Market Summary

WTW Stock Price

WTW RSI Chart

WTW Valuation

WTW Price/Sales (Trailing)

WTW Profitability

WTW Fundamentals

WTW Revenue

WTW Earnings

Breaking Down WTW Revenue

52 Week Range

Last 7 days

1.5%

Last 30 days

-5.9%

Last 90 days

-6.2%

Trailing 12 Months

11.2%

How does WTW drawdown profile look like?

WTW Financial Health

WTW Investor Care

Historical Charts for Stock Metrics

| Year | Q1 | Q2 | Q3 | Q4 |

|---|---|---|---|---|

| 2024 | 9.6B | 0 | 0 | 0 |

| 2023 | 8.9B | 9.1B | 9.3B | 9.5B |

| 2022 | 8.9B | 8.9B | 8.8B | 8.9B |

| 2021 | 8.7B | 8.9B | 9.0B | 9.0B |

| 2020 | 8.8B | 8.7B | 8.6B | 8.6B |

| 2019 | 8.5B | 8.6B | 8.7B | 9.0B |

| 2018 | 8.2B | 8.2B | 8.2B | 8.5B |

| 2017 | 8.0B | 8.0B | 8.1B | 8.2B |

| 2016 | 5.0B | 6.0B | 6.9B | 7.9B |

| 2015 | 3.8B | 3.8B | 3.8B | 3.8B |

| 2014 | 3.7B | 3.7B | 3.8B | 3.8B |

| 2013 | 3.5B | 3.6B | 3.6B | 3.7B |

| 2012 | 3.5B | 3.4B | 3.4B | 3.5B |

| 2011 | 3.4B | 3.4B | 3.5B | 3.4B |

| 2010 | 3.3B | 3.3B | 3.3B | 3.3B |

| 2009 | 0 | 3.0B | 3.1B | 3.3B |

| 2008 | 0 | 0 | 0 | 2.8B |

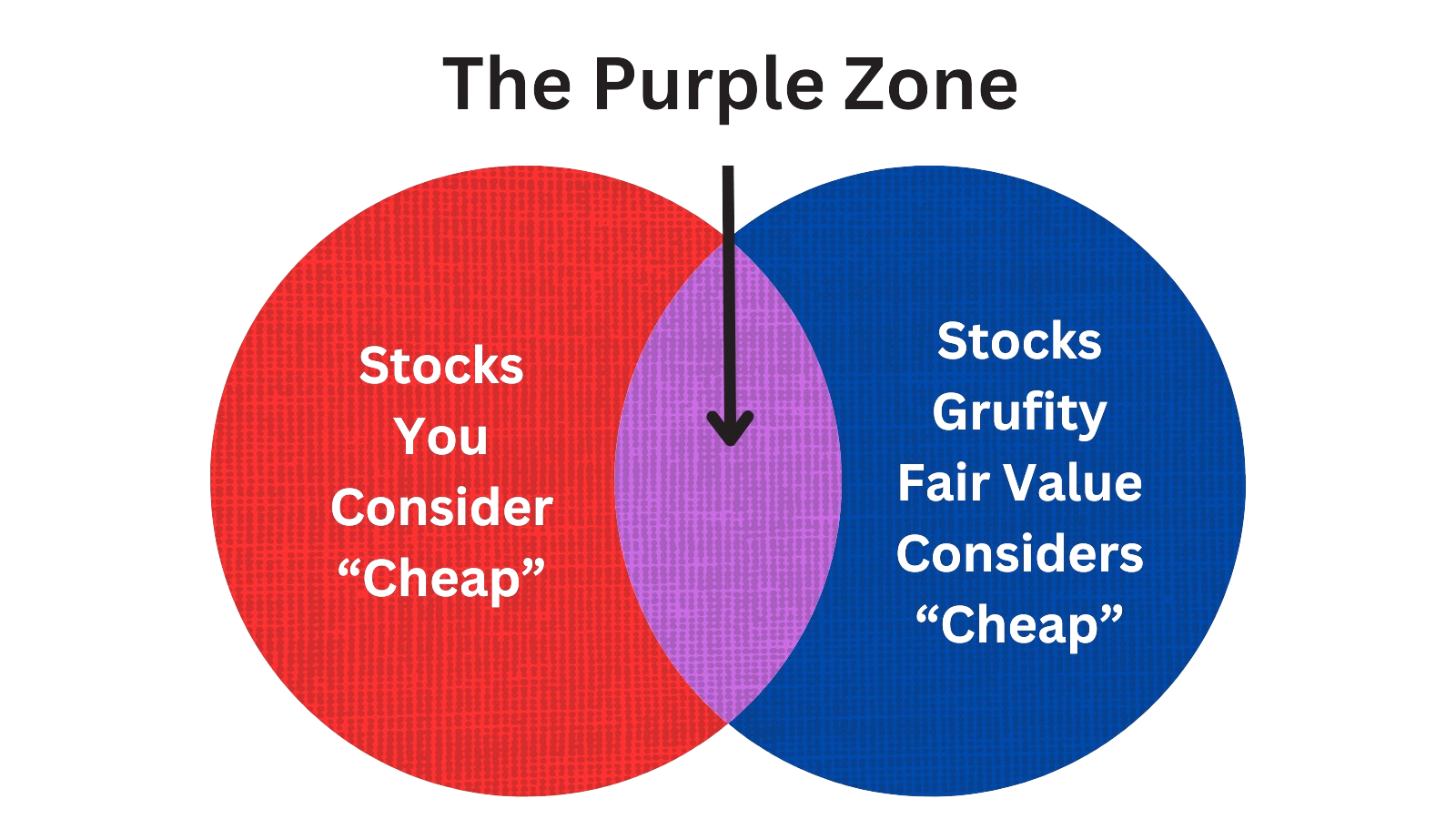

Stocks Marked 'Very Cheap' by Grufity's Fair Value Model Have Outperformed S&P 500 Index

Grufity's Fair Value model takes all the S&P 500 stocks and divides them into separate buckets based on their attractiveness. The 'Very Cheap' bucket of S&P 500 has greatly outperformed S&P 500 Index. Conversely, S&P500 stocks considered 'Very Expensive' by the model underperformed the S&P500 index in the past three years. Grufity Fair Value is available for 2300+ stocks, including 90% of S&P 500 stocks. Grufity's Fair Value Model separates high-return stocks from low-return stocks.

Returns of $10,000 invested in:

Very Cheap Stocks: $17,289

S&P 500 Index: $12,922

Very Expensive Stocks: $11,022

Grufity's Fair Value model does a great job in separating High Performing Stocks from Low Performing ones in the S&P 500 list.

Tracking the Latest Insider Buys and Sells of Willis Towers Watson Public Lim

Filter Transactions| Datesorted ascending | Name | Buy/Sell | $ Value | Avg. Price | # Shares | Title |

|---|---|---|---|---|---|---|

| Apr 18, 2024 | pullum anne | sold (taxes) | -550 | 275 | -2.00 | head of europe |

| Apr 18, 2024 | garrard adam | sold (taxes) | -825 | 275 | -3.00 | head of risk & broking |

| Apr 18, 2024 | gebauer julie jarecke | sold (taxes) | -825 | 275 | -3.00 | head of health, wealth &career |

| Apr 18, 2024 | hess carl aaron | sold (taxes) | -3,025 | 275 | -11.00 | chief executive officer |

| Apr 18, 2024 | thomson-hall pamela | sold (taxes) | -275 | 275 | -1.00 | head of international |

| Apr 18, 2024 | faber alexis | sold (taxes) | -550 | 275 | -2.00 | chief operating officer |

| Apr 18, 2024 | krasner andrew jay | sold (taxes) | -550 | 275 | -2.00 | chief financial officer |

| Apr 18, 2024 | banas kristy d | sold (taxes) | -275 | 275 | -1.00 | chief human resources officer |

| Apr 18, 2024 | furman matthew | sold (taxes) | -550 | 275 | -2.00 | general counsel |

| Apr 18, 2024 | qureshi imran ahmed | sold (taxes) | -825 | 275 | -3.00 | head of north america |

Which funds bought or sold WTW recently?

View All Details| Datesorted ascending | Fund Name | Type | % Chg | $ Change | $ Held | % Portfolio |

|---|---|---|---|---|---|---|

| May 06, 2024 | SouthState Corp | reduced | -72.00 | -8,210 | 3,850 | -% |

| May 06, 2024 | Accretive Wealth Partners, LLC | added | 0.36 | 71,147 | 1,537,640 | 0.68% |

| May 06, 2024 | Quantbot Technologies LP | new | - | 2,952,120 | 2,952,120 | 0.17% |

| May 06, 2024 | Investors Research Corp | unchanged | - | 5,104 | 41,525 | 0.01% |

| May 06, 2024 | VitalStone Financial, LLC | new | - | 3,000 | 3,000 | -% |

| May 06, 2024 | Jefferies Financial Group Inc. | new | - | 209,205 | 209,205 | -% |

| May 06, 2024 | Riverpoint Wealth Management Holdings, LLC | added | 0.06 | 52,195 | 423,963 | 0.12% |

| May 06, 2024 | NEW YORK LIFE INVESTMENT MANAGEMENT LLC | reduced | -3.85 | 385,659 | 4,391,750 | 0.04% |

| May 06, 2024 | Empowered Funds, LLC | added | 614 | 2,198,000 | 2,505,520 | 0.04% |

| May 06, 2024 | Advisory Services Network, LLC | reduced | -1.41 | 48,863 | 443,535 | 0.01% |

Are Funds Buying or Selling WTW?

Unveiling Willis Towers Watson Public Lim's Major ShareHolders

| Date Filed | Name of Filer | Percent of Class | No. of Shares | Form Type | |

|---|---|---|---|---|---|

| Feb 13, 2024 | vanguard group inc | 11.25% | 11,617,466 | SC 13G/A | |

| Feb 12, 2024 | artisan partners limited partnership | 4.4% | 4,521,760 | SC 13G/A | |

| Feb 09, 2024 | massachusetts financial services co /ma/ | 9.4% | 9,670,510 | SC 13G/A | |

| Feb 08, 2024 | first eagle investment management, llc | 5.39% | 5,568,252 | SC 13G | |

| Feb 07, 2024 | blackrock inc. | 10.1% | 10,399,659 | SC 13G/A | |

| Feb 06, 2024 | blackrock inc. | 9.99% | 10,323,053 | SC 13G/A | |

| Feb 10, 2023 | artisan partners limited partnership | 6.0% | 6,466,172 | SC 13G | |

| Feb 09, 2023 | vanguard group inc | 11.31% | 12,241,335 | SC 13G/A | |

| Feb 08, 2023 | massachusetts financial services co /ma/ | 5.7% | 6,122,061 | SC 13G | |

| Jan 24, 2023 | blackrock inc. | 10.0% | 10,836,419 | SC 13G/A |

Recent SEC filings of Willis Towers Watson Public Lim

View All Filings| Date Filed | Form Type | Document | |

|---|---|---|---|

| Apr 25, 2024 | 10-Q | Quarterly Report | |

| Apr 25, 2024 | 8-K | Current Report | |

| Apr 22, 2024 | 4 | Insider Trading | |

| Apr 22, 2024 | 4 | Insider Trading | |

| Apr 22, 2024 | 4 | Insider Trading | |

| Apr 22, 2024 | 4 | Insider Trading | |

| Apr 22, 2024 | 4 | Insider Trading | |

| Apr 22, 2024 | 4 | Insider Trading | |

| Apr 22, 2024 | 4 | Insider Trading | |

| Apr 22, 2024 | 4 | Insider Trading |

- …

Peers (Alternatives to Willis Towers Watson Public Lim)

| Name | Mkt Capsorted ascending | Revenue | Price %, 1M | Returns, 1Y | P/E | P/S | Rev 1-Yr | Inc 1-Yr |

|---|---|---|---|---|---|---|---|---|

| LARGE-CAP | ||||||||

ARGO | 1.0T | 1.3B | 1.04% | 3195.96% | -4.9K | 773.83 | -10.27% | -34.69% |

AJG | 53.6B | 10.6B | 0.45% | 13.83% | 49.04 | 5.04 | 20.42% | -6.05% |

AIG | 53.3B | 48.4B | 3.31% | 49.36% | 11.03 | 1.1 | -4.15% | -20.63% |

TRV | 49.7B | 42.9B | -6.01% | 18.86% | 15.83 | 1.16 | 13.52% | 12.15% |

AFL | 48.1B | 19.3B | -0.90% | 25.15% | 8.99 | 2.49 | 3.03% | 17.35% |

ACGL | 36.7B | 13.6B | 3.49% | 28.99% | 8.27 | 2.7 | 41.83% | 201.02% |

AFG | 10.8B | 8.0B | -2.57% | 11.52% | 12.28 | 1.36 | 11.14% | 7.56% |

| MID-CAP | ||||||||

UNM | 9.9B | 12.6B | -2.35% | 17.17% | 7.52 | 0.79 | 4.24% | -13.40% |

AIZ | 9.3B | 11.1B | -0.68% | 35.68% | 14.45 | 0.83 | 9.21% | 132.28% |

LNC | 5.0B | 11.9B | -5.21% | 37.41% | 3.67 | 0.41 | -33.27% | 234.43% |

AEL | 4.5B | 2.8B | -0.20% | 45.14% | 21.34 | 1.58 | 100.59% | -89.04% |

| SMALL-CAP | ||||||||

BRP | 1.7B | 1.3B | 0.25% | 17.87% | -31.85 | 1.37 | 18.74% | 30.90% |

AMSF | 911.0M | 308.9M | 0.21% | -15.21% | 14.77 | 2.95 | 3.79% | 10.94% |

AMBC | 815.9M | 314.0M | 13.99% | 19.72% | 14.19 | 2.6 | -29.20% | -88.19% |

AAME | 35.9M | 186.8M | -18.72% | -19.82% | -209.99 | 0.19 | -0.56% | -111.21% |

Willis Towers Watson Public Lim News

Willis Towers Watson Public Lim Earnings Report: Key Takeaways & Analysis

| Income Statement (Quarterly) | (In Millions) | |||||||||||||||||||||

| Description | (%) Q/Q | 2024Q1 | 2023Q4 | 2023Q3 | 2023Q2 | 2023Q1 | 2022Q4 | 2022Q3 | 2022Q2 | 2022Q1 | 2021Q4 | 2021Q3 | 2021Q2 | 2021Q1 | 2020Q4 | 2020Q3 | 2020Q2 | 2020Q1 | 2019Q4 | 2019Q3 | 2019Q2 | 2019Q1 |

| Revenue | -19.7% | 2,341 | 2,914 | 2,166 | 2,159 | 2,244 | 2,722 | 1,953 | 2,031 | 2,160 | 2,706 | 1,973 | 2,091 | 2,228 | 2,669 | 1,897 | 1,927 | 2,122 | 2,690 | 1,989 | 2,048 | 2,312 |

| Costs and Expenses | -3.5% | 2,061 | 2,135 | 2,007 | 2,017 | 1,959 | 2,014 | 1,799 | 1,894 | 1,981 | 2,016 | 842 | 1,921 | 2,017 | 2,090 | 1,831 | 1,853 | 1,982 | 2,003 | 1,882 | 1,872 | 1,953 |

| Operating Expenses | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | 1,872 | 1,953 |

| EBITDA Margin | -1.2% | 0.18* | 0.19* | 0.19* | 0.19* | 0.20* | 0.19* | 0.19* | 0.31* | 0.31* | 0.35* | 0.32* | 0.21* | - | - | - | - | - | - | - | - | - |

| Interest Expenses | 1.6% | 64.00 | 63.00 | 61.00 | 57.00 | 54.00 | 54.00 | 54.00 | 51.00 | 49.00 | 50.00 | 50.00 | 52.00 | 59.00 | 60.00 | 61.00 | 62.00 | 61.00 | 62.00 | 62.00 | 56.00 | 54.00 |

| Income Taxes | -58.6% | 48.00 | 116 | 25.00 | 24.00 | 50.00 | 131 | 1.00 | 19.00 | 43.00 | 150 | 267 | 75.00 | 44.00 | 85.00 | 42.00 | 75.00 | 78.00 | 72.00 | 20.00 | 38.00 | 67.00 |

| Earnings Before Taxes | -67.3% | 242 | 739 | 164 | 120 | 256 | 737 | 185 | 179 | 157 | 724 | 1,186 | 192 | 590 | 438 | 161 | 177 | 391 | 399 | 100 | 187 | 360 |

| EBT Margin | -2.1% | 0.13* | 0.13* | 0.14* | 0.14* | 0.15* | 0.14* | 0.14* | 0.25* | 0.25* | 0.30* | 0.27* | 0.16* | - | - | - | - | - | - | - | - | - |

| Net Income | -69.5% | 190 | 622 | 136 | 94.00 | 203 | 588 | 190 | 109 | 122 | 2,402 | 903 | 184 | 733 | 476 | 121 | 94.00 | 305 | 544 | 75.00 | 149 | 293 |

| Net Income Margin | -2.2% | 0.11* | 0.11* | 0.11* | 0.12* | 0.12* | 0.11* | 0.32* | 0.40* | 0.40* | 0.47* | 0.26* | 0.17* | - | - | - | - | - | - | - | - | - |

| Free Cashflow | -95.4% | 24.00 | 522 | 347 | 250 | 88.00 | 329 | 133 | 191 | -25.00 | 138 | 1,465 | 448 | - | - | - | - | - | - | - | - | - |

| Balance Sheet | (In Millions) | |||||||||||||||||||||

| Description | (%) Q/Q | 2024Q1 | 2023Q4 | 2023Q3 | 2023Q2 | 2023Q1 | 2022Q4 | 2022Q3 | 2022Q2 | 2022Q1 | 2021Q4 | 2021Q3 | 2021Q2 | 2021Q1 | 2020Q4 | 2020Q3 | 2020Q2 | 2020Q1 | 2019Q4 | 2019Q3 | 2019Q2 | 2019Q1 |

| Assets | 3.9% | 30,237 | 29,090 | 27,623 | 28,773 | 31,906 | 31,769 | 30,991 | 32,509 | 32,841 | 34,970 | 37,282 | 38,267 | 38,632 | 38,531 | 38,037 | 38,110 | 37,727 | 35,426 | 35,703 | 35,166 | 35,893 |

| Current Assets | 9.0% | 14,642 | 13,433 | 11,834 | 12,817 | 15,946 | 15,835 | 15,051 | 16,370 | 16,412 | 18,488 | 20,591 | 20,568 | 20,872 | 20,301 | 19,914 | 19,922 | 19,550 | 17,037 | 17,400 | 18,333 | 19,020 |

| Cash Equivalents | 32.9% | 1,893 | 1,424 | 1,247 | 1,602 | 1,135 | 4,721 | 1,496 | 1,920 | 2,198 | 4,486 | 2,162 | 2,217 | 1,960 | 6,301 | 1,654 | 1,094 | 906 | 4,183 | 874 | 812 | 992 |

| Net PPE | -2.4% | 703 | 720 | 710 | 725 | 723 | 718 | 701 | 744 | 817 | 851 | 881 | 927 | 951 | 1,013 | 997 | 989 | 974 | 1,046 | 963 | 967 | 957 |

| Goodwill | -0.1% | 10,186 | 10,195 | 10,143 | 10,202 | 10,193 | 10,173 | 10,089 | 10,158 | 10,200 | 10,183 | 10,146 | 10,995 | 10,986 | 10,392 | 11,131 | 11,196 | 11,162 | 10,385 | 11,187 | 10,454 | 10,456 |

| Liabilities | 6.0% | 20,669 | 19,497 | 18,138 | 18,896 | 21,730 | 21,676 | 21,078 | 22,092 | 21,766 | 21,662 | 25,849 | 26,552 | 27,058 | 27,599 | 27,417 | 27,654 | 27,338 | 25,057 | 25,672 | 24,934 | 25,651 |

| Current Liabilities | 3.9% | 13,118 | 12,630 | 11,305 | 11,969 | 14,889 | 14,779 | 14,122 | 14,692 | 14,914 | 14,724 | 18,616 | 19,174 | 19,020 | 19,332 | 19,220 | 19,019 | 18,624 | 16,070 | 16,736 | 17,204 | 17,654 |

| Long Term Debt | 16.2% | 5,307 | 4,567 | 4,565 | 4,565 | 4,472 | 4,471 | 4,470 | 4,720 | 3,975 | 3,974 | 3,993 | 3,995 | 4,632 | 4,664 | 4,641 | 5,068 | 5,177 | 5,301 | 5,381 | 4,284 | 4,518 |

| LT Debt, Current | 0% | 650 | 650 | 649 | 899 | 250 | 250 | 250 | - | 599 | 613 | 644 | 1,110 | 471 | 971 | 973 | 525 | 697 | 316 | 484 | 187 | 187 |

| LT Debt, Non Current | 16.2% | 5,307 | 4,567 | 4,565 | 4,565 | 4,472 | 4,471 | 4,470 | 4,720 | 3,975 | 3,974 | 3,993 | 3,995 | 4,632 | 4,664 | 4,641 | 5,068 | 5,177 | 5,301 | 5,381 | 4,284 | 4,518 |

| Shareholder's Equity | -0.3% | 9,489 | 9,520 | 9,410 | 9,877 | 10,176 | 10,093 | 9,913 | 10,417 | 11,075 | 13,308 | 11,433 | 11,715 | 11,574 | 10,932 | 10,620 | 10,456 | 10,389 | 10,369 | 10,001 | 10,204 | 10,214 |

| Retained Earnings | -0.1% | 1,464 | 1,466 | 1,127 | 1,429 | 1,774 | 1,764 | 1,706 | 1,971 | 2,423 | 4,645 | 2,969 | 3,166 | 3,075 | 2,434 | 2,047 | 2,015 | 2,009 | 36.00 | -36.00 | - | 1,439 |

| Additional Paid-In Capital | 0.2% | 10,930 | 10,910 | 10,903 | 10,910 | 10,890 | 10,876 | 10,855 | 10,855 | 10,826 | 10,804 | 10,786 | 10,785 | 10,765 | 10,748 | 10,724 | 10,713 | 10,703 | 10,687 | 10,667 | 10,644 | 10,630 |

| Minority Interest | 8.2% | 79.00 | 73.00 | 75.00 | 78.00 | 80.00 | 77.00 | 75.00 | 80.00 | 71.00 | 48.00 | 40.00 | 45.00 | 48.00 | 112 | 105 | 121 | 126 | 120 | 114 | 114 | 122 |

| Float | - | - | - | - | 24,662 | - | - | - | 21,628 | - | - | - | 29,461 | - | - | - | 25,185 | - | - | - | 24,555 | - |

| Cashflow (Quarterly) | (In Millions) | |||||||||||||||||||||

| Description | (%) Q/Q | 2024Q1 | 2023Q4 | 2023Q3 | 2023Q2 | 2023Q1 | 2022Q4 | 2022Q3 | 2022Q2 | 2022Q1 | 2021Q4 | 2021Q3 | 2021Q2 | 2021Q1 | 2020Q4 | 2020Q3 | 2020Q2 | 2020Q1 | 2019Q4 | 2019Q3 | 2019Q2 | 2019Q1 |

| Cashflow From Operations | -95.4% | 24.00 | 522 | 393 | 296 | 134 | 375 | 179 | 237 | 21.00 | 184 | 1,511 | 494 | -128 | 568 | 521 | 662 | 23.00 | 461 | 317 | 350 | -47.00 |

| Share Based Compensation | -36.8% | 24.00 | 38.00 | 29.00 | 32.00 | 26.00 | 28.00 | 24.00 | 25.00 | 22.00 | 30.00 | 19.00 | 25.00 | 27.00 | 31.00 | 31.00 | 29.00 | -1.00 | 26.00 | 21.00 | 17.00 | 10.00 |

| Cashflow From Investing | -34.5% | -74.00 | -55.00 | 5.00 | -974 | -61.00 | -115 | -77.00 | -55.00 | 74.00 | 2,209 | -13.00 | -55.00 | 429 | -52.00 | 141 | -87.00 | -162 | -83.00 | -1,383 | -73.00 | -75.00 |

| Cashflow From Financing | 429.7% | 1,556 | -472 | -615 | 340 | -453 | -336 | -419 | -110 | -2,580 | -858 | -1,189 | -235 | -832 | 712 | -119 | -401 | 186 | -319 | 1,148 | -456 | 82.00 |

| Dividend Payments | -1.1% | 86.00 | 87.00 | 88.00 | 90.00 | 87.00 | 89.00 | 91.00 | 91.00 | 98.00 | 99.00 | 6.00 | 177 | 92.00 | 87.00 | 88.00 | 87.00 | 84.00 | 84.00 | 84.00 | 84.00 | 77.00 |

| Buy Backs | -48.5% | 101 | 196 | 350 | 350 | 104 | 440 | 369 | 471 | 2,250 | 627 | 1,000 | - | - | - | - | - | - | 3.00 | 96.00 | 51.00 | - |

WTW Income Statement

2024-03-31Condensed Consolidated Statements of Comprehensive Income (Unaudited) - USD ($) $ in Millions | 3 Months Ended | |

|---|---|---|

Mar. 31, 2024 | Mar. 31, 2023 | |

| Income Statement [Abstract] | ||

| Revenue | $ 2,341 | $ 2,244 |

| Costs of providing services | ||

| Salaries and benefits | 1,342 | 1,313 |

| Other operating expenses | 457 | 453 |

| Depreciation | 59 | 60 |

| Amortization | 60 | 71 |

| Restructuring costs | 18 | 3 |

| Transaction and transformation | 125 | 59 |

| Total costs of providing services | 2,061 | 1,959 |

| Income from operations | 280 | 285 |

| Interest expense | (64) | (54) |

| Other income, net | 26 | 25 |

| INCOME FROM OPERATIONS BEFORE INCOME TAXES | 242 | 256 |

| Provision for income taxes | (48) | (50) |

| NET INCOME | 194 | 206 |

| Income attributable to non-controlling interests | (4) | (3) |

| NET INCOME ATTRIBUTABLE TO WTW | $ 190 | $ 203 |

| Basic earnings per share: | ||

| Basic earnings per share | $ 1.84 | $ 1.89 |

| Diluted earnings per share: | ||

| Diluted earnings per share | $ 1.83 | $ 1.88 |

| Comprehensive income before non-controlling interests | $ 145 | $ 259 |

| Comprehensive income attributable to non-controlling interests | (4) | (3) |

| Comprehensive income attributable to WTW | $ 141 | $ 256 |

WTW Balance Sheet

2024-03-31Condensed Consolidated Balance Sheets (Unaudited) - USD ($) $ in Millions | Mar. 31, 2024 | Dec. 31, 2023 |

|---|---|---|

| ASSETS | ||

| Cash and cash equivalents | $ 1,893 | $ 1,424 |

| Fiduciary assets | 9,940 | 9,073 |

| Accounts receivable, net | 2,430 | 2,572 |

| Prepaid and other current assets | 379 | 364 |

| Total current assets | 14,642 | 13,433 |

| Fixed assets, net | 703 | 720 |

| Goodwill | 10,186 | 10,195 |

| Other intangible assets, net | 1,960 | 2,016 |

| Right-of-use assets | 542 | 565 |

| Pension benefits assets | 598 | 588 |

| Other non-current assets | 1,606 | 1,573 |

| Total non-current assets | 15,595 | 15,657 |

| TOTAL ASSETS | 30,237 | 29,090 |

| LIABILITIES AND EQUITY | ||

| Fiduciary liabilities | 9,940 | 9,073 |

| Deferred revenue and accrued expenses | 1,638 | 2,104 |

| Current debt | 650 | 650 |

| Current lease liabilities | 123 | 125 |

| Other current liabilities | 767 | 678 |

| Total current liabilities | 13,118 | 12,630 |

| Long-term debt | 5,307 | 4,567 |

| Liability for pension benefits | 526 | 563 |

| Deferred tax liabilities | 550 | 542 |

| Provision for liabilities | 377 | 365 |

| Long-term lease liabilities | 570 | 592 |

| Other non-current liabilities | 221 | 238 |

| Total non-current liabilities | 7,551 | 6,867 |

| TOTAL LIABILITIES | 20,669 | 19,497 |

| COMMITMENTS AND CONTINGENCIES | ||

| EQUITY | ||

| Additional paid-in capital | 10,930 | 10,910 |

| Retained earnings | 1,464 | 1,466 |

| Accumulated other comprehensive loss, net of tax | (2,905) | (2,856) |

| Total WTW shareholders' equity | 9,489 | 9,520 |

| Non-controlling interests | 79 | 73 |

| Total equity | 9,568 | 9,593 |

| TOTAL LIABILITIES AND EQUITY | $ 30,237 | $ 29,090 |

| CEO | Mr. Carl A. Hess CERA, F.S.A. |

|---|---|

| WEBSITE | willistowerswatson.com |

| INDUSTRY | Insurance Property & Casualty |

| EMPLOYEES | 46000 |