Market Summary

ISRG Stock Price

ISRG RSI Chart

ISRG Valuation

ISRG Price/Sales (Trailing)

ISRG Profitability

ISRG Fundamentals

ISRG Revenue

ISRG Earnings

Breaking Down ISRG Revenue

52 Week Range

Last 7 days

4.8%

Last 30 days

0.0%

Last 90 days

-0.7%

Trailing 12 Months

28.2%

How does ISRG drawdown profile look like?

ISRG Financial Health

ISRG Investor Care

Historical Charts for Stock Metrics

| Year | Q1 | Q2 | Q3 | Q4 |

|---|---|---|---|---|

| 2024 | 7.3B | 0 | 0 | 0 |

| 2023 | 6.4B | 6.7B | 6.9B | 7.1B |

| 2022 | 5.9B | 6.0B | 6.1B | 6.2B |

| 2021 | 4.6B | 5.2B | 5.5B | 5.7B |

| 2020 | 4.6B | 4.4B | 4.3B | 4.4B |

| 2019 | 3.9B | 4.0B | 4.2B | 4.5B |

| 2018 | 3.3B | 3.5B | 3.6B | 3.7B |

| 2017 | 2.8B | 2.9B | 3.0B | 3.1B |

| 2016 | 2.4B | 2.5B | 2.6B | 2.7B |

| 2015 | 2.2B | 2.3B | 2.3B | 2.4B |

| 2014 | 2.1B | 2.1B | 2.1B | 2.1B |

| 2013 | 2.3B | 2.3B | 2.3B | 2.3B |

| 2012 | 1.9B | 2.0B | 2.1B | 2.2B |

| 2011 | 1.5B | 1.5B | 1.6B | 1.8B |

| 2010 | 1.2B | 1.3B | 1.3B | 1.4B |

| 2009 | 875.1M | 916.5M | 960.6M | 1.1B |

| 2008 | 0 | 692.2M | 783.5M | 874.9M |

| 2007 | 0 | 0 | 0 | 600.8M |

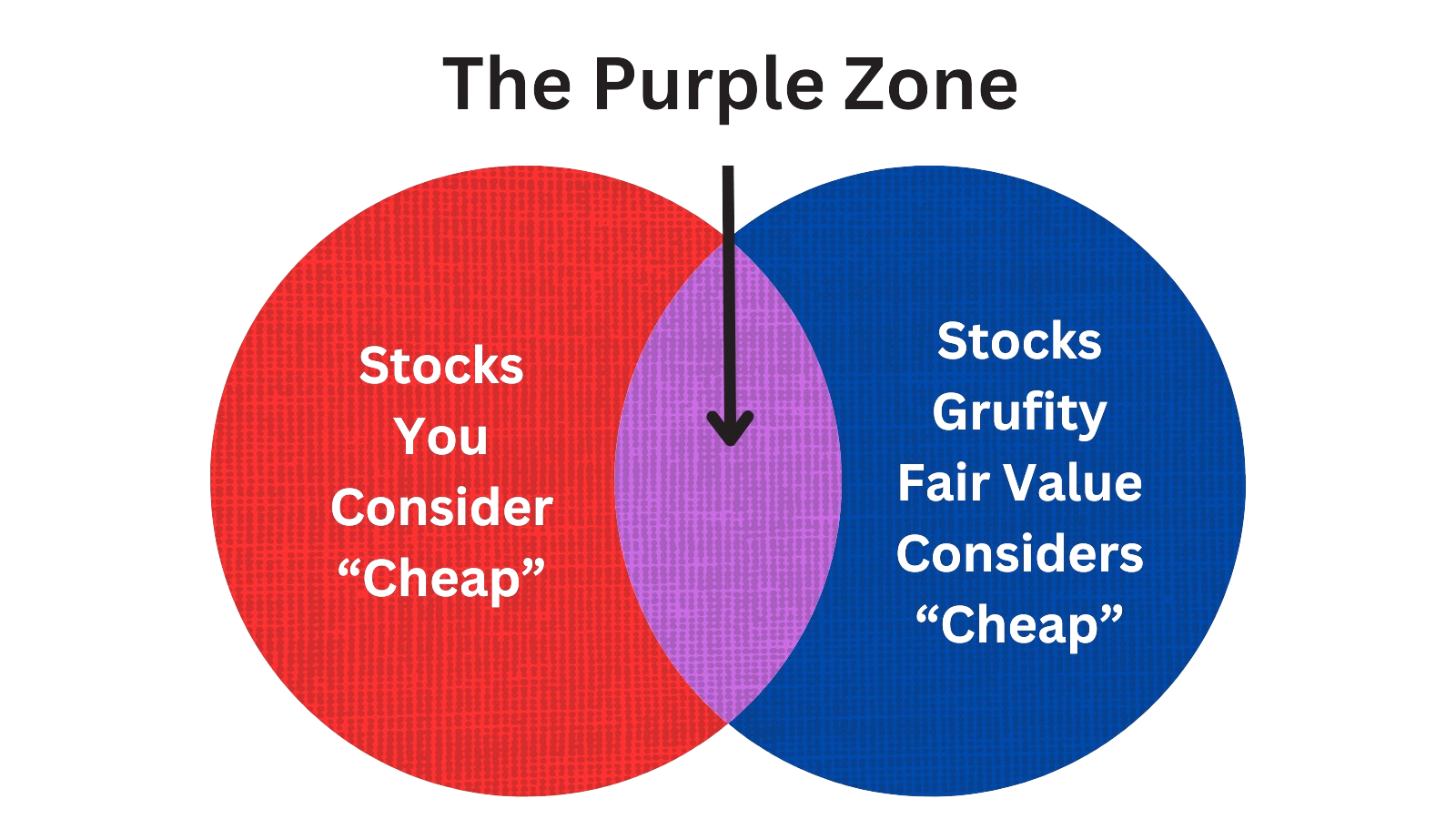

Stocks Marked 'Very Cheap' by Grufity's Fair Value Model Have Outperformed S&P 500 Index

Grufity's Fair Value model takes all the S&P 500 stocks and divides them into separate buckets based on their attractiveness. The 'Very Cheap' bucket of S&P 500 has greatly outperformed S&P 500 Index. Conversely, S&P500 stocks considered 'Very Expensive' by the model underperformed the S&P500 index in the past three years. Grufity Fair Value is available for 2300+ stocks, including 90% of S&P 500 stocks. Grufity's Fair Value Model separates high-return stocks from low-return stocks.

Returns of $10,000 invested in:

Very Cheap Stocks: $17,289

S&P 500 Index: $12,922

Very Expensive Stocks: $11,022

Grufity's Fair Value model does a great job in separating High Performing Stocks from Low Performing ones in the S&P 500 list.

Tracking the Latest Insider Buys and Sells of Intuitive Surgical Inc

Filter Transactions| Datesorted ascending | Name | Buy/Sell | $ Value | Avg. Price | # Shares | Title |

|---|---|---|---|---|---|---|

| May 03, 2024 | rubash mark j | sold | -649,420 | 380 | -1,709 | - |

| May 03, 2024 | rubash mark j | acquired | 505,727 | 295 | 1,709 | - |

| Apr 29, 2024 | desantis robert | acquired | 93,855 | 249 | 376 | evp & chief strategy & corp op |

| Apr 29, 2024 | desantis robert | sold | -70,573 | 375 | -188 | evp & chief strategy & corp op |

| Apr 26, 2024 | desantis robert | acquired | 408,950 | 272 | 1,498 | evp & chief strategy & corp op |

| Apr 26, 2024 | desantis robert | sold | -440,771 | 370 | -1,190 | evp & chief strategy & corp op |

| Apr 25, 2024 | reed monica p | acquired | - | - | 569 | - |

| Apr 25, 2024 | beery joseph c | acquired | - | - | 569 | - |

| Apr 25, 2024 | nachtsheim jami k | acquired | - | - | 569 | - |

| Apr 25, 2024 | rubash mark j | acquired | - | - | 569 | - |

Which funds bought or sold ISRG recently?

View All Details| Datesorted ascending | Fund Name | Type | % Chg | $ Change | $ Held | % Portfolio |

|---|---|---|---|---|---|---|

| May 06, 2024 | First Business Financial Services, Inc. | unchanged | - | - | 504,353 | 0.06% |

| May 06, 2024 | Metis Global Partners, LLC | added | 0.2 | 967,335 | 6,186,300 | 0.22% |

| May 06, 2024 | Kades & Cheifetz LLC | reduced | -1.76 | 37,249 | 266,991 | 0.17% |

| May 06, 2024 | Candriam S.C.A. | reduced | -16.65 | -1,455,010 | 102,593,000 | 0.66% |

| May 06, 2024 | Quantbot Technologies LP | sold off | -100 | -730,722 | - | -% |

| May 06, 2024 | IFG Advisory, LLC | sold off | -100 | -331,286 | - | -% |

| May 06, 2024 | Diligent Investors, LLC | added | 22.39 | 337,388 | 1,090,710 | 0.27% |

| May 06, 2024 | Pinnacle Wealth Management, LLC | reduced | -1.48 | 425,903 | 2,999,960 | 3.13% |

| May 06, 2024 | Wealthspire Advisors, LLC | reduced | -18.03 | -12,876 | 411,861 | -% |

| May 06, 2024 | Valmark Advisers, Inc. | added | 3.14 | 61,489 | 340,823 | 0.01% |

Are Funds Buying or Selling ISRG?

Unveiling Intuitive Surgical Inc's Major ShareHolders

| Date Filed | Name of Filer | Percent of Class | No. of Shares | Form Type | |

|---|---|---|---|---|---|

| Feb 14, 2024 | price t rowe associates inc /md/ | 4.8% | 16,990,447 | SC 13G/A | |

| Feb 13, 2024 | vanguard group inc | 8.63% | 30,375,212 | SC 13G/A | |

| Jan 25, 2024 | blackrock inc. | 8.4% | 29,575,972 | SC 13G/A | |

| Feb 14, 2023 | price t rowe associates inc /md/ | 5.9% | 20,823,995 | SC 13G/A | |

| Feb 09, 2023 | vanguard group inc | 8.33% | 29,425,186 | SC 13G/A | |

| Feb 03, 2023 | blackrock inc. | 8.0% | 28,447,145 | SC 13G/A | |

| Feb 14, 2022 | price t rowe associates inc /md/ | 6.9% | 24,756,021 | SC 13G/A | |

| Feb 07, 2022 | blackrock inc. | 7.4% | 26,538,660 | SC 13G/A | |

| Feb 16, 2021 | price t rowe associates inc /md/ | 8.1% | 9,599,898 | SC 13G/A | |

| Feb 10, 2021 | vanguard group inc | 7.76% | 9,127,891 | SC 13G/A |

Recent SEC filings of Intuitive Surgical Inc

View All Filings| Date Filed | Form Type | Document | |

|---|---|---|---|

| May 07, 2024 | 144 | Notice of Insider Sale Intent | |

| May 06, 2024 | 4 | Insider Trading | |

| May 03, 2024 | 144 | Notice of Insider Sale Intent | |

| Apr 30, 2024 | 8-K | Current Report | |

| Apr 30, 2024 | 4 | Insider Trading | |

| Apr 29, 2024 | 4 | Insider Trading | |

| Apr 29, 2024 | 144 | Notice of Insider Sale Intent | |

| Apr 26, 2024 | 4 | Insider Trading | |

| Apr 26, 2024 | 4 | Insider Trading | |

| Apr 26, 2024 | 4 | Insider Trading |

- …

Peers (Alternatives to Intuitive Surgical Inc)

| Name | Mkt Capsorted ascending | Revenue | Price %, 1M | Returns, 1Y | P/E | P/S | Rev 1-Yr | Inc 1-Yr |

|---|---|---|---|---|---|---|---|---|

| LARGE-CAP | ||||||||

ABT | 184.5B | 40.3B | -4.60% | -4.35% | 32.81 | 4.58 | -2.84% | -3.08% |

BDX | 68.5B | 19.7B | -3.65% | -5.69% | 51.42 | 3.48 | 4.82% | -17.56% |

ALGN | 21.6B | 3.9B | -9.77% | -6.38% | 46.66 | 5.51 | 5.72% | 46.72% |

BAX | 18.4B | 14.9B | -15.25% | -20.81% | 6.95 | 1.24 | 2.98% | 207.68% |

| MID-CAP | ||||||||

ATR | 9.9B | 3.5B | 5.58% | 23.16% | 31.71 | 2.8 | 6.16% | 35.06% |

HSIC | 9.1B | 12.5B | -1.81% | -10.76% | 23.5 | 0.73 | -0.61% | -18.83% |

BIO | 8.2B | 2.7B | -13.87% | -26.12% | -12.81 | 3.06 | -4.68% | 82.43% |

XRAY | 5.9B | 3.9B | -12.53% | -31.61% | -62.76 | 1.49 | 0.23% | 91.03% |

AXNX | 3.4B | 387.1M | -0.62% | 22.51% | -215.76 | 8.88 | 30.82% | 65.57% |

PDCO | 2.3B | 6.6B | -0.84% | -0.80% | 12.05 | 0.35 | 2.78% | -0.87% |

| SMALL-CAP | ||||||||

AHCO | 1.3B | 3.2B | -6.97% | -19.30% | -1.87 | 0.4 | 7.94% | -1661.78% |

ANIK | 420.5M | 166.7M | 10.85% | 9.31% | -5.09 | 2.52 | 6.67% | -456.34% |

ANGO | 245.9M | 324.0M | -12.80% | -31.58% | -1.28 | 0.76 | -3.19% | -337.41% |

APYX | 48.8M | 52.3M | -6.00% | -59.48% | -2.61 | 0.93 | 17.61% | 19.28% |

AEMD | 3.4M | 3.7M | -25.71% | 271.43% | -0.27 | 0.89 | 5.77% | 8.23% |

Intuitive Surgical Inc News

Intuitive Surgical Inc Earnings Report: Key Takeaways & Analysis

| Income Statement (Quarterly) | (In Millions) | |||||||||||||||||||||

| Description | (%) Q/Q | 2024Q1 | 2023Q4 | 2023Q3 | 2023Q2 | 2023Q1 | 2022Q4 | 2022Q3 | 2022Q2 | 2022Q1 | 2021Q4 | 2021Q3 | 2021Q2 | 2021Q1 | 2020Q4 | 2020Q3 | 2020Q2 | 2020Q1 | 2019Q4 | 2019Q3 | 2019Q2 | 2019Q1 |

| Revenue | -2.0% | 1,891 | 1,928 | 1,744 | 1,756 | 1,696 | 1,655 | 1,557 | 1,522 | 1,488 | 1,551 | 1,403 | 1,464 | 1,292 | 1,329 | 1,078 | 852 | 1,100 | 1,278 | 1,128 | 1,099 | 974 |

| Gross Profit | -2.5% | 1,245 | 1,277 | 1,167 | 1,172 | 1,113 | 1,111 | 1,052 | 1,023 | 1,010 | 1,061 | 971 | 1,024 | 903 | 896 | 724 | 503 | 738 | 896 | 786 | 759 | 670 |

| Operating Expenses | -6.2% | 776 | 827 | 701 | 709 | 725 | 738 | 653 | 626 | 602 | 610 | 529 | 513 | 486 | 480 | 454 | 422 | 455 | 498 | 420 | 400 | 417 |

| S&GA Expenses | -13.3% | 492 | 567 | 452 | 464 | 481 | 494 | 436 | 418 | 391 | 427 | 363 | 350 | 326 | 330 | 299 | 279 | 308 | 342 | 284 | 279 | 273 |

| R&D Expenses | 9.4% | 285 | 260 | 249 | 244 | 245 | 244 | 217 | 207 | 211 | 183 | 166 | 162 | 160 | 150 | 155 | 143 | 147 | 157 | 136 | 121 | 144 |

| EBITDA Margin | 3.1% | 0.28* | 0.27* | 0.31* | 0.30* | 0.29* | 0.30* | 0.32* | 0.33* | 0.36* | 0.38* | 0.39* | 0.39* | 0.35* | 0.32* | - | - | - | - | - | - | - |

| Income Taxes | 90.6% | -8.90 | -94.80 | 102 | 73.00 | 61.00 | 58.00 | 78.00 | 93.00 | 33.00 | 72.00 | 74.00 | 3.00 | 14.00 | 73.00 | 38.00 | 37.00 | -8.10 | 69.00 | 0.00 | 75.00 | -24.30 |

| Earnings Before Taxes | 4.4% | 539 | 516 | 522 | 499 | 422 | 395 | 403 | 407 | 402 | 454 | 461 | 526 | 449 | 437 | 355 | 107 | 308 | 432 | 399 | 392 | 280 |

| EBT Margin | 3.1% | 0.28* | 0.27* | 0.27* | 0.26* | 0.25* | 0.26* | 0.27* | 0.29* | 0.31* | 0.33* | 0.34* | 0.34* | 0.30* | 0.28* | - | - | - | - | - | - | - |

| Net Income | -10.1% | 545 | 606 | 416 | 421 | 355 | 325 | 324 | 308 | 366 | 381 | 381 | 517 | 426 | 365 | 314 | 68.00 | 314 | 358 | 397 | 318 | 307 |

| Net Income Margin | 7.6% | 0.27* | 0.25* | 0.22* | 0.21* | 0.20* | 0.21* | 0.23* | 0.24* | 0.28* | 0.30* | 0.31* | 0.31* | 0.26* | 0.24* | - | - | - | - | - | - | - |

| Free Cashflow | 16.3% | 265 | 228 | 548 | 666 | 371 | 438 | 383 | 447 | 223 | 568 | 501 | 543 | 478 | 628 | - | - | - | - | - | - | - |

| Balance Sheet | (In Millions) | |||||||||||||||||||||

| Description | (%) Q/Q | 2024Q1 | 2023Q4 | 2023Q3 | 2023Q2 | 2023Q1 | 2022Q4 | 2022Q3 | 2022Q2 | 2022Q1 | 2021Q4 | 2021Q3 | 2021Q2 | 2021Q1 | 2020Q4 | 2020Q3 | 2020Q2 | 2020Q1 | 2019Q4 | 2019Q3 | 2019Q2 | 2019Q1 |

| Assets | 2.5% | 15,828 | 15,442 | 14,713 | 13,903 | 13,053 | 12,974 | 13,261 | 13,705 | 13,678 | 13,555 | 12,935 | 12,297 | 11,540 | 11,169 | 10,618 | 10,104 | 9,891 | 9,733 | 9,131 | 8,532 | 8,235 |

| Current Assets | -3.2% | 7,633 | 7,888 | 8,903 | 8,032 | 6,877 | 6,253 | 6,293 | 6,293 | 5,803 | 5,845 | 5,728 | 6,017 | 6,066 | 6,626 | 6,300 | 5,899 | 4,692 | 4,663 | 4,317 | 4,072 | 4,025 |

| Cash Equivalents | 3.3% | 2,840 | 2,750 | 3,602 | 3,435 | 2,166 | 1,601 | 1,554 | 1,551 | 1,118 | 1,306 | 1,362 | 1,631 | 1,418 | 1,639 | 1,386 | 2,052 | 1,239 | 1,183 | 985 | 805 | 891 |

| Inventory | 6.4% | 1,299 | 1,221 | 1,148 | 1,005 | 947 | 893 | 837 | 724 | 653 | 587 | 585 | 570 | 577 | 602 | 663 | 646 | 620 | 596 | 580 | 513 | 468 |

| Net PPE | 7.4% | 3,800 | 3,538 | 3,077 | 2,831 | 2,580 | 2,374 | 2,244 | 2,109 | 1,968 | 1,876 | 1,738 | 1,651 | 1,593 | 1,577 | 1,510 | 1,450 | 1,369 | 1,273 | 1,137 | 1,032 | 935 |

| Goodwill | -0.1% | 348 | 349 | 348 | 349 | 349 | 349 | 348 | 349 | 343 | 344 | 344 | 344 | 345 | 337 | 336 | 337 | 335 | 307 | 305 | 245 | 248 |

| Liabilities | -12.8% | 1,782 | 2,044 | 2,089 | 1,944 | 1,759 | 1,861 | 1,687 | 1,623 | 1,522 | 1,604 | 1,475 | 1,418 | 1,350 | 1,410 | 1,331 | 1,337 | 1,361 | 1,449 | 1,354 | 1,252 | 1,195 |

| Current Liabilities | -17.1% | 1,375 | 1,659 | 1,676 | 1,538 | 1,307 | 1,422 | 1,233 | 1,175 | 1,112 | 1,150 | 1,027 | 1,005 | 905 | 965 | 895 | 925 | 946 | 1,030 | 931 | 808 | 740 |

| Shareholder's Equity | 4.9% | 13,963 | 13,308 | 12,539 | 11,960 | 11,294 | 11,113 | 11,574 | 12,082 | 12,157 | 11,952 | 11,460 | 10,880 | 10,190 | 9,759 | 9,287 | 8,766 | 8,531 | 8,285 | 7,777 | 7,280 | 7,040 |

| Retained Earnings | 6.9% | 5,068 | 4,743 | 4,209 | 3,808 | 3,397 | 3,500 | 4,018 | 4,683 | 4,858 | 4,761 | 4,390 | 4,023 | 3,515 | 3,261 | 2,937 | 2,633 | 2,571 | 2,495 | 2,143 | 1,819 | 1,696 |

| Additional Paid-In Capital | 3.8% | 8,903 | 8,576 | 8,386 | 8,151 | 7,928 | 7,704 | 7,685 | 7,484 | 7,355 | 7,164 | 7,015 | 6,804 | 6,627 | 6,445 | 6,304 | 6,085 | 5,927 | 5,757 | 5,601 | 5,430 | 5,329 |

| Accumulated Depreciation | -100.0% | - | 1,562 | - | - | - | 1,238 | - | - | - | 969 | - | - | - | 758 | - | - | - | 563 | - | - | - |

| Shares Outstanding | 0.7% | 355 | 352 | 352 | 351 | 350 | 350 | 355 | 358 | 358 | 356 | 357 | 356 | 354 | - | - | - | - | - | - | - | - |

| Minority Interest | -6.6% | 84.00 | 90.00 | 85.00 | 81.00 | 77.00 | 71.00 | 59.00 | 59.00 | 55.00 | 50.00 | 49.00 | 42.00 | 37.00 | 28.00 | 29.00 | 26.00 | 24.00 | 21.00 | 16.00 | 14.00 | 16.00 |

| Float | - | - | - | - | 119,600 | - | - | - | 71,400 | - | - | - | 108,700 | - | - | - | 66,400 | - | - | - | 59,900 | - |

| Cashflow (Quarterly) | (In Millions) | |||||||||||||||||||||

| Description | (%) Q/Q | 2024Q1 | 2023Q4 | 2023Q3 | 2023Q2 | 2023Q1 | 2022Q4 | 2022Q3 | 2022Q2 | 2022Q1 | 2021Q4 | 2021Q3 | 2021Q2 | 2021Q1 | 2020Q4 | 2020Q3 | 2020Q2 | 2020Q1 | 2019Q4 | 2019Q3 | 2019Q2 | 2019Q1 |

| Cashflow From Operations | 16.3% | 265 | 228 | 548 | 666 | 371 | 438 | 383 | 447 | 223 | 568 | 501 | 543 | 478 | 628 | 275 | 230 | 353 | 553 | 396 | 316 | 333 |

| Share Based Compensation | 1.9% | 153 | 150 | 156 | 147 | 140 | 128 | 138 | 127 | 121 | 118 | 120 | 108 | 103 | 103 | 106 | 96.00 | 91.00 | 89.00 | 89.00 | 82.00 | 76.00 |

| Cashflow From Investing | 87.7% | -128 | -1,044 | -446 | 558 | 573 | 575 | 545 | 466 | -214 | -641 | -838 | -384 | -597 | -334 | -1,025 | 537 | -117 | -406 | -216 | -222 | -308 |

| Cashflow From Financing | -48.3% | -46.70 | -31.50 | 62.00 | 63.00 | -381 | -963 | -926 | -482 | -199 | 19.00 | 68.00 | 58.00 | -102 | -39.80 | 85.00 | 48.00 | -178 | 51.00 | 1.00 | -178 | -41.80 |

| Buy Backs | -100.0% | - | 66.00 | - | - | 350 | 1,001 | 1,000 | 500 | 107 | - | - | - | - | 34.00 | - | - | 100 | - | 70.00 | 200 | - |

ISRG Income Statement

2024-03-31Condensed Consolidated Statements of Comprehensive Income (Unaudited) - USD ($) shares in Millions, $ in Millions | 3 Months Ended | |

|---|---|---|

Mar. 31, 2024 | Mar. 31, 2023 | |

| Revenue: | ||

| Total revenue | $ 1,890.6 | $ 1,696.2 |

| Cost of revenue: | ||

| Total cost of revenue | 645.2 | 583.2 |

| Gross profit | 1,245.4 | 1,113.0 |

| Operating expenses: | ||

| Selling, general and administrative | 491.5 | 480.5 |

| Research and development | 284.5 | 244.9 |

| Total operating expenses | 776.0 | 725.4 |

| Income from operations | 469.4 | 387.6 |

| Interest and other income, net | 69.1 | 34.2 |

| Income before taxes | 538.5 | 421.8 |

| Income tax expense (benefit) | (8.9) | 61.0 |

| Net income | 547.4 | 360.8 |

| Less: net income attributable to noncontrolling interest in joint venture | 2.5 | 5.5 |

| Net income attributable to Intuitive Surgical, Inc. | $ 544.9 | $ 355.3 |

| Net income per share attributable to Intuitive Surgical, Inc.: | ||

| Basic (in dollars per share) | $ 1.54 | $ 1.01 |

| Diluted (in dollars per share) | $ 1.51 | $ 1.00 |

| Shares used in computing net income per share attributable to Intuitive Surgical, Inc.: | ||

| Basic (in shares) | 353.5 | 350.2 |

| Diluted (in shares) | 360.5 | 356.0 |

| Other comprehensive income, net of tax: | ||

| Unrealized gains on hedge instruments | $ 5.6 | $ 2.5 |

| Unrealized gains (losses) on available-for-sale securities | (4.2) | 37.6 |

| Foreign currency translation gains | 1.8 | 14.2 |

| Prior service cost for employee benefit plans | (0.1) | 0.0 |

| Other comprehensive income | 3.1 | 54.3 |

| Total comprehensive income | 550.5 | 415.1 |

| Less: comprehensive income attributable to noncontrolling interest | 2.1 | 5.8 |

| Total comprehensive income attributable to Intuitive Surgical, Inc. | 548.4 | 409.3 |

| Corporate Joint Venture | ||

| Operating expenses: | ||

| Less: net income attributable to noncontrolling interest in joint venture | 2.5 | 5.5 |

| Product | ||

| Revenue: | ||

| Total revenue | 1,577.1 | 1,413.0 |

| Cost of revenue: | ||

| Total cost of revenue | 554.4 | 493.0 |

| Service | ||

| Revenue: | ||

| Total revenue | 313.5 | 283.2 |

| Cost of revenue: | ||

| Total cost of revenue | $ 90.8 | $ 90.2 |

ISRG Balance Sheet

2024-03-31Condensed Consolidated Balance Sheets (Unaudited) - USD ($) $ in Millions | Mar. 31, 2024 | Dec. 31, 2023 |

|---|---|---|

| Current assets: | ||

| Cash and cash equivalents | $ 2,839.5 | $ 2,750.1 |

| Short-term investments | 1,960.6 | 2,473.1 |

| Accounts receivable, net | 1,127.9 | 1,130.2 |

| Inventory | 1,299.3 | 1,220.6 |

| Prepaids and other current assets | 405.4 | 314.0 |

| Total current assets | 7,632.7 | 7,888.0 |

| Property, plant, and equipment, net | 3,799.6 | 3,537.6 |

| Long-term investments | 2,522.6 | 2,120.0 |

| Deferred tax assets | 917.8 | 910.5 |

| Intangible and other assets, net | 607.1 | 636.7 |

| Goodwill | 348.2 | 348.7 |

| Total assets | 15,828.0 | 15,441.5 |

| Current liabilities: | ||

| Accounts payable | 194.4 | 188.7 |

| Accrued compensation and employee benefits | 238.4 | 436.4 |

| Deferred revenue | 437.5 | 446.1 |

| Other accrued liabilities | 504.8 | 587.5 |

| Total current liabilities | 1,375.1 | 1,658.7 |

| Other long-term liabilities | 406.5 | 385.5 |

| Total liabilities | 1,781.6 | 2,044.2 |

| Contingencies (Note 8) | ||

| Stockholders’ equity: | ||

| Preferred stock, 2.5 shares authorized, $0.001 par value, issuable in series; zero shares issued and outstanding as of March 31, 2024, and December 31, 2023 | 0.0 | 0.0 |

| Common stock, 600.0 shares authorized, $0.001 par value, 354.7 shares and 352.3 shares issued and outstanding as of March 31, 2024, and December 31, 2023, respectively | 0.4 | 0.4 |

| Additional paid-in capital | 8,903.0 | 8,576.4 |

| Retained earnings | 5,067.9 | 4,743.0 |

| Accumulated other comprehensive loss | (8.7) | (12.2) |

| Total Intuitive Surgical, Inc. stockholders’ equity | 13,962.6 | 13,307.6 |

| Noncontrolling interest in joint venture | 83.8 | 89.7 |

| Total stockholders’ equity | 14,046.4 | 13,397.3 |

| Total liabilities and stockholders’ equity | $ 15,828.0 | $ 15,441.5 |

| CEO | Dr. Gary S. Guthart Ph.D. |

|---|---|

| WEBSITE | intuitive.com |

| INDUSTRY | Medical Instruments & Supplies |

| EMPLOYEES | 12120 |