Market Summary

EPAM Stock Price

EPAM RSI Chart

EPAM Valuation

EPAM Price/Sales (Trailing)

EPAM Profitability

EPAM Fundamentals

EPAM Revenue

EPAM Earnings

Breaking Down EPAM Revenue

Last 7 days

2.4%

Last 30 days

-24.6%

Last 90 days

-39.8%

Trailing 12 Months

-21.1%

How does EPAM drawdown profile look like?

EPAM Financial Health

EPAM Investor Care

Historical Charts for Stock Metrics

| Year | Q1 | Q2 | Q3 | Q4 |

|---|---|---|---|---|

| 2024 | 4.6B | 0 | 0 | 0 |

| 2023 | 4.9B | 4.8B | 4.8B | 4.7B |

| 2022 | 4.1B | 4.5B | 4.7B | 4.8B |

| 2021 | 2.8B | 3.0B | 3.4B | 3.8B |

| 2020 | 2.4B | 2.5B | 2.6B | 2.7B |

| 2019 | 1.9B | 2.0B | 2.2B | 2.3B |

| 2018 | 1.5B | 1.6B | 1.7B | 1.8B |

| 2017 | 1.2B | 1.3B | 1.4B | 1.5B |

| 2016 | 978.6M | 1.0B | 1.1B | 1.2B |

| 2015 | 769.7M | 812.8M | 856.1M | 914.1M |

| 2014 | 591.3M | 632.8M | 685.4M | 730.0M |

| 2013 | 463.6M | 493.0M | 523.1M | 555.1M |

| 2012 | 356.1M | 379.7M | 403.4M | 433.8M |

| 2011 | 250.0M | 278.2M | 306.4M | 334.5M |

| 2010 | 0 | 0 | 0 | 221.8M |

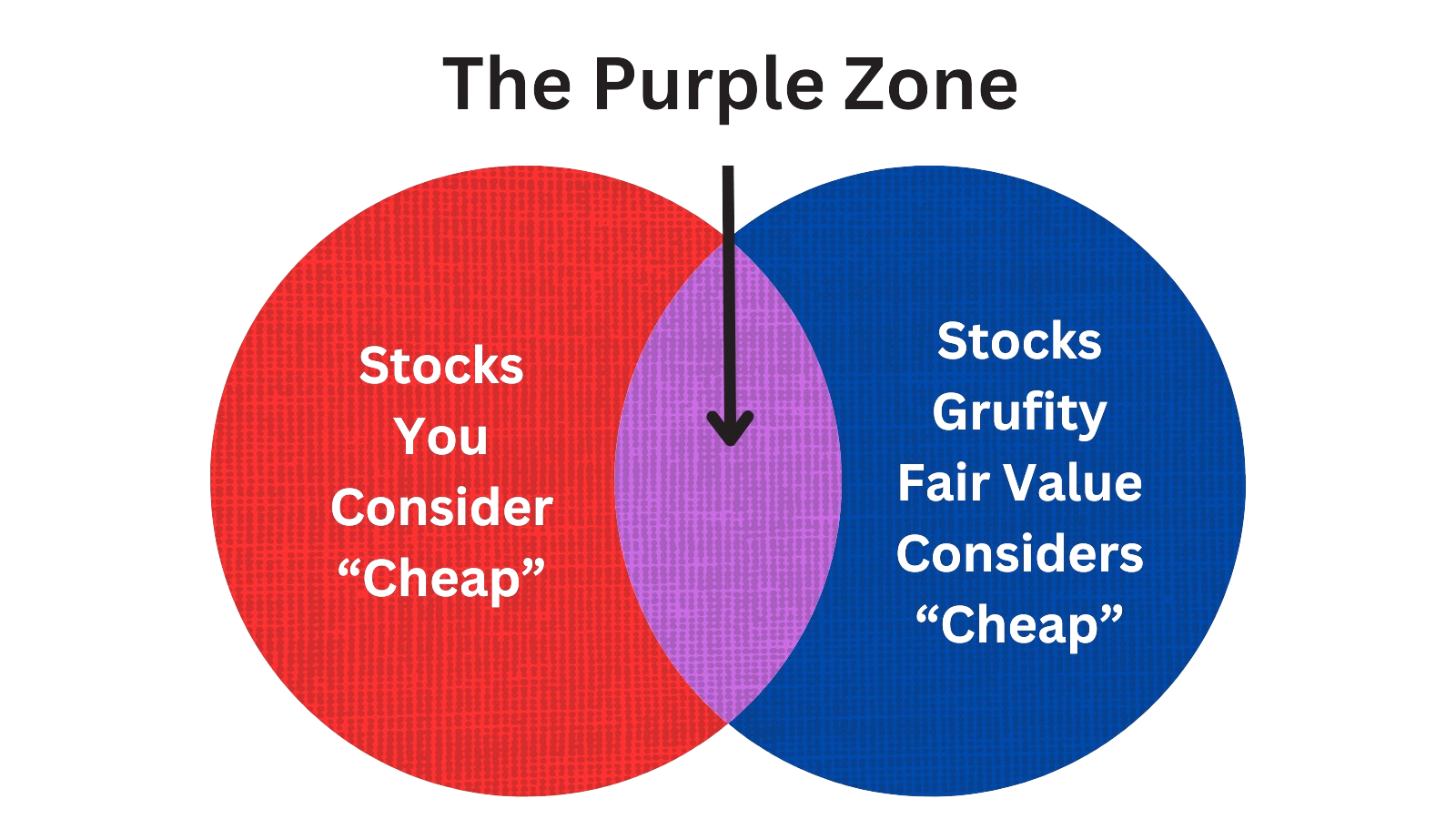

Stocks Marked 'Very Cheap' by Grufity's Fair Value Model Have Outperformed S&P 500 Index

Grufity's Fair Value model takes all the S&P 500 stocks and divides them into separate buckets based on their attractiveness. The 'Very Cheap' bucket of S&P 500 has greatly outperformed S&P 500 Index. Conversely, S&P500 stocks considered 'Very Expensive' by the model underperformed the S&P500 index in the past three years. Grufity Fair Value is available for 2300+ stocks, including 90% of S&P 500 stocks. Grufity's Fair Value Model separates high-return stocks from low-return stocks.

Returns of $10,000 invested in:

Very Cheap Stocks: $17,289

S&P 500 Index: $12,922

Very Expensive Stocks: $11,022

Grufity's Fair Value model does a great job in separating High Performing Stocks from Low Performing ones in the S&P 500 list.

Tracking the Latest Insider Buys and Sells of EPAM Systems Inc

Filter Transactions| Datesorted ascending | Name | Buy/Sell | $ Value | Avg. Price | # Shares | Title |

|---|---|---|---|---|---|---|

| Mar 31, 2024 | shnayder boris | acquired | - | - | 1,343 | svp/co-head of global business |

| Mar 27, 2024 | rockwell edward | sold (taxes) | -18,519 | 268 | -69.00 | svp/general counsel |

| Mar 27, 2024 | abrahams gary c | sold (taxes) | -8,857 | 268 | -33.00 | vp, corporate controller, pao |

| Mar 27, 2024 | solomon lawrence f | sold (taxes) | -80,520 | 268 | -300 | svp & chief people officer |

| Mar 27, 2024 | fejes balazs | sold (taxes) | -81,056 | 268 | -302 | evp/co-head of global business |

| Mar 27, 2024 | shnayder boris | sold (taxes) | -31,671 | 268 | -118 | svp/co-head of global business |

| Mar 27, 2024 | dvorkin viktar | sold (taxes) | -44,017 | 268 | -164 | svp/head of global delivery |

| Mar 27, 2024 | peterson jason d. | sold (taxes) | -88,035 | 268 | -328 | chief financial officer |

| Mar 27, 2024 | shekhter elaina | sold (taxes) | -31,671 | 268 | -118 | svp, chief marketing officer |

| Mar 27, 2024 | yezhkov sergey | sold (taxes) | -57,706 | 268 | -215 | svp/co-head of global business |

Which funds bought or sold EPAM recently?

View All Details| Datesorted ascending | Fund Name | Type | % Chg | $ Change | $ Held | % Portfolio |

|---|---|---|---|---|---|---|

| May 17, 2024 | New Covenant Trust Company, N.A. | new | - | 14,360 | 14,360 | 0.01% |

| May 16, 2024 | Tidal Investments LLC | added | 17.17 | 70,892 | 874,602 | 0.01% |

| May 16, 2024 | Motley Fool Asset Management LLC | added | 5.24 | -7,155 | 310,404 | 0.02% |

| May 16, 2024 | CALIFORNIA STATE TEACHERS RETIREMENT SYSTEM | added | 1.4 | -1,564,080 | 25,278,600 | 0.03% |

| May 16, 2024 | COMERICA BANK | added | 3.07 | -118,011 | 2,649,140 | 0.01% |

| May 16, 2024 | JANE STREET GROUP, LLC | added | 24.22 | 927,266 | 6,960,890 | -% |

| May 16, 2024 | SkyView Investment Advisors, LLC | new | - | 544,000 | 544,000 | 0.10% |

| May 16, 2024 | Semmax Financial Advisors Inc. | sold off | -100 | -34,084 | - | -% |

| May 15, 2024 | GTS SECURITIES LLC | reduced | -65.25 | -1,416,560 | 674,935 | -% |

| May 15, 2024 | BRITISH COLUMBIA INVESTMENT MANAGEMENT Corp | added | 21.31 | 10,026,200 | 89,190,300 | 0.62% |

Are Funds Buying or Selling EPAM?

Unveiling EPAM Systems Inc's Major ShareHolders

| Date Filed | Name of Filer | Percent of Class | No. of Shares | Form Type | |

|---|---|---|---|---|---|

| Feb 14, 2024 | alliancebernstein l.p. | 1.6% | 928,374 | SC 13G/A | |

| Feb 13, 2024 | vanguard group inc | 11.83% | 6,825,589 | SC 13G/A | |

| Feb 09, 2024 | capital research global investors | 13.3% | 7,698,930 | SC 13G/A | |

| Jan 30, 2024 | wcm investment management, llc | 4.3% | 2,502,390 | SC 13G/A | |

| Jan 25, 2024 | blackrock inc. | 8.2% | 4,722,559 | SC 13G/A | |

| Feb 14, 2023 | alliancebernstein l.p. | 6.1% | 3,489,287 | SC 13G | |

| Feb 13, 2023 | capital research global investors | 11.9% | 6,840,778 | SC 13G/A | |

| Feb 10, 2023 | wcm investment management, llc | 5.9% | 3,414,098 | SC 13G/A | |

| Feb 09, 2023 | vanguard group inc | 11.29% | 6,493,769 | SC 13G/A | |

| Feb 01, 2023 | blackrock inc. | 7.0% | 4,005,541 | SC 13G/A |

Recent SEC filings of EPAM Systems Inc

View All Filings| Date Filed | Form Type | Document | |

|---|---|---|---|

| May 17, 2024 | DEFA14A | DEFA14A | |

| May 09, 2024 | 10-Q | Quarterly Report | |

| May 09, 2024 | 8-K | Current Report | |

| Apr 16, 2024 | DEF 14A | DEF 14A | |

| Apr 02, 2024 | 4 | Insider Trading | |

| Mar 28, 2024 | 4 | Insider Trading | |

| Mar 28, 2024 | 4 | Insider Trading | |

| Mar 28, 2024 | 4 | Insider Trading | |

| Mar 28, 2024 | 4 | Insider Trading | |

| Mar 28, 2024 | 4 | Insider Trading |

Peers (Alternatives to EPAM Systems Inc)

| Name | Mkt Capsorted ascending | Revenue | Price %, 1M | Returns, 1Y | P/E | P/S | Rev 1-Yr | Inc 1-Yr |

|---|---|---|---|---|---|---|---|---|

| LARGE-CAP | ||||||||

ACN | 191.1B | 64.6B | -3.43% | 5.66% | 27.17 | 2.96 | 2.26% | 1.32% |

IBM | 155.0B | 62.1B | -7.68% | 33.99% | 18.95 | 2.5 | 2.45% | 346.26% |

CTSH | 34.2B | 19.3B | 1.82% | 8.09% | 16.34 | 1.77 | -0.58% | -9.32% |

CDW | 30.1B | 21.1B | -5.54% | 28.00% | 27.57 | 1.42 | -7.67% | -0.37% |

BR | 24.0B | 6.4B | 5.16% | 31.93% | 34.39 | 3.76 | 7.68% | 26.07% |

| MID-CAP | ||||||||

CACI | 9.5B | 7.3B | 17.76% | 40.72% | 24.22 | 1.3 | 10.28% | 6.24% |

EXLS | 5.1B | 1.7B | 6.05% | 0.91% | 27.84 | 3.04 | 12.34% | 15.10% |

ASGN | 4.6B | 4.4B | 6.73% | 49.39% | 22.32 | 1.06 | -5.37% | -17.11% |

DXC | 3.0B | 13.7B | -16.57% | -30.75% | 32.46 | 0.22 | -5.29% | 116.02% |

XRX | 1.7B | 6.7B | -13.84% | -4.58% | -9.47 | 0.26 | -6.72% | 6.15% |

| SMALL-CAP | ||||||||

CTG | 1.7B | 302.0M | 13.51% | 1525.39% | 2.8K | 4.93 | -16.01% | -96.16% |

GDYN | 782.8M | 312.6M | 0.29% | 24.76% | 346.84 | 2.5 | -2.04% | 106.54% |

CNDT | 779.5M | 3.7B | 26.16% | 6.72% | -2.63 | 0.21 | -2.41% | -62.64% |

DMRC | 538.6M | 36.9M | 11.26% | -16.91% | -12.75 | 14.58 | 20.62% | 24.62% |

CSPI | 140.7M | 62.1M | -11.69% | 31.99% | 25.89 | 2.27 | 0.80% | 60.81% |

EPAM Systems Inc News

EPAM Systems Inc Earnings Report: Key Takeaways & Analysis

| Income Statement (Quarterly) | (In Millions) | |||||||||||||||||||||

| Description | (%) Q/Q | 2024Q1 | 2023Q4 | 2023Q3 | 2023Q2 | 2023Q1 | 2022Q4 | 2022Q3 | 2022Q2 | 2022Q1 | 2021Q4 | 2021Q3 | 2021Q2 | 2021Q1 | 2020Q4 | 2020Q3 | 2020Q2 | 2020Q1 | 2019Q4 | 2019Q3 | 2019Q2 | 2019Q1 |

| Revenue | 0.7% | 1,165 | 1,157 | 1,152 | 1,170 | 1,211 | 1,231 | 1,227 | 1,195 | 1,172 | 1,107 | 989 | 881 | 781 | 723 | 652 | 632 | 651 | 633 | 588 | 552 | 521 |

| Cost Of Revenue | 4.6% | 834 | 798 | 794 | 809 | 856 | 833 | 827 | 846 | 781 | 727 | 653 | 584 | 519 | 466 | 423 | 420 | 424 | 410 | 378 | 356 | 345 |

| S&GA Expenses | -7.3% | 198 | 214 | 195 | 194 | 212 | 205 | 198 | 233 | 237 | 191 | 169 | 152 | 136 | 129 | 117 | 114 | 125 | 125 | 119 | 112 | 102 |

| EBITDA Margin | 0.3% | 0.14* | 0.13* | 0.15* | 0.16* | 0.13* | 0.12* | 0.12* | 0.11* | 0.15* | 0.16* | 0.16* | 0.17* | - | - | - | - | - | - | - | - | - |

| Income Taxes | -75.2% | 7.00 | 30.00 | 35.00 | 30.00 | 25.00 | 46.00 | 35.00 | -9.95 | 17.00 | 18.00 | 20.00 | 8.00 | 6.00 | 16.00 | 15.00 | 9.00 | 11.00 | 10.00 | 13.00 | 12.00 | 3.00 |

| Earnings Before Taxes | -2.9% | 124 | 127 | 132 | 150 | 127 | 201 | 191 | 9.00 | 106 | 160 | 135 | 123 | 115 | 102 | 104 | 76.00 | 96.00 | 85.00 | 80.00 | 71.00 | 64.00 |

| EBT Margin | 0.3% | 0.11* | 0.11* | 0.13* | 0.14* | 0.11* | 0.11* | 0.10* | 0.09* | 0.13* | 0.14* | 0.14* | 0.15* | - | - | - | - | - | - | - | - | - |

| Net Income | 19.2% | 116 | 98.00 | 97.00 | 120 | 102 | 155 | 156 | 19.00 | 90.00 | 142 | 116 | 115 | 109 | 86.00 | 89.00 | 67.00 | 86.00 | 75.00 | 67.00 | 59.00 | 61.00 |

| Net Income Margin | 4.4% | 0.09* | 0.09* | 0.10* | 0.11* | 0.09* | 0.09* | 0.09* | 0.08* | 0.11* | 0.13* | 0.13* | 0.13* | - | - | - | - | - | - | - | - | - |

| Free Cashflow | -23.7% | 123 | 161 | 211 | 82.00 | 79.00 | 165 | 234 | 59.00 | -75.12 | 228 | 185 | 46.00 | - | - | - | - | - | - | - | - | - |

| Balance Sheet | (In Millions) | |||||||||||||||||||||

| Description | (%) Q/Q | 2024Q1 | 2023Q4 | 2023Q3 | 2023Q2 | 2023Q1 | 2022Q4 | 2022Q3 | 2022Q2 | 2022Q1 | 2021Q4 | 2021Q3 | 2021Q2 | 2021Q1 | 2020Q4 | 2020Q3 | 2020Q2 | 2020Q1 | 2019Q4 | 2019Q3 | 2019Q2 | 2019Q1 |

| Assets | 0.5% | 4,375 | 4,352 | 4,162 | 4,094 | 4,071 | 4,009 | 3,736 | 3,564 | 3,508 | 3,523 | 3,242 | 2,962 | 2,781 | 2,721 | 2,555 | 2,389 | 2,312 | 2,244 | 2,040 | 1,931 | 1,831 |

| Current Assets | -0.3% | 3,083 | 3,091 | 2,925 | 2,872 | 2,831 | 2,760 | 2,528 | 2,360 | 2,267 | 2,269 | 2,092 | 2,038 | 2,005 | 1,913 | 1,752 | 1,598 | 1,508 | 1,474 | 1,365 | 1,286 | 1,245 |

| Cash Equivalents | -2.3% | 1,990 | 2,036 | 1,873 | 1,777 | 1,749 | 1,681 | 1,490 | 1,296 | 1,308 | 1,447 | 1,426 | 1,285 | 1,374 | 1,324 | 1,162 | 995 | 917 | 938 | 854 | 779 | 764 |

| Net PPE | -5.4% | 222 | 235 | 240 | 256 | 267 | 273 | 210 | 211 | 220 | 236 | 177 | 174 | 165 | 170 | 164 | 167 | 165 | 165 | 115 | 111 | 106 |

| Goodwill | 5.8% | 595 | 562 | 548 | 534 | 534 | 529 | 506 | 521 | 534 | 531 | 387 | 335 | 125 | 212 | 208 | 199 | 199 | 195 | 186 | 179 | 168 |

| Liabilities | 2.0% | 899 | 881 | 862 | 830 | 941 | 1,006 | 977 | 940 | 954 | 1,027 | 903 | 749 | 717 | 738 | 695 | 636 | 664 | 648 | 548 | 509 | 493 |

| Current Liabilities | 2.1% | 659 | 645 | 614 | 584 | 683 | 747 | 728 | 685 | 683 | 763 | 633 | 523 | 464 | 466 | 415 | 366 | 389 | 387 | 311 | 273 | 283 |

| Short Term Borrowings | - | - | - | - | - | - | 3.00 | 8.00 | 7.00 | 10.00 | 16.00 | - | 25.00 | - | - | - | - | - | - | - | - | - |

| Long Term Debt | -1.3% | 26.00 | 26.00 | 28.00 | 26.00 | 28.00 | 28.00 | 28.00 | 30.00 | 31.00 | 30.00 | 25.00 | 0.00 | 25.00 | 25.00 | 25.00 | 25.00 | 25.00 | 25.00 | 25.00 | 25.00 | 25.00 |

| LT Debt, Non Current | -100.0% | - | 26.00 | 28.00 | 26.00 | 28.00 | 28.00 | 28.00 | 30.00 | 31.00 | 30.00 | 25.00 | 0.00 | 25.00 | 25.00 | 25.00 | 25.00 | - | 25.00 | - | - | - |

| Shareholder's Equity | 0.1% | 3,476 | 3,471 | 3,299 | 3,263 | 3,130 | 3,002 | 2,759 | 2,624 | 2,554 | 2,496 | 2,339 | 2,213 | 2,064 | 1,983 | 1,860 | 1,753 | 1,647 | 1,596 | 1,492 | 1,422 | 1,338 |

| Additional Paid-In Capital | 3.1% | 1,040 | 1,009 | 951 | 914 | 864 | 848 | 802 | 761 | 719 | 712 | 694 | 670 | 648 | 661 | 649 | 631 | 611 | 607 | 590 | 575 | 554 |

| Shares Outstanding | 0.3% | 58.00 | 58.00 | 58.00 | 58.00 | 58.00 | 58.00 | 57.00 | 57.00 | 57.00 | 57.00 | 57.00 | 56.00 | - | - | - | - | - | - | - | - | - |

| Minority Interest | -0.7% | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 2.00 | 2.00 | 9.00 | - | - | - | - | - | - | - | - | - | - | - |

| Float | - | - | - | - | 12,607 | - | - | - | 16,370 | - | - | - | 27,964 | - | - | - | 13,560 | - | - | - | 9,127 | - |

| Cashflow (Quarterly) | (In Thousands) | |||||||||||||||||||||

| Description | (%) Q/Q | 2024Q1 | 2023Q4 | 2023Q3 | 2023Q2 | 2023Q1 | 2022Q4 | 2022Q3 | 2022Q2 | 2022Q1 | 2021Q4 | 2021Q3 | 2021Q2 | 2021Q1 | 2020Q4 | 2020Q3 | 2020Q2 | 2020Q1 | 2019Q4 | 2019Q3 | 2019Q2 | 2019Q1 |

| Cashflow From Operations | -24.2% | 129,920 | 171,369 | 214,879 | 89,052 | 87,334 | 186,069 | 252,368 | 77,515 | -51,848 | 284,614 | 206,050 | 68,836 | 12,827 | 159,432 | 175,564 | 146,156 | 63,255 | 124,587 | 119,039 | 44,029 | -202 |

| Share Based Compensation | 17.3% | 44,791 | 38,194 | 37,847 | 33,110 | 38,579 | 31,617 | 33,287 | 27,893 | 7,112 | 34,017 | 29,187 | 23,898 | 24,553 | 20,444 | 23,474 | 19,439 | 11,881 | 19,012 | 15,471 | 15,697 | 21,856 |

| Cashflow From Investing | -146.4% | -50,990 | -20,697 | -10,561 | -17,793 | -17,717 | -31,139 | -28,700 | -88,525 | -34,563 | -210,432 | -61,102 | -145,851 | 48,461 | -17,907 | -15,676 | -74,086 | -59,485 | -57,787 | -40,137 | -28,885 | -18,560 |

| Cashflow From Financing | -401.3% | -112,081 | -22,356 | -80,586 | -47,513 | -15,318 | 8,045 | 568 | -1,030 | -9,604 | -45,059 | 4,498 | -20,325 | 1,329 | 318 | 5,565 | -4,602 | -2,046 | 7,216 | 4,939 | -1,973 | 10,181 |

| Buy Backs | 230.5% | 120,593 | 36,491 | 78,487 | 41,437 | 8,510 | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - |

EPAM Income Statement

2024-03-31CONDENSED CONSOLIDATED STATEMENTS OF INCOME - USD ($) shares in Thousands, $ in Thousands | 3 Months Ended | |

|---|---|---|

Mar. 31, 2024 | Mar. 31, 2023 | |

| Income Statement [Abstract] | ||

| Revenues | $ 1,165,465 | $ 1,210,941 |

| Operating expenses: | ||

| Cost of revenues (exclusive of depreciation and amortization) | 834,334 | 855,901 |

| Selling, general and administrative expenses | 198,453 | 211,887 |

| Depreciation and amortization expense | 22,146 | 22,782 |

| Income from operations | 110,532 | 120,371 |

| Interest and other income, net | 15,042 | 11,521 |

| Foreign exchange loss | (1,919) | (4,608) |

| Income before provision for income taxes | 123,655 | 127,284 |

| Provision for income taxes | 7,412 | 24,992 |

| Net income | $ 116,243 | $ 102,292 |

| Net income per share: | ||

| Basic (in usd per share) | $ 2.01 | $ 1.77 |

| Diluted (in usd per share) | $ 1.97 | $ 1.73 |

| Shares used in calculation of net income per share: | ||

| Basic (in shares) | 57,837 | 57,702 |

| Diluted (in shares) | 58,931 | 59,298 |

EPAM Balance Sheet

2024-03-31CONDENSED CONSOLIDATED BALANCE SHEETS - USD ($) $ in Thousands | Mar. 31, 2024 | Dec. 31, 2023 |

|---|---|---|

| Current assets | ||

| Cash and cash equivalents | $ 1,983,721 | $ 2,036,235 |

| Trade receivables and contract assets, net of allowance of $8,403 and $11,864, respectively | 931,409 | 897,032 |

| Short-term investments | 61,625 | 60,739 |

| Prepaid and other current assets | 106,398 | 97,355 |

| Total current assets | 3,083,153 | 3,091,361 |

| Property and equipment, net | 222,244 | 235,053 |

| Operating lease right-of-use assets, net | 135,754 | 134,898 |

| Intangible assets, net | 80,756 | 71,118 |

| Goodwill | 595,220 | 562,459 |

| Deferred tax assets | 197,474 | 197,901 |

| Other noncurrent assets | 59,976 | 59,575 |

| Total assets | 4,374,577 | 4,352,365 |

| Current liabilities | ||

| Accounts payable | 27,247 | 31,992 |

| Accrued compensation and benefits expenses | 438,216 | 412,747 |

| Accrued expenses and other current liabilities | 122,900 | 124,823 |

| Income taxes payable, current | 33,962 | 38,812 |

| Operating lease liabilities, current | 36,205 | 36,558 |

| Total current liabilities | 658,530 | 644,932 |

| Long-term debt | 25,787 | 26,126 |

| Operating lease liabilities, noncurrent | 110,368 | 109,261 |

| Other noncurrent liabilities | 104,207 | 100,576 |

| Total liabilities | 898,892 | 880,895 |

| Commitments and contingencies (Note 14) | ||

| Stockholders’ equity | ||

| Common stock, $0.001 par value; 160,000 shares authorized; 57,933 shares issued and outstanding at March 31, 2024, and 57,787 shares issued and outstanding at December 31, 2023 | 58 | 58 |

| Additional paid-in capital | 1,039,647 | 1,008,766 |

| Retained earnings | 2,496,757 | 2,501,107 |

| Accumulated other comprehensive loss | (61,352) | (39,040) |

| Total EPAM Systems, Inc. stockholders’ equity | 3,475,110 | 3,470,891 |

| Noncontrolling interest in consolidated subsidiaries | 575 | 579 |

| Total equity | 3,475,685 | 3,471,470 |

| Total liabilities and equity | $ 4,374,577 | $ 4,352,365 |

| CEO | Mr. Arkadiy Dobkin |

|---|---|

| WEBSITE | epam.com |

| INDUSTRY | IT Services |

| EMPLOYEES | 59300 |