Market Summary

LUV Stock Price

LUV RSI Chart

LUV Valuation

LUV Price/Sales (Trailing)

LUV Profitability

LUV Fundamentals

LUV Revenue

LUV Earnings

Breaking Down LUV Revenue

Last 7 days

5.9%

Last 30 days

-5.1%

Last 90 days

-15.9%

Trailing 12 Months

-8.3%

How does LUV drawdown profile look like?

LUV Financial Health

LUV Investor Care

Historical Charts for Stock Metrics

| Year | Q1 | Q2 | Q3 | Q4 |

|---|---|---|---|---|

| 2024 | 26.7B | 0 | 0 | 0 |

| 2023 | 24.8B | 25.1B | 25.4B | 26.1B |

| 2022 | 18.4B | 21.2B | 22.7B | 23.8B |

| 2021 | 6.9B | 9.9B | 12.8B | 15.8B |

| 2020 | 21.5B | 16.6B | 12.8B | 9.0B |

| 2019 | 22.2B | 22.3B | 22.4B | 22.4B |

| 2018 | 21.2B | 21.2B | 21.5B | 22.0B |

| 2017 | 20.5B | 20.8B | 21.0B | 21.1B |

| 2016 | 20.2B | 20.5B | 20.3B | 20.4B |

| 2015 | 18.9B | 19.0B | 19.5B | 19.8B |

| 2014 | 17.8B | 18.1B | 18.4B | 18.6B |

| 2013 | 17.2B | 17.2B | 17.4B | 17.7B |

| 2012 | 16.5B | 17.0B | 17.0B | 17.1B |

| 2011 | 12.0B | 13.5B | 14.7B | 15.7B |

| 2010 | 10.6B | 0 | 11.2B | 11.6B |

| 2009 | 10.9B | 10.6B | 10.4B | 10.4B |

| 2008 | 10.2B | 10.4B | 10.7B | 11.0B |

| 2007 | 0 | 0 | 0 | 9.9B |

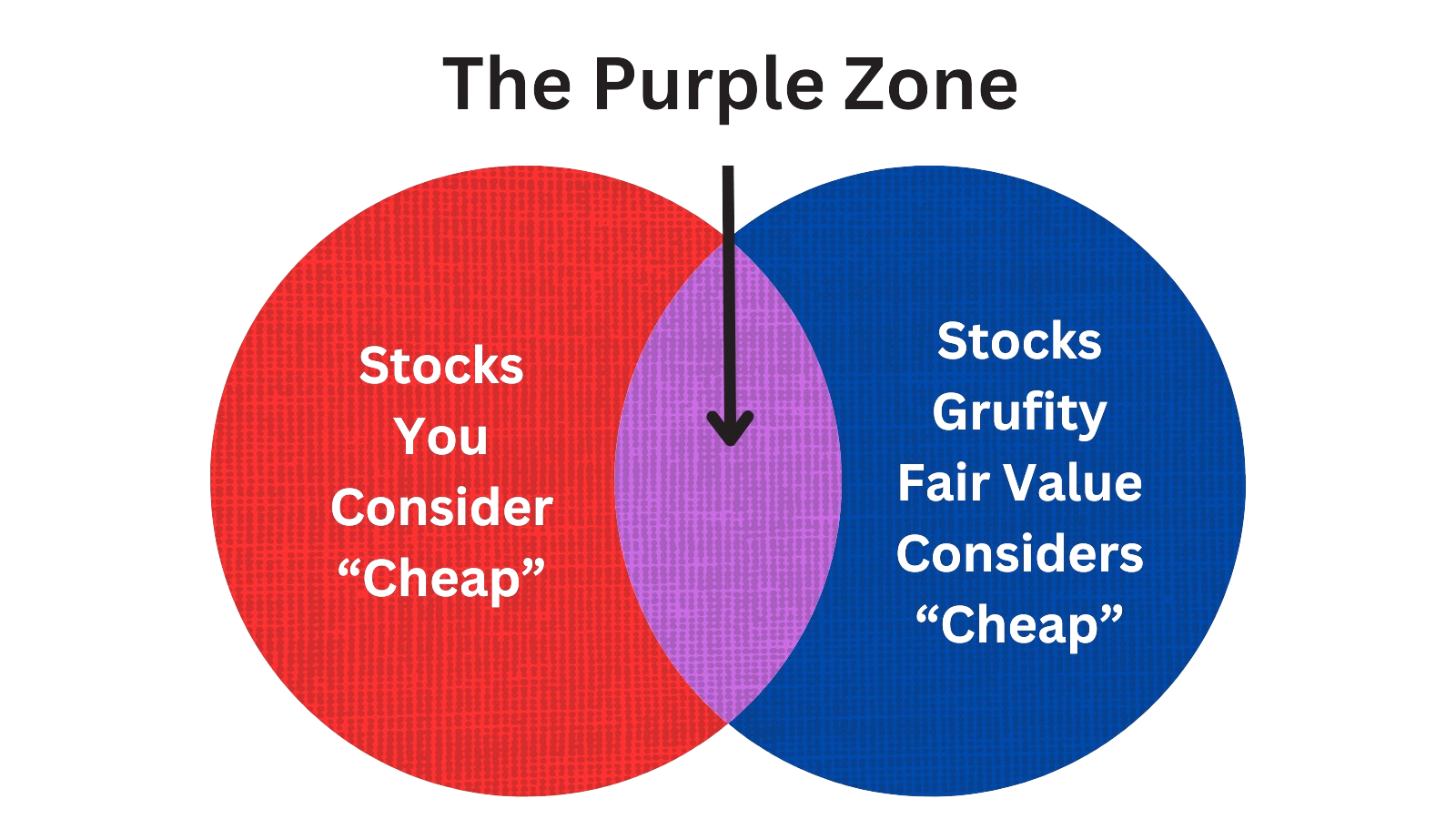

Stocks Marked 'Very Cheap' by Grufity's Fair Value Model Have Outperformed S&P 500 Index

Grufity's Fair Value model takes all the S&P 500 stocks and divides them into separate buckets based on their attractiveness. The 'Very Cheap' bucket of S&P 500 has greatly outperformed S&P 500 Index. Conversely, S&P500 stocks considered 'Very Expensive' by the model underperformed the S&P500 index in the past three years. Grufity Fair Value is available for 2300+ stocks, including 90% of S&P 500 stocks. Grufity's Fair Value Model separates high-return stocks from low-return stocks.

Returns of $10,000 invested in:

Very Cheap Stocks: $17,289

S&P 500 Index: $12,922

Very Expensive Stocks: $11,022

Grufity's Fair Value model does a great job in separating High Performing Stocks from Low Performing ones in the S&P 500 list.

Tracking the Latest Insider Buys and Sells of Southwest Airlines Co

Filter Transactions| Datesorted ascending | Name | Buy/Sell | $ Value | Avg. Price | # Shares | Title |

|---|---|---|---|---|---|---|

| Apr 30, 2024 | kelly gary c | gifted | - | - | -120,133 | executive chairman |

| Apr 30, 2024 | kelly gary c | gifted | - | - | 90,759 | executive chairman |

| Apr 30, 2024 | kelly gary c | gifted | - | - | 12,864 | executive chairman |

| Apr 30, 2024 | kelly gary c | gifted | - | - | 16,510 | executive chairman |

| Feb 21, 2024 | jones justin | sold (taxes) | -79,891 | 34.54 | -2,313 | evp operations |

| Feb 21, 2024 | green ryan c. | sold (taxes) | -179,850 | 34.54 | -5,207 | evp & chief commercial officer |

| Feb 21, 2024 | watterson andrew m | sold (taxes) | -761,123 | 34.54 | -22,036 | chief operating officer |

| Feb 21, 2024 | jordan robert e | sold (taxes) | -918,868 | 34.54 | -26,603 | ceo & president |

| Feb 21, 2024 | kelly gary c | sold (taxes) | -1,024,420 | 34.54 | -29,659 | executive chairman |

| Feb 21, 2024 | shaw mark r | sold (taxes) | -766,235 | 34.54 | -22,184 | evp & clro |

Which funds bought or sold LUV recently?

View All Details| Datesorted ascending | Fund Name | Type | % Chg | $ Change | $ Held | % Portfolio |

|---|---|---|---|---|---|---|

| May 07, 2024 | Arizona State Retirement System | added | 0.16 | 14,555 | 1,196,500 | 0.01% |

| May 07, 2024 | CarsonAllaria Wealth Management, Ltd. | added | 1.3 | 415 | 18,195 | 0.01% |

| May 07, 2024 | SEI INVESTMENTS CO | reduced | -8.56 | -2,350,270 | 28,670,500 | 0.04% |

| May 07, 2024 | MEEDER ASSET MANAGEMENT INC | new | - | 3,269 | 3,269 | -% |

| May 07, 2024 | OPPENHEIMER & CO INC | reduced | -33.69 | -933,753 | 1,897,730 | 0.03% |

| May 07, 2024 | Williams Jones Wealth Management, LLC. | reduced | -0.38 | 25,982 | 3,806,200 | 0.05% |

| May 07, 2024 | O'Dell Group, LLC | sold off | -100 | -17,452 | - | -% |

| May 07, 2024 | Cornerstone Planning Group LLC | sold off | -100 | -1,473 | - | -% |

| May 07, 2024 | SYNTAX RESEARCH, INC. | unchanged | - | 43.00 | 4,029 | -% |

| May 07, 2024 | Concurrent Investment Advisors, LLC | reduced | -4.78 | -22,559 | 577,360 | 0.02% |

Are Funds Buying or Selling LUV?

Unveiling Southwest Airlines Co's Major ShareHolders

| Date Filed | Name of Filer | Percent of Class | No. of Shares | Form Type | |

|---|---|---|---|---|---|

| Mar 08, 2024 | capital world investors | 10.0% | 59,789,401 | SC 13G/A | |

| Feb 13, 2024 | vanguard group inc | 10.97% | 65,421,331 | SC 13G/A | |

| Feb 12, 2024 | primecap management co/ca/ | 8.29% | 49,444,947 | SC 13G/A | |

| Feb 09, 2024 | capital world investors | 9.0% | 53,569,646 | SC 13G | |

| Jan 31, 2024 | blackrock inc. | 5.5% | 32,943,061 | SC 13G/A | |

| Jan 30, 2024 | state street corp | 6.82% | 40,639,399 | SC 13G/A | |

| Feb 13, 2023 | blackrock inc. | 6.0% | 35,569,761 | SC 13G/A | |

| Feb 10, 2023 | state street corp | 6.72% | 39,920,188 | SC 13G/A | |

| Feb 09, 2023 | primecap management co/ca/ | 8.79% | 52,198,099 | SC 13G/A | |

| Feb 09, 2023 | vanguard group inc | 11.05% | 65,581,138 | SC 13G/A |

Recent SEC filings of Southwest Airlines Co

View All Filings| Date Filed | Form Type | Document | |

|---|---|---|---|

| May 02, 2024 | 4 | Insider Trading | |

| May 01, 2024 | 8-K | Current Report | |

| Apr 26, 2024 | 10-Q | Quarterly Report | |

| Apr 25, 2024 | 8-K | Current Report | |

| Apr 05, 2024 | ARS | ARS | |

| Apr 05, 2024 | DEF 14A | DEF 14A | |

| Apr 05, 2024 | DEFA14A | DEFA14A | |

| Mar 12, 2024 | 8-K | Current Report | |

| Mar 08, 2024 | SC 13G/A | Major Ownership Report | |

| Feb 23, 2024 | 4 | Insider Trading |

Peers (Alternatives to Southwest Airlines Co)

| Name | Mkt Capsorted ascending | Revenue | Price %, 1M | Returns, 1Y | P/E | P/S | Rev 1-Yr | Inc 1-Yr |

|---|---|---|---|---|---|---|---|---|

| LARGE-CAP | ||||||||

DAL | 33.7B | 59.0B | 11.25% | 52.92% | 6.74 | 0.57 | 9.34% | 164.26% |

UAL | 17.4B | 54.8B | 22.40% | 14.34% | 6.48 | 0.32 | 12.31% | 40.00% |

LUV | 16.3B | 26.7B | -5.13% | -8.27% | 50.28 | 0.61 | 7.60% | -43.44% |

| MID-CAP | ||||||||

AAL | 9.5B | 53.2B | 3.74% | -0.35% | 18.92 | 0.18 | 1.74% | -71.78% |

ALK | 5.5B | 10.5B | 1.71% | -1.34% | 22.43 | 0.53 | 2.96% | 315.25% |

JBLU | 1.9B | 9.5B | -19.20% | -18.97% | -2.32 | 0.2 | -2.60% | -178.93% |

| SMALL-CAP | ||||||||

ALGT | 971.4M | 2.5B | -19.27% | -48.98% | 8.26 | 0.39 | 9.04% | 4617.05% |

ATSG | 957.6M | 2.1B | 13.02% | -7.07% | 15.87 | 0.46 | 1.23% | -69.62% |

HA | 681.8M | 2.7B | -1.05% | 60.56% | -2.27 | 0.25 | -0.99% | -46.20% |

SAVE | 372.3M | 5.3B | -27.97% | -78.47% | -0.77 | 0.07 | -3.17% | -4.93% |

MESA | 37.3M | 498.1M | 3.41% | -55.83% | -0.27 | 0.07 | -6.20% | 34.25% |

Southwest Airlines Co News

Southwest Airlines Co Earnings Report: Key Takeaways & Analysis

| Income Statement (Quarterly) | (In Millions) | |||||||||||||||||||||

| Description | (%) Q/Q | 2024Q1 | 2023Q4 | 2023Q3 | 2023Q2 | 2023Q1 | 2022Q4 | 2022Q3 | 2022Q2 | 2022Q1 | 2021Q4 | 2021Q3 | 2021Q2 | 2021Q1 | 2020Q4 | 2020Q3 | 2020Q2 | 2020Q1 | 2019Q4 | 2019Q3 | 2019Q2 | 2019Q1 |

| Revenue | -7.2% | 6,329 | 6,823 | 6,525 | 7,037 | 5,706 | 6,172 | 6,220 | 6,728 | 4,694 | 5,051 | 4,679 | 4,008 | 2,052 | 2,013 | 1,793 | 1,008 | 4,234 | 5,729 | 5,639 | 5,909 | 5,149 |

| Operating Expenses | -7.0% | 6,722 | 7,227 | 6,408 | 6,242 | 5,990 | 6,557 | 5,825 | 5,570 | 4,845 | 4,856 | 3,946 | 3,414 | 1,853 | 3,181 | 3,204 | 2,135 | 4,344 | 5,066 | 4,820 | 4,941 | 4,644 |

| EBITDA Margin | -4.4% | 0.09* | 0.09* | 0.09* | 0.10* | 0.10* | 0.10* | 0.12* | 0.14* | 0.13* | 0.19* | 0.12* | -0.07* | - | - | - | - | - | - | - | - | - |

| Interest Expenses | -80.9% | 18.00 | 94.00 | 19.00 | 96.00 | 19.00 | 102 | 42.00 | 141 | 20.00 | 148 | 22.00 | 150 | 17.00 | 151 | 7.00 | 40.00 | 14.00 | 29.00 | 11.00 | 33.00 | 15.00 |

| Income Taxes | -100.0% | -67.00 | -33.50 | 44.00 | 203 | -46.00 | -65.00 | 76.00 | 276 | -98.00 | 10.00 | 154 | 154 | 30.00 | -423 | -385 | -324 | -50.00 | 153 | 160 | 227 | 117 |

| Earnings Before Taxes | -4.4% | -298 | -285 | 237 | 886 | -205 | -285 | 353 | 1,036 | -376 | 77.00 | 600 | 502 | 146 | -1,331 | -1,542 | -1,239 | -144 | 666 | 819 | 968 | 504 |

| EBT Margin | -16.7% | 0.02* | 0.02* | 0.02* | 0.03* | 0.04* | 0.03* | 0.05* | 0.06* | 0.04* | 0.08* | -0.01* | -0.23* | - | - | - | - | - | - | - | - | - |

| Net Income | -26.6% | -231 | -182 | 193 | 544 | -159 | -220 | 277 | 674 | 225 | -62.50 | 446 | 544 | 180 | -908 | -1,157 | -859 | -219 | 514 | 659 | 741 | 387 |

| Net Income Margin | 20.4% | 0.01* | 0.01* | 0.01* | 0.01* | 0.02* | 0.04* | 0.05* | 0.06* | 0.06* | 0.07* | 0.02* | -0.14* | - | - | - | - | - | - | - | - | - |

| Free Cashflow | -124.4% | -104 | 426 | 164 | 964 | 254 | 127 | -218 | 1,454 | 619 | -205 | -1,027 | 1,553 | - | - | - | - | - | - | - | - | - |

| Balance Sheet | (In Millions) | |||||||||||||||||||||

| Description | (%) Q/Q | 2024Q1 | 2023Q4 | 2023Q3 | 2023Q2 | 2023Q1 | 2022Q4 | 2022Q3 | 2022Q2 | 2022Q1 | 2021Q4 | 2021Q3 | 2021Q2 | 2021Q1 | 2020Q4 | 2020Q3 | 2020Q2 | 2020Q1 | 2019Q4 | 2019Q3 | 2019Q2 | 2019Q1 |

| Assets | -1.3% | 36,018 | 36,487 | 36,980 | 36,519 | 35,546 | 35,369 | 35,946 | 38,302 | 37,262 | 36,320 | 37,110 | 38,206 | 35,493 | 34,588 | 35,605 | 35,596 | 26,885 | 25,895 | 26,467 | 26,374 | 26,459 |

| Current Assets | -4.8% | 13,281 | 13,955 | 14,631 | 14,661 | 14,274 | 14,808 | 16,418 | 19,396 | 18,822 | 18,036 | 18,554 | 19,188 | 16,100 | 15,173 | 16,133 | 15,872 | 7,028 | 5,974 | 5,650 | 5,554 | 5,483 |

| Cash Equivalents | -9.9% | 8,367 | 9,288 | 9,497 | 9,158 | 8,359 | 9,492 | 10,443 | 13,234 | 13,098 | 12,480 | 12,980 | 14,124 | 11,971 | 11,063 | 12,109 | 12,351 | 3,940 | 2,548 | 2,488 | 2,446 | 2,344 |

| Net PPE | 1.0% | 19,561 | 19,375 | 19,075 | 18,596 | 18,024 | 17,342 | 16,337 | 15,594 | 14,937 | 14,842 | 15,056 | 15,242 | 15,648 | 15,831 | 16,056 | 16,247 | 16,989 | 17,025 | 17,842 | 17,733 | 17,773 |

| Goodwill | 0% | 970 | 970 | 970 | 970 | 970 | 970 | 970 | 970 | 970 | 970 | 970 | 970 | 970 | 970 | 970 | 970 | 970 | 970 | 970 | 970 | 970 |

| Current Liabilities | -0.3% | 12,225 | 12,256 | 12,112 | 11,728 | 11,329 | 10,378 | 10,416 | 11,711 | 10,069 | 9,164 | 9,135 | 12,476 | 8,182 | 7,506 | 7,804 | 9,361 | 10,241 | 8,952 | 8,629 | 8,611 | 8,723 |

| Long Term Debt | -0.1% | 7,974 | 7,978 | 7,984 | 7,994 | 7,999 | 8,046 | 8,315 | 8,877 | 10,309 | 10,274 | 11,013 | 9,188 | 10,546 | 10,111 | 10,135 | 8,905 | 2,288 | 1,846 | 2,398 | 2,449 | 2,602 |

| Shareholder's Equity | -3.0% | 10,196 | 10,515 | 11,054 | 10,789 | 10,302 | 10,687 | 10,924 | 11,120 | 10,417 | 10,414 | 10,250 | 9,688 | 9,093 | 8,876 | 9,769 | 10,878 | 9,075 | 9,832 | 9,931 | 9,940 | 9,791 |

| Retained Earnings | -2.1% | 15,959 | 16,297 | 16,657 | 16,571 | 15,995 | 16,261 | 16,588 | 16,311 | 15,551 | 15,774 | 15,706 | 15,260 | 14,912 | 14,777 | 15,685 | 16,842 | 17,757 | 17,945 | 17,525 | 16,962 | 16,320 |

| Additional Paid-In Capital | -0.4% | 4,138 | 4,153 | 4,135 | 4,103 | 4,058 | 4,037 | 3,989 | 3,966 | 3,940 | 4,224 | 4,251 | 4,269 | 4,220 | 4,191 | 4,175 | 4,159 | 1,582 | 1,581 | 1,554 | 1,534 | 1,513 |

| Accumulated Depreciation | 0.6% | 14,536 | 14,443 | 14,389 | 14,159 | 13,878 | 13,642 | 13,501 | 13,216 | 12,945 | 12,732 | 12,496 | 12,199 | 11,733 | 11,743 | 11,443 | 11,164 | 10,912 | 10,688 | 10,445 | 10,164 | 9,875 |

| Shares Outstanding | - | 597 | - | 595 | 595 | 594 | - | 593 | 593 | 592 | - | 591 | 591 | 591 | - | - | - | - | - | - | - | - |

| Float | - | - | - | - | 21,499 | - | - | - | 21,358 | - | - | - | 31,305 | - | - | - | 20,095 | - | - | - | 27,212 | - |

| Cashflow (Quarterly) | (In Millions) | |||||||||||||||||||||

| Description | (%) Q/Q | 2024Q1 | 2023Q4 | 2023Q3 | 2023Q2 | 2023Q1 | 2022Q4 | 2022Q3 | 2022Q2 | 2022Q1 | 2021Q4 | 2021Q3 | 2021Q2 | 2021Q1 | 2020Q4 | 2020Q3 | 2020Q2 | 2020Q1 | 2019Q4 | 2019Q3 | 2019Q2 | 2019Q1 |

| Cashflow From Operations | -124.4% | -104 | 426 | 616 | 1,416 | 706 | 579 | 234 | 1,906 | 1,071 | 247 | -575 | 2,005 | 645 | -596 | -1,050 | 897 | -377 | 825 | 1,091 | 966 | 1,105 |

| Cashflow From Investing | 11.9% | -585 | -664 | -64.00 | -627 | -1,577 | -932 | -1,120 | -1,555 | -139 | -182 | -412 | -469 | -201 | 91.00 | -434 | 332 | -5.00 | 144 | -359 | -252 | 164 |

| Cashflow From Financing | -886.4% | -232 | 30.00 | -213 | 10.00 | -262 | -597 | -1,905 | -215 | -314 | -564 | -157 | 617 | 464 | -540 | 1,242 | 7,182 | 1,774 | -908 | -690 | -612 | -779 |

| Dividend Payments | - | 215 | - | 214 | - | 214 | - | - | - | - | - | - | - | - | - | - | - | 188 | - | 96.00 | 98.00 | 178 |

| Buy Backs | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | 451 | 550 | 500 | 450 | 500 |

LUV Income Statement

2024-03-31Condensed Consolidated Statement of Comprehensive Loss - USD ($) shares in Millions, $ in Millions | 3 Months Ended | |

|---|---|---|

Mar. 31, 2024 | Mar. 31, 2023 | |

| OPERATING REVENUES: | ||

| Total operating revenues | $ 6,329 | $ 5,706 |

| OPERATING EXPENSES: | ||

| Salaries, wages, and benefits | 2,940 | 2,478 |

| Fuel and oil | 1,531 | 1,547 |

| Maintenance materials and repairs | 361 | 240 |

| Landing fees and airport rentals | 464 | 408 |

| Depreciation and amortization | 408 | 365 |

| Other operating expenses | 1,018 | 952 |

| Total operating expenses | 6,722 | 5,990 |

| OPERATING LOSS | (393) | (284) |

| OTHER EXPENSES (INCOME): | ||

| Interest expense | 65 | 66 |

| Capitalized interest | (7) | (6) |

| Interest income | (141) | (125) |

| Other gains, net | (12) | (14) |

| Total other income | (95) | (79) |

| LOSS BEFORE INCOME TAXES | (298) | (205) |

| BENEFIT FOR INCOME TAXES | (67) | (46) |

| NET LOSS | $ (231) | $ (159) |

| Net loss per share, basic (in USD per share) | $ (0.39) | $ (0.27) |

| Net loss per share, diluted (in USD per share) | $ (0.39) | $ (0.27) |

| COMPREHENSIVE LOSS | $ (212) | $ (306) |

| WEIGHTED AVERAGE SHARES OUTSTANDING | ||

| Basic (in shares) | 597 | 594 |

| Diluted (in shares) | 597 | 594 |

| Passenger | ||

| OPERATING REVENUES: | ||

| Total operating revenues | $ 5,712 | $ 5,105 |

| Freight | ||

| OPERATING REVENUES: | ||

| Total operating revenues | 42 | 41 |

| Other | ||

| OPERATING REVENUES: | ||

| Total operating revenues | $ 575 | $ 560 |

LUV Balance Sheet

2024-03-31Condensed Consolidated Balance Sheet - USD ($) $ in Millions | Mar. 31, 2024 | Dec. 31, 2023 |

|---|---|---|

| Current assets: | ||

| Cash and cash equivalents | $ 8,367 | $ 9,288 |

| Short-term investments | 2,145 | 2,186 |

| Accounts and other receivables | 1,354 | 1,154 |

| Inventories of parts and supplies, at cost | 812 | 807 |

| Prepaid expenses and other current assets | 603 | 520 |

| Total current assets | 13,281 | 13,955 |

| Property and equipment, at cost: | ||

| Flight equipment | 26,131 | 26,060 |

| Ground property and equipment | 7,500 | 7,460 |

| Deposits on flight equipment purchase contracts | 395 | 236 |

| Assets constructed for others | 71 | 62 |

| Property and equipment, at cost | 34,097 | 33,818 |

| Less allowance for depreciation and amortization | 14,536 | 14,443 |

| Property and equipment, net | 19,561 | 19,375 |

| Goodwill | 970 | 970 |

| Operating lease right-of-use assets | 1,182 | 1,223 |

| Other assets | 1,024 | 964 |

| Total assets | 36,018 | 36,487 |

| Current liabilities: | ||

| Accounts payable | 1,949 | 1,862 |

| Accrued liabilities | 2,400 | 3,606 |

| Current operating lease liabilities | 206 | 208 |

| Air traffic liability | 7,642 | 6,551 |

| Current maturities of long-term debt | 28 | 29 |

| Total current liabilities | 12,225 | 12,256 |

| Long-term debt less current maturities | 7,974 | 7,978 |

| Air traffic liability - noncurrent | 1,752 | 1,728 |

| Deferred income taxes | 1,981 | 2,044 |

| Noncurrent operating lease liabilities | 953 | 985 |

| Other noncurrent liabilities | 937 | 981 |

| Stockholders' equity: | ||

| Common stock | 888 | 888 |

| Capital in excess of par value | 4,138 | 4,153 |

| Retained earnings | 15,959 | 16,297 |

| Accumulated other comprehensive income | 19 | 0 |

| Treasury stock, at cost | (10,808) | (10,823) |

| Total stockholders' equity | 10,196 | 10,515 |

| Total liabilities and stockholders' equity | $ 36,018 | $ 36,487 |

| CEO | Mr. Robert E. Jordan |

|---|---|

| WEBSITE | southwest.com |

| INDUSTRY | Airlines |

| EMPLOYEES | 65535 |