALGN | 21.6B | 3.9B | -9.77% | -6.38% | 46.66 | 5.51 | 5.72% | 46.72% |

BAX | 18.4B | 14.9B | -15.25% | -20.81% | 6.95 | 1.24 | 2.98% | 207.68% |

| MID-CAP | ||||||||

ATR | 9.9B | 3.5B | 5.58% | 23.16% | 31.71 | 2.8 | 6.16% | 35.06% |

HSIC | 9.1B | 12.5B | -1.81% | -10.76% | 23.5 | 0.73 | -0.61% | -18.83% |

BIO | 8.2B | 2.7B | -13.87% | -26.12% | -12.81 | 3.06 | -4.68% | 82.43% |

XRAY | 5.9B | 3.9B | -12.53% | -31.61% | -62.76 | 1.49 | 0.23% | 91.03% |

AXNX | 3.4B | 387.1M | -0.62% | 22.51% | -215.76 | 8.88 | 30.82% | 65.57% |

PDCO | 2.3B | 6.6B | -0.84% | -0.80% | 12.05 | 0.35 | 2.78% | -0.87% |

| SMALL-CAP | ||||||||

AHCO | 1.3B | 3.2B | -6.97% | -19.30% | -1.87 | 0.4 | 7.94% | -1661.78% |

ANIK | 420.5M | 166.7M | 10.85% | 9.31% | -5.09 | 2.52 | 6.67% | -456.34% |

ANGO | 245.9M | 324.0M | -12.80% | -31.58% | -1.28 | 0.76 | -3.19% | -337.41% |

APYX | 48.8M | 52.3M | -6.00% | -59.48% | -2.61 | 0.93 | 17.61% | 19.28% |

AEMD | 3.4M | 3.7M | -25.71% | 271.43% | -0.27 | 0.89 | 5.77% | 8.23% |

DENTSPLY SIRONA Inc News

DENTSPLY SIRONA Inc Earnings Report: Key Takeaways & Analysis

| Income Statement (Quarterly) | (In Millions) | |||||||||||||||||||||

| Description | (%) Q/Q | 2024Q1 | 2023Q4 | 2023Q3 | 2023Q2 | 2023Q1 | 2022Q4 | 2022Q3 | 2022Q2 | 2022Q1 | 2021Q4 | 2021Q3 | 2021Q2 | 2021Q1 | 2020Q4 | 2020Q3 | 2020Q2 | 2020Q1 | 2019Q4 | 2019Q3 | 2019Q2 | 2019Q1 |

| Revenue | -5.8% | 953 | 1,012 | 947 | 1,028 | 978 | 983 | 947 | 1,023 | 969 | 1,103 | 1,040 | 1,062 | 1,026 | 1,076 | 883 | 499 | 881 | 1,112 | 962 | 1,009 | 946 |

| Gross Profit | -3.1% | 506 | 522 | 495 | 550 | 519 | 517 | 508 | 581 | 521 | 604 | 569 | 595 | 579 | 567 | 432 | 182 | 475 | 611 | 514 | 541 | 500 |

| S&GA Expenses | 1.5% | 415 | 409 | 372 | 416 | 416 | 402 | 401 | 410 | 376 | 377 | 395 | 393 | 386 | 373 | 313 | 259 | 357 | 325 | 399 | 431 | 432 |

| R&D Expenses | -2.3% | 42.00 | 43.00 | 46.00 | 49.00 | 46.00 | 43.00 | 41.00 | 45.00 | 45.00 | 49.00 | 39.00 | 43.00 | 40.00 | 38.00 | 29.00 | 20.00 | 36.00 | - | - | - | - |

| EBITDA Margin | 154.2% | 0.02* | 0.01* | 0.00* | -0.26* | -0.25* | -0.22* | -0.18* | 0.15* | 0.16* | 0.17* | 0.17* | 0.16* | 0.12* | - | - | - | - | - | - | - | - |

| Interest Expenses | -21.7% | 18.00 | 23.00 | 18.00 | 21.00 | 19.00 | 24.00 | 14.00 | 15.00 | 12.00 | 18.00 | 14.00 | 15.00 | 14.00 | 14.00 | 14.00 | 11.00 | 7.00 | 7.00 | 7.00 | 8.00 | 8.00 |

| Income Taxes | 193.3% | 14.00 | -15.00 | 16.00 | -39.00 | -5.00 | 23.00 | -164 | 18.00 | 18.00 | 37.00 | 29.00 | 35.00 | 33.00 | 24.00 | 9.00 | -22.00 | 12.00 | 35.00 | 22.00 | 11.00 | 15.00 |

| Earnings Before Taxes | -45.6% | 31.00 | 57.00 | -250 | 46.00 | -28.00 | 8.00 | -1,241 | 91.00 | 87.00 | 156 | 113 | 131 | 145 | 129 | 57.00 | -114 | -122 | 130 | 107 | 48.00 | 54.00 |

| EBT Margin | 33.3% | -0.03* | -0.04* | -0.06* | -0.31* | -0.30* | -0.27* | -0.22* | 0.11* | 0.12* | 0.13* | 0.12* | 0.11* | 0.06* | - | - | - | - | - | - | - | - |

| Net Income | -74.1% | 18.00 | 70.00 | -266 | 85.00 | -23.00 | -15.00 | -1,077 | 73.00 | 69.00 | 119 | 84.00 | 96.00 | 112 | 105 | 47.00 | -91.00 | -134 | 102 | 85.00 | 36.00 | 39.00 |

| Net Income Margin | 30.0% | -0.02* | -0.03* | -0.06* | -0.26* | -0.27* | -0.24* | -0.20* | 0.08* | 0.09* | 0.10* | 0.09* | 0.09* | 0.05* | - | - | - | - | - | - | - | - |

| Free Cashflow | -84.4% | 25.00 | 160 | 134 | 104 | -58.25 | 105 | 109 | 173 | - | 187 | - | - | 27.00 | 242 | 176 | 144 | -40.75 | 269 | - | - | - |

| Balance Sheet | (In Millions) | |||||||||||||||||||||

| Description | (%) Q/Q | 2024Q1 | 2023Q4 | 2023Q3 | 2023Q2 | 2023Q1 | 2022Q4 | 2022Q3 | 2022Q2 | 2022Q1 | 2021Q4 | 2021Q3 | 2021Q2 | 2021Q1 | 2020Q4 | 2020Q3 | 2020Q2 | 2020Q1 | 2019Q4 | 2019Q3 | 2019Q2 | 2019Q1 |

| Assets | -3.4% | 7,123 | 7,370 | 7,201 | 7,650 | 7,673 | 7,643 | 7,522 | 8,948 | 9,172 | 9,239 | 9,289 | 9,378 | 9,137 | 9,350 | 8,896 | 8,604 | 8,058 | 8,603 | 8,367 | 8,575 | 8,605 |

| Current Assets | -3.6% | 1,902 | 1,973 | 1,913 | 1,920 | 1,943 | 1,893 | 1,939 | 1,885 | 1,897 | 1,852 | 1,805 | 1,785 | 1,696 | 1,798 | 2,580 | 2,363 | 1,805 | 2,000 | 1,811 | 1,828 | 1,796 |

| Cash Equivalents | -12.9% | 291 | 334 | 309 | 295 | 318 | 365 | 418 | 362 | 374 | 339 | 281 | 332 | 318 | 438 | 1,272 | 1,109 | 236 | 405 | 226 | 250 | 225 |

| Inventory | -1.8% | 613 | 624 | 651 | 657 | 659 | 627 | 592 | 581 | 553 | 515 | 548 | 539 | 1.00 | 476 | 489 | 549 | 591 | 562 | 605 | 608 | 618 |

| Net PPE | -2.2% | 782 | 800 | 753 | 772 | 770 | 761 | 714 | 744 | 771 | 773 | 771 | 769 | 758 | 791 | 772 | 772 | 777 | 802 | 783 | 820 | 854 |

| Goodwill | -1.6% | 2,400 | 2,438 | 2,374 | 2,703 | 2,701 | 2,688 | 2,584 | 3,858 | 3,944 | 3,976 | 4,000 | 4,033 | 3,952 | 3,986 | 3,283 | 3,227 | 3,192 | 3,397 | 3,356 | 3,413 | 3,399 |

| Liabilities | -5.2% | 3,865 | 4,076 | 3,830 | 3,948 | 4,035 | 3,831 | 3,908 | 4,110 | 4,308 | 4,242 | 4,226 | 4,301 | 4,207 | 4,415 | 4,134 | 3,959 | 3,368 | 3,508 | 3,308 | 3,392 | 3,495 |

| Current Liabilities | -6.7% | 1,330 | 1,425 | 1,218 | 1,271 | 1,374 | 1,170 | 1,296 | 1,241 | 1,372 | 1,261 | 1,199 | 1,251 | 1,212 | 1,372 | 1,178 | 763 | 892 | 995 | 869 | 881 | 871 |

| Long Term Debt | -2.7% | 1,747 | 1,796 | 1,803 | 1,841 | 1,842 | 1,826 | 1,737 | 1,807 | 1,872 | 1,913 | 1,925 | 1,946 | 1,923 | 1,978 | 1,930 | 2,183 | 1,421 | 1,433 | 1,404 | 1,441 | 1,545 |

| LT Debt, Non Current | -100.0% | - | 1,796 | 1,803 | 1,841 | 1,842 | 1,826 | 1,737 | 1,807 | 1,872 | 1,913 | 1,925 | 1,946 | 1,923 | 1,978 | 1,930 | 2,183 | 1,421 | 1,433 | 1,404 | 1,441 | 1,545 |

| Shareholder's Equity | -1.1% | 3,258 | 3,293 | 3,375 | 3,702 | 3,638 | 3,811 | 3,614 | 4,838 | 4,864 | 4,997 | 5,063 | 5,034 | 4,890 | 4,935 | 4,720 | 4,608 | 4,649 | 5,048 | 5,059 | 5,183 | 5,110 |

| Retained Earnings | -7.3% | 190 | 205 | 167 | 463 | 407 | 456 | 498 | 1,602 | 1,556 | 1,514 | 1,419 | 1,402 | 1,328 | 1,198 | 1,156 | 1,125 | 1,242 | 1,404 | 1,324 | 1,262 | 1,245 |

| Additional Paid-In Capital | -0.1% | 6,639 | 6,643 | 6,645 | 6,648 | 6,604 | 6,629 | 6,619 | 6,617 | 6,573 | 6,606 | 6,659 | 6,638 | 6,618 | 6,604 | 6,592 | 6,577 | 6,554 | 6,587 | 6,567 | 6,551 | 6,520 |

| Shares Outstanding | 0.2% | 208 | 207 | 212 | 212 | 213 | 215 | 216 | 216 | 217 | 217 | 219 | 219 | 219 | - | - | - | - | - | - | - | - |

| Minority Interest | -100.0% | - | 1.00 | -4.00 | -4.00 | -3.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 3.00 | 3.00 | 3.00 | 3.00 | 2.00 | 2.00 | 3.00 | 2.00 | 2.00 | 2.00 | 2.00 |

| Float | - | - | - | - | 8,463 | - | - | - | 7,665 | - | - | - | 13,791 | - | - | - | 9,606 | - | - | - | 13,062 | - |

| Cashflow (Quarterly) | (In Millions) | |||||||||||||||||||||

| Description | (%) Q/Q | 2024Q1 | 2023Q4 | 2023Q3 | 2023Q2 | 2023Q1 | 2022Q4 | 2022Q3 | 2022Q2 | 2022Q1 | 2021Q4 | 2021Q3 | 2021Q2 | 2021Q1 | 2020Q4 | 2020Q3 | 2020Q2 | 2020Q1 | 2019Q4 | 2019Q3 | 2019Q2 | 2019Q1 |

| Cashflow From Operations | -84.4% | 25.00 | 160 | 134 | 104 | -21.00 | 142 | 109 | 173 | 93.00 | - | - | - | - | 264 | 221 | 174 | -10.00 | 306 | 159 | 145 | 29.00 |

| Share Based Compensation | -15.4% | 11.00 | 13.00 | 2.00 | 14.00 | 17.00 | 12.00 | 14.00 | 22.00 | 11.00 | -6.00 | 22.00 | 19.00 | 13.00 | 11.00 | 17.00 | 9.00 | 10.00 | 16.00 | 15.00 | 25.00 | 9.00 |

| Cashflow From Investing | -115.0% | -43.00 | -20.00 | -2.00 | -30.00 | -37.00 | -29.00 | -26.00 | -40.00 | -43.00 | - | - | - | - | -1,101 | -25.00 | 36.00 | -16.00 | -29.30 | -15.20 | -11.80 | -12.70 |

| Cashflow From Financing | 89.1% | -14.00 | -128 | -109 | -87.00 | 17.00 | -161 | -6.00 | -152 | -10.00 | - | - | - | -53.00 | -15.00 | -37.00 | 658 | -130 | -101 | -160 | -110 | -99.20 |

| Dividend Payments | -100.0% | - | 30.00 | 29.00 | 30.00 | 27.00 | 26.00 | 27.00 | 27.00 | 24.00 | 24.00 | 24.00 | 22.00 | 22.00 | 22.00 | 22.00 | 22.00 | 22.00 | 22.00 | 20.00 | 20.00 | 20.00 |

| Buy Backs | -100.0% | - | 150 | - | - | 150 | - | - | - | 150 | 110 | - | - | 90.00 | - | - | - | 140 | 100 | 100 | 60.00 | - |

XRAY Income Statement

2024-03-31CONSOLIDATED STATEMENTS OF OPERATIONS - USD ($) shares in Millions, $ in Millions | 3 Months Ended | |

|---|---|---|

Mar. 31, 2024 | Mar. 31, 2023 | |

| Income Statement [Abstract] | ||

| Net sales | $ 953 | $ 978 |

| Cost of products sold | 447 | 459 |

| Gross profit | 506 | 519 |

| Selling, general, and administrative expenses | 415 | 416 |

| Research and development expenses | 42 | 46 |

| Intangible asset impairments | 6 | 0 |

| Restructuring and other costs | 1 | 59 |

| Operating income (loss) | 42 | (2) |

| Other income and expenses: | ||

| Interest expense, net | 18 | 20 |

| Other (income) expense, net | (7) | 6 |

| Income (loss) before income taxes | 31 | (28) |

| Provision (benefit) for income taxes | 14 | (5) |

| Net income (loss) | 17 | (23) |

| Less: Net loss attributable to noncontrolling interest | (1) | (4) |

| Net income (loss) attributable to Dentsply Sirona | $ 18 | $ (19) |

| Net income (loss) per common share attributable to Dentsply Sirona: | ||

| Basic (in dollars per share) | $ 0.09 | $ (0.09) |

| Diluted (in dollars per share) | $ 0.09 | $ (0.09) |

| Weighted average common shares outstanding: | ||

| Basic (in shares) | 207.4 | 214.5 |

| Diluted (in shares) | 208.5 | 214.5 |

XRAY Balance Sheet

2024-03-31CONSOLIDATED BALANCE SHEETS - USD ($) $ in Millions | Mar. 31, 2024 | Dec. 31, 2023 |

|---|---|---|

| Current Assets: | ||

| Cash and cash equivalents | $ 291 | $ 334 |

| Accounts and notes receivable-trade, net | 656 | 695 |

| Inventories, net | 613 | 624 |

| Prepaid expenses and other current assets | 342 | 320 |

| Total Current Assets | 1,902 | 1,973 |

| Property, plant, and equipment, net | 782 | 800 |

| Operating lease right-of-use assets, net | 171 | 178 |

| Identifiable intangible assets, net | 1,618 | 1,705 |

| Goodwill | 2,400 | 2,438 |

| Other noncurrent assets | 250 | 276 |

| Total Assets | 7,123 | 7,370 |

| Current Liabilities: | ||

| Accounts payable | 279 | 305 |

| Accrued liabilities | 681 | 749 |

| Income taxes payable | 27 | 49 |

| Notes payable and current portion of long-term debt | 343 | 322 |

| Total Current Liabilities | 1,330 | 1,425 |

| Long-term debt | 1,747 | 1,796 |

| Operating lease liabilities | 120 | 125 |

| Deferred income taxes | 214 | 228 |

| Other noncurrent liabilities | 454 | 502 |

| Total Liabilities | 3,865 | 4,076 |

| Commitments and contingencies (Note 14) | ||

| Equity: | ||

| Preferred stock, $1.00 par value; 0.25 million shares authorized; no shares issued | 0 | 0 |

| Common stock, $0.01 par value; 400.0 million shares authorized, and 264.5 million shares issued at March 31, 2024 and December 31, 2023, 211.8 million and 215.3 million shares outstanding at March 31, 2024 and December 31, 2023 | 3 | 3 |

| Capital in excess of par value | 6,639 | 6,643 |

| Retained earnings | 190 | 205 |

| Accumulated other comprehensive loss | (666) | (636) |

| Treasury stock, at cost, 56.9 million and 57.3 million shares at March 31, 2024 and December 31, 2023, respectively | (2,908) | (2,922) |

| Total Dentsply Sirona Equity | 3,258 | 3,293 |

| Noncontrolling interests | 0 | 1 |

| Total Equity | 3,258 | 3,294 |

| Total Liabilities and Equity | $ 7,123 | $ 7,370 |

| CEO | Mr. Simon D. Campion |

|---|---|

| WEBSITE | dentsplysirona.com |

| INDUSTRY | Medical Instruments & Supplies |

| EMPLOYEES | 15000 |