Discover The Joy of Investing...

Experience

Powerful Data...

"Grufity doesn't just provide you point-in-time metrics for stocks like most websites on internet, it also provides the historical trend of such metrics. Knowing the history of price to sales ratio of a stock is more important than knowing it's point value now as the history puts the current value in right context."

"...eliminates the gap between hedge funds and retail investors."

Easy Access

All the financial data and tools you need, at one place

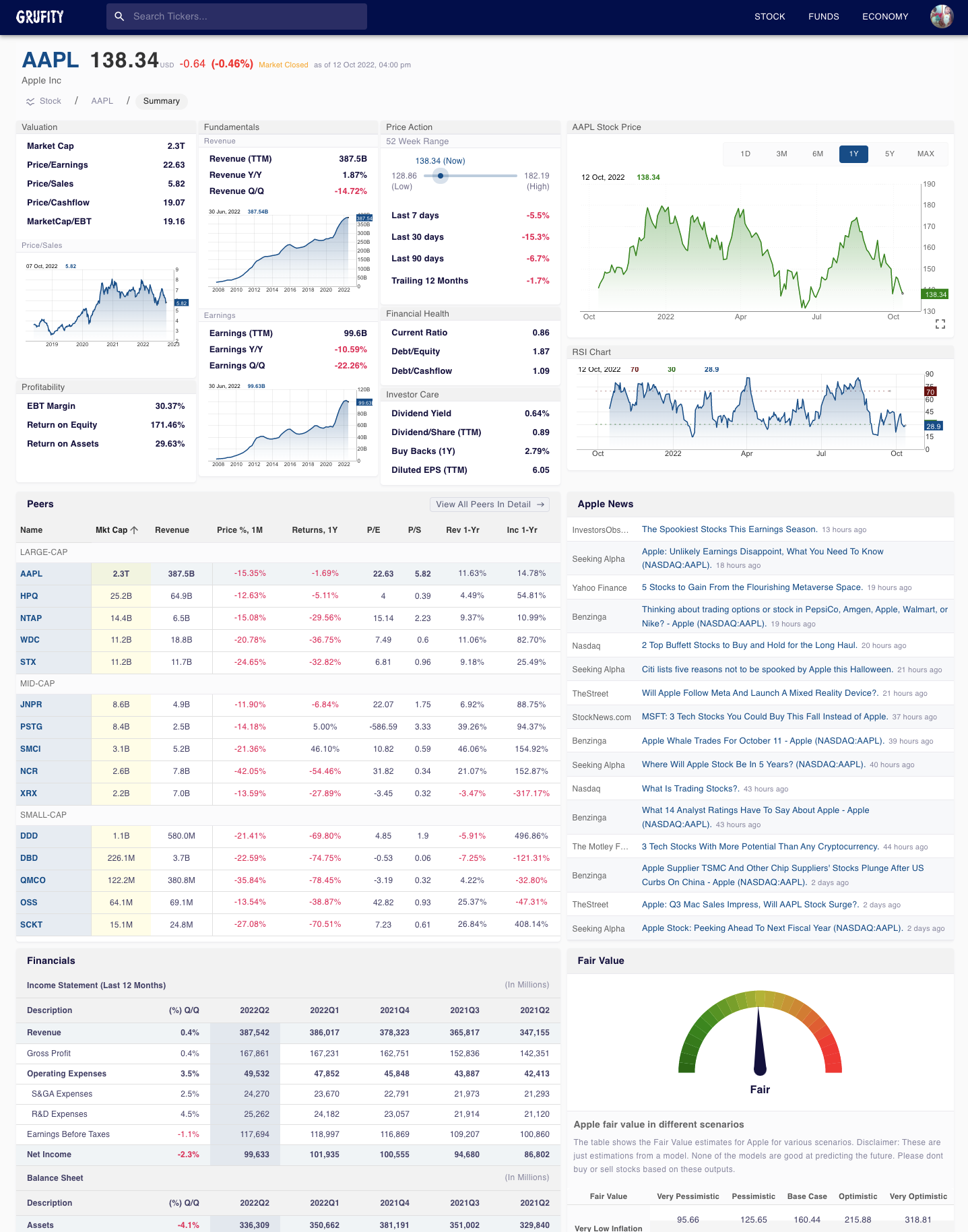

Stocks

The best place on internet to do your due-diligence on any stock. Detail Historical trend on Financial ratios (PE, PS, ROE, ROA, Debt/Equity ratio, Financial Health metrics, operation health metrics. etc).

Insider trading trends and alets.

Are funds buying or selling the stock?

Latest financial reports and news.

Are funds buying or selling the stock?

Latest financial reports and news.

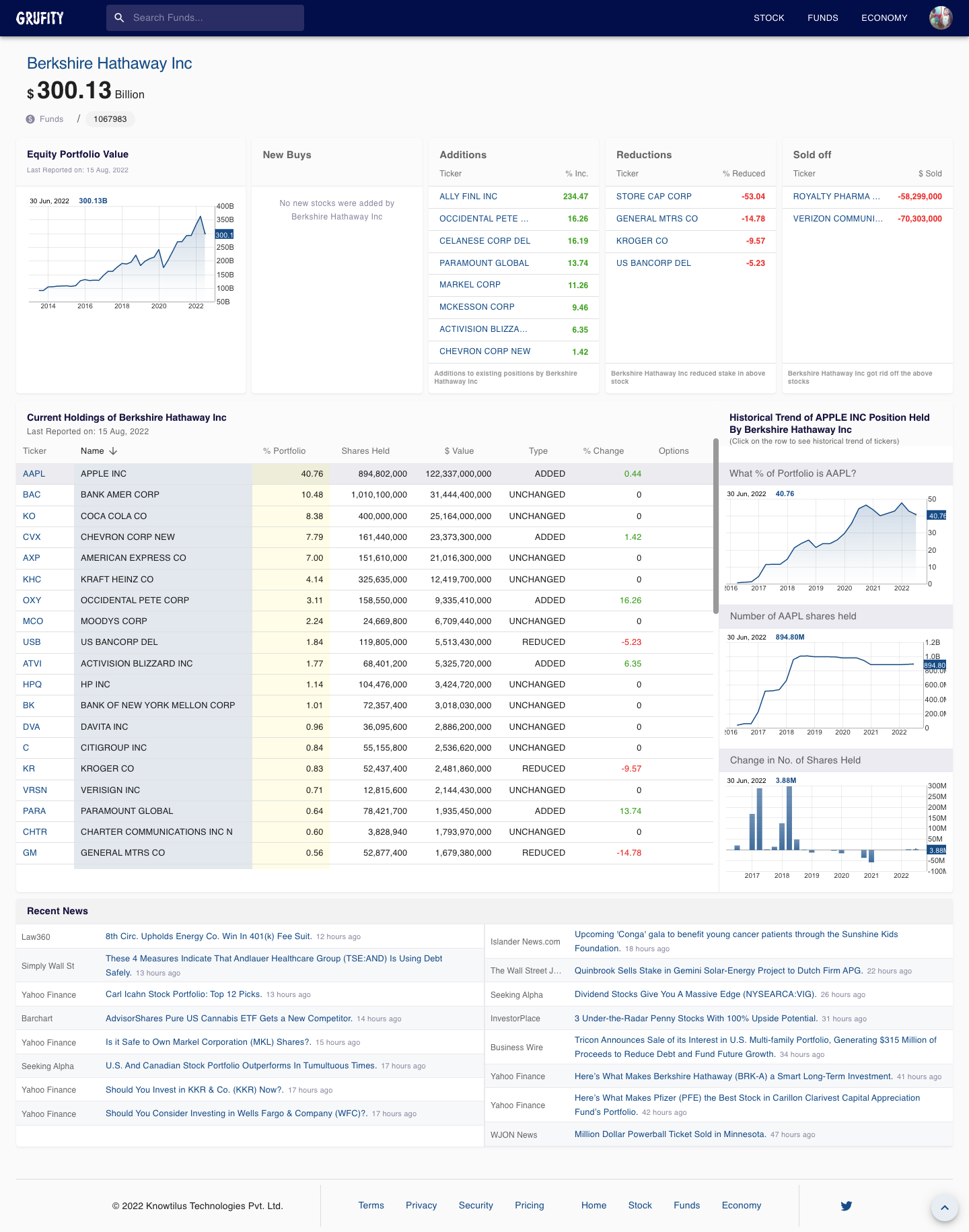

Funds

A great tool for shadow investing. Coverage of all major funds.

What are their current holdings? What stocks they bought or sold recently. Percentage increase in their positon sizes. Historical trend of how a fund increased or decreased it's position in a particular stock.

What are their current holdings? What stocks they bought or sold recently. Percentage increase in their positon sizes. Historical trend of how a fund increased or decreased it's position in a particular stock.

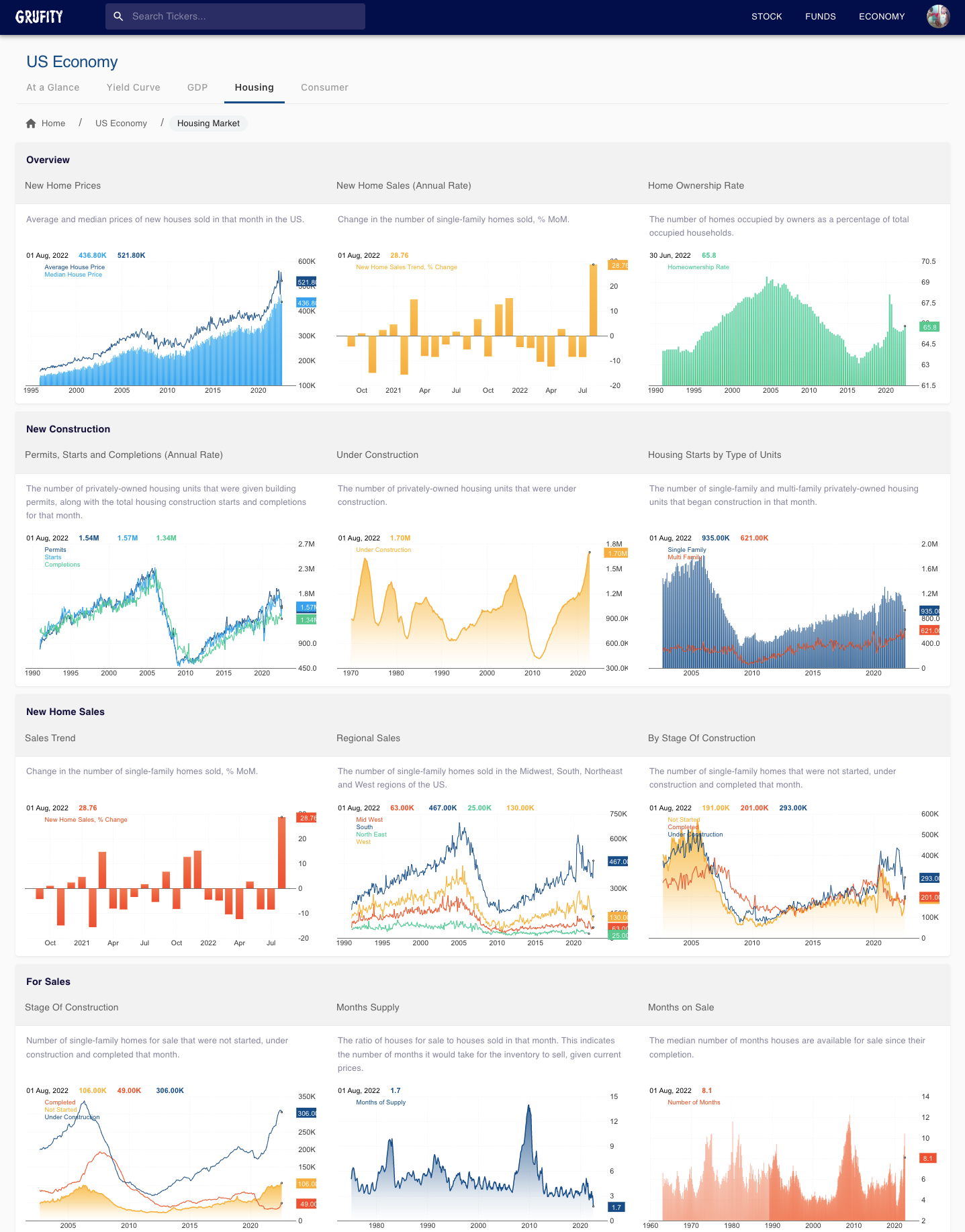

Economy

Yield Curve: The shape of the yield curve has been a strong predictor of recessions in the past. Visit our daily updated Yield Curve analysis.

Inflation: Our Inflation page provides quick view of CPI, PCE etc.

GDP: Breakdown of GDP and past trends.

Housing: Detailed charts on the sector that impacts us all.

Consumer: Two-thrids of economy is Consumption. So consumer strength analsysis matters the most.

"...value of $2000/mth 'Terminal' for

one Starbucks coffee"

GET FULL ACCESS TO GRUFITY

"Rule No. 1 is never lose money." - Warren Buffett

"...never buy a stock without a complete look at Grufity."

Features

Grufity provides a 360° view on Stocks and Economy

Intuitive query language to filter stocks any way you like instead of pre-canned bins. Save as many Screens you like. | |

|---|---|

Quickest way to perform due-diligence on any stock. Most comprehensive and in-depth one-pager on the internet. | |

Equity portfolio of 1000s of active funds such as Buffett, Carl Icahn, Cathie Woods etc. What stocks are the funds buying or selling? Historical trend of purchase of a stock by a fund | |

Get most comprehensive analysis on daily movement of yield curve on the internet. | |

Great tool for stock discovery especially for lesser known micro-caps and mid-caps. Which stocks made 52-week highs? Which stocks had the most earnings in the industry? Which stocks were crushed recently? Which have been multi-baggers ? | |

Are funds buying or selling the stock? What funds have sold the stock? Which opened new positions? Trend of number of funds interested in the stock. | |

Quick look at the Insider Transaction as on a stock. Have there been any unusual sales by insiders? Are the insiders selling at a faster or slower speed than before? | |

What are the historical Year-over-Year Returns, Rolling returns etc.? | |

What is the probability of a 20 or a 40% paper loss on a stock? What has been the historical drawdown on the stock? How is stock's volatility vs S&P500? | |

History of important ratios for stocks. Valuation Metrics - Trends for PE, Price-to-Sales, EV/EBT etc. Profitability Metrics - ROE, Return-On-Assets etc. Financial Health - Debt-to-Equity Ratio, Current Ratio etc. Operational Performance - Asset-to-Sales Ratio, Sales-to-Inventory etc. | |

Important tables from financial statements reported by companies. Hundreds of time series per stock such as Revenue (Trailing 12 Months), Income Growth, Assets Growth etc. | |

Alerts on Stocks and macro movements Alerts are activated on every stock on unusual activities such as - High insider trading activity Big loss in Income or a dip in revenue Unusual interest from funds |

Don't just follow experts

Aim to be one

If you have been mostly looking at the price chart and hoping to make a quick buck on a stock then chances are that you haven't yet discovered the true joy of investing. Price charts are important but know that they are just one clue out of many. The real joy of investing is in exploring many stocks and finding a few gems that will multi-fold your investments over the years.

Frequently Asked Questions